Question: - All work to be submitted in Excel Worksheet - Please note you are writing from a viewpoint of a individual person. Description: You hope

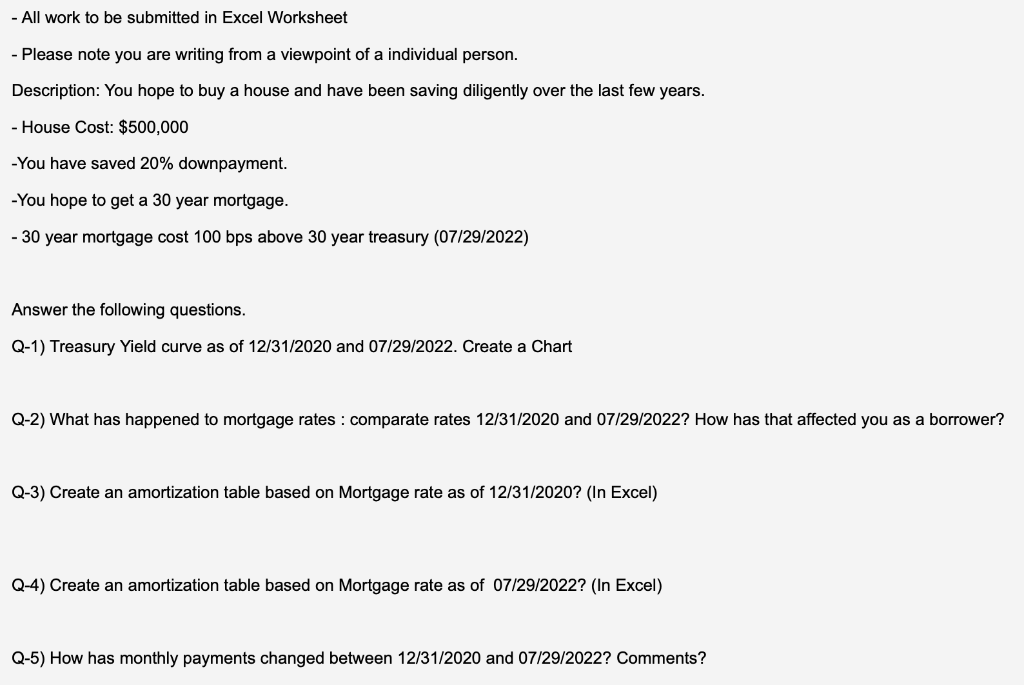

- All work to be submitted in Excel Worksheet - Please note you are writing from a viewpoint of a individual person. Description: You hope to buy a house and have been saving diligently over the last few years. - House Cost: $500,000 -You have saved 20% downpayment. -You hope to get a 30 year mortgage. - 30 year mortgage cost 100 bps above 30 year treasury (07/29/2022) Answer the following questions. Q-1) Treasury Yield curve as of 12/31/2020 and 07/29/2022. Create a Chart Q-2) What has happened to mortgage rates : comparate rates 12/31/2020 and 07/29/2022? How has that affected you as a borrower? Q-3) Create an amortization table based on Mortgage rate as of 12/31/2020? (In Excel) Q-4) Create an amortization table based on Mortgage rate as of 07/29/2022? (In Excel) Q-5) How has monthly payments changed between 12/31/2020 and 07/29/2022? Comments? - All work to be submitted in Excel Worksheet - Please note you are writing from a viewpoint of a individual person. Description: You hope to buy a house and have been saving diligently over the last few years. - House Cost: $500,000 -You have saved 20% downpayment. -You hope to get a 30 year mortgage. - 30 year mortgage cost 100 bps above 30 year treasury (07/29/2022) Answer the following questions. Q-1) Treasury Yield curve as of 12/31/2020 and 07/29/2022. Create a Chart Q-2) What has happened to mortgage rates : comparate rates 12/31/2020 and 07/29/2022? How has that affected you as a borrower? Q-3) Create an amortization table based on Mortgage rate as of 12/31/2020? (In Excel) Q-4) Create an amortization table based on Mortgage rate as of 07/29/2022? (In Excel) Q-5) How has monthly payments changed between 12/31/2020 and 07/29/2022? Comments

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts