Question: Allegra is considering producing Blu - ray players and digital video recorders ( DVRs ) . The products require different specialized machines, each costing $

Allegra is considering producing Bluray players and digital video recorders DVRs The products require different specialized machines, each costing $ million. Each machine has a fiveyear life and zero residual value. The two products have different patterns of predicted net cash inflows:

Click the icon to view the predicted cash inflows.

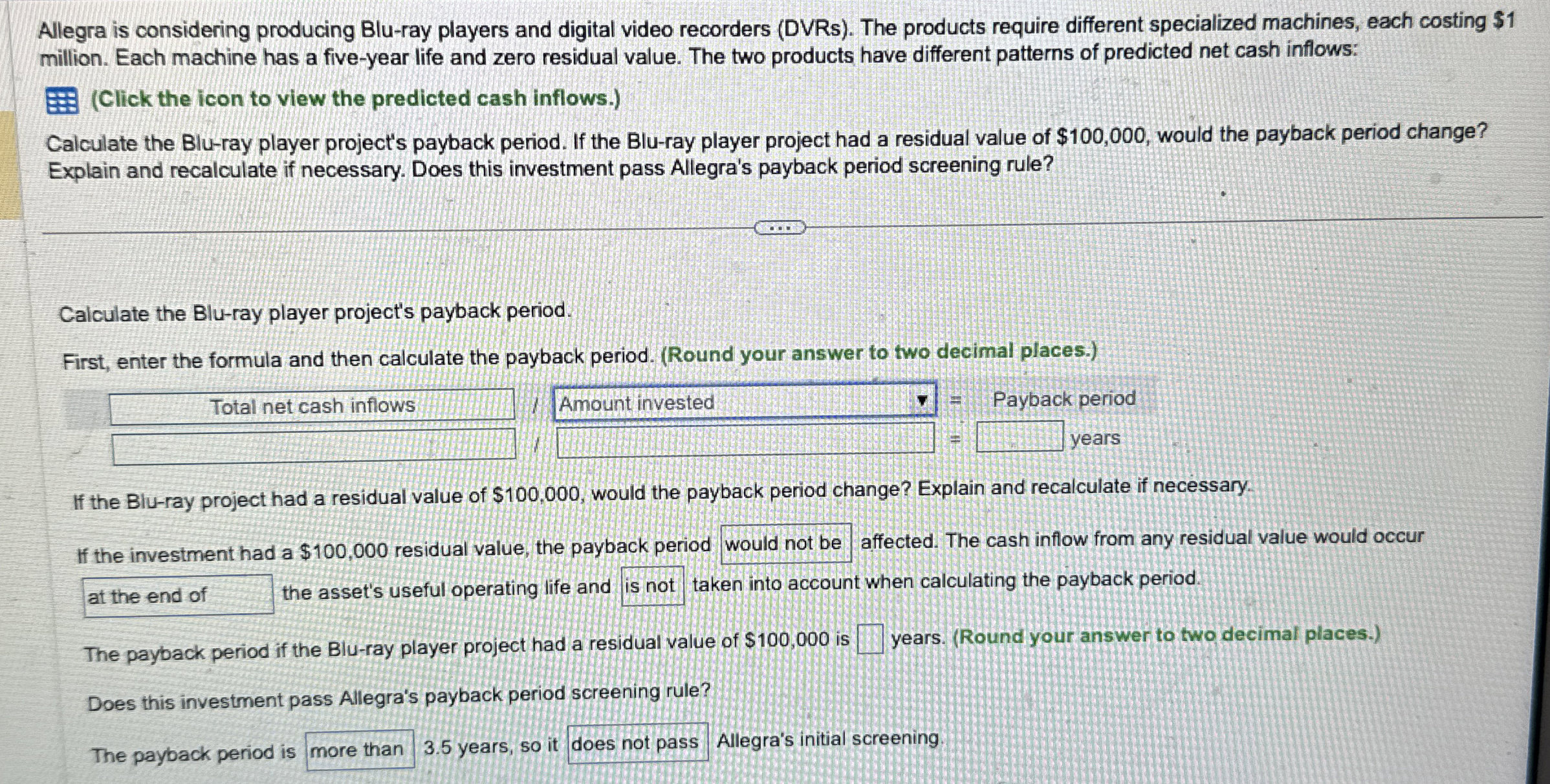

Calculate the Bluray player project's payback period. If the Bluray player project had a residual value of $ would the payback period change? Explain and recalculate if necessary. Does this investment pass Allegra's payback period screening rule?

Calculate the Bluray player project's payback period.

First, enter the formula and then calculate the payback period. Round your answer to two decimal places.

Total net cash inflows H Payback period years

If the Bluray project had a residual value of $ would the payback period change? Explain and recalculate if necessary.

If the investment had a $ residual value, the payback period would not be affected. The cash inflow from any residual value would occur at the end of the asset's useful operating life and taken into account when calculating the payback period.

The payback period if the Bluray player project had a residual value of $ is years. Round your answer to two decimal places.

Does this investment pass Allegra's payback period screening rule?

The payback period is years, so it Allegra's initial screening.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock