Question: ALLE PROBLEMS 1 Problem 4-58 Calculating Annuity Values After deciding to acquire a new car, you can either lease the car or purchase it with

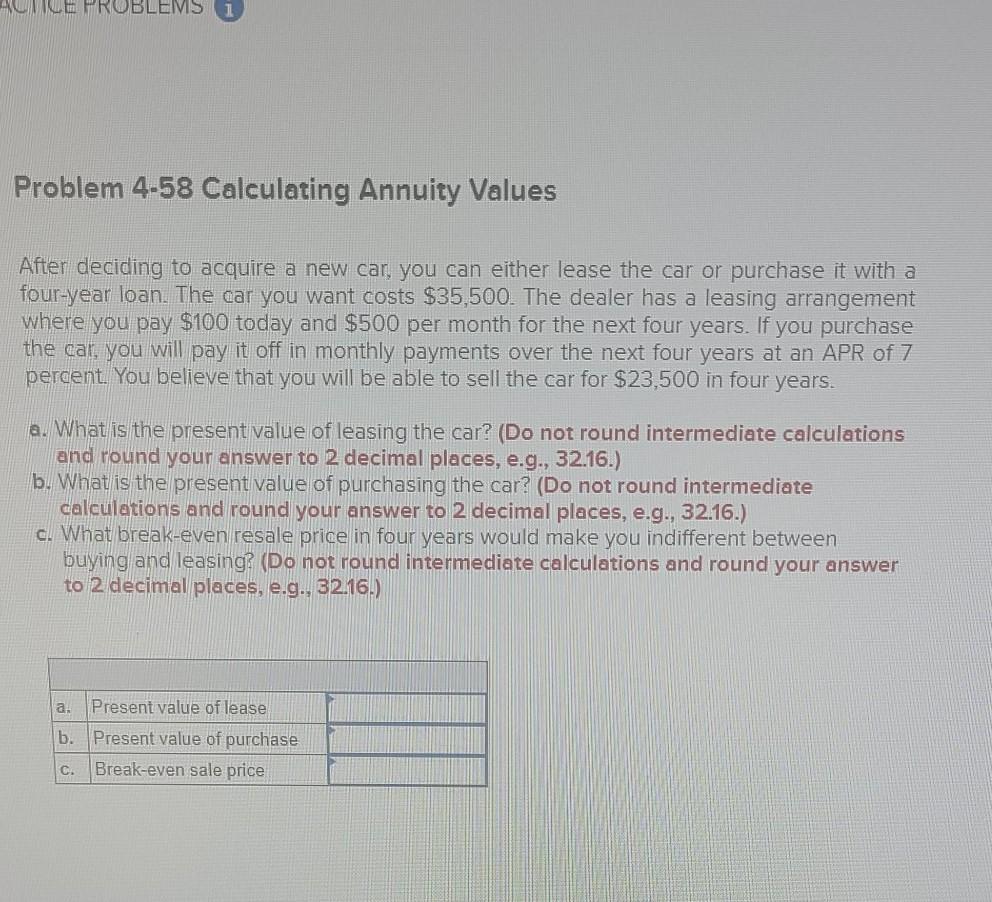

ALLE PROBLEMS 1 Problem 4-58 Calculating Annuity Values After deciding to acquire a new car, you can either lease the car or purchase it with a four-year loan. The car you want costs $35,500. The dealer has a leasing arrangement where you pay $100 today and $500 per month for the next four years. If you purchase the car, you will pay it off in monthly payments over the next four years at an APR of 7 percent. You believe that you will be able to sell the car for $23,500 in four years. a. What is the present value of leasing the car? (Do not round intermediate calculations and round your answer to 2 decimal places, g., 32.16.) b. What is the present value of purchasing the car? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) c. What break-even resale price in four years would make you indifferent between buying and leasing? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) a. Present value of lease b. Present value of purchase Break-even sale price C

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts