Question: All written work must be completed in Excel with proper formatting. Make sure each question fits on one page. Write your name at the top

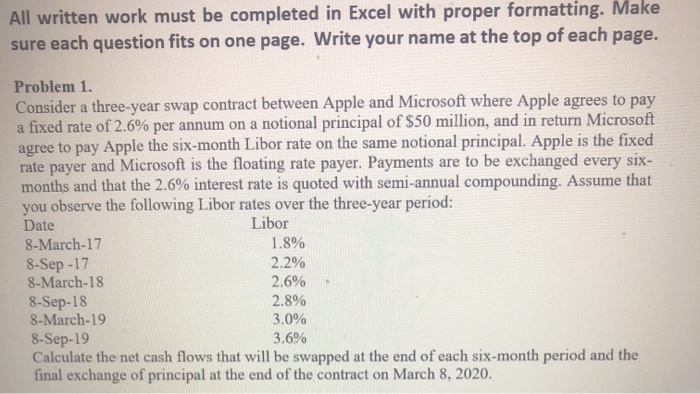

All written work must be completed in Excel with proper formatting. Make sure each question fits on one page. Write your name at the top of each page. Problem 1. Consider a three-year swap contract between Apple and Microsoft where Apple agrees to pay a fixed rate of 2.6% per annum on a notional principal of $50 million, and in return Microsoft agree to pay Apple the six-month Libor rate on the same notional principal. Apple is the fixed rate payer and Microsoft is the floating rate payer. Payments are to be exchanged every six- months and that the 2.6% interest rate is quoted with semi-annual compounding. Assume that you observe the following Libor rates over the three-year period: Date Libor 8-March-17 1.8% 8-Sep-17 2.2% 8-March-18 2.6% 8-Sep-18 2.8% 8-March-19 3.0% 8-Sep-19 3.6% Calculate the net cash flows that will be swapped at the end of each six-month period and the final exchange of principal at the end of the contract on March 8, 2020

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts