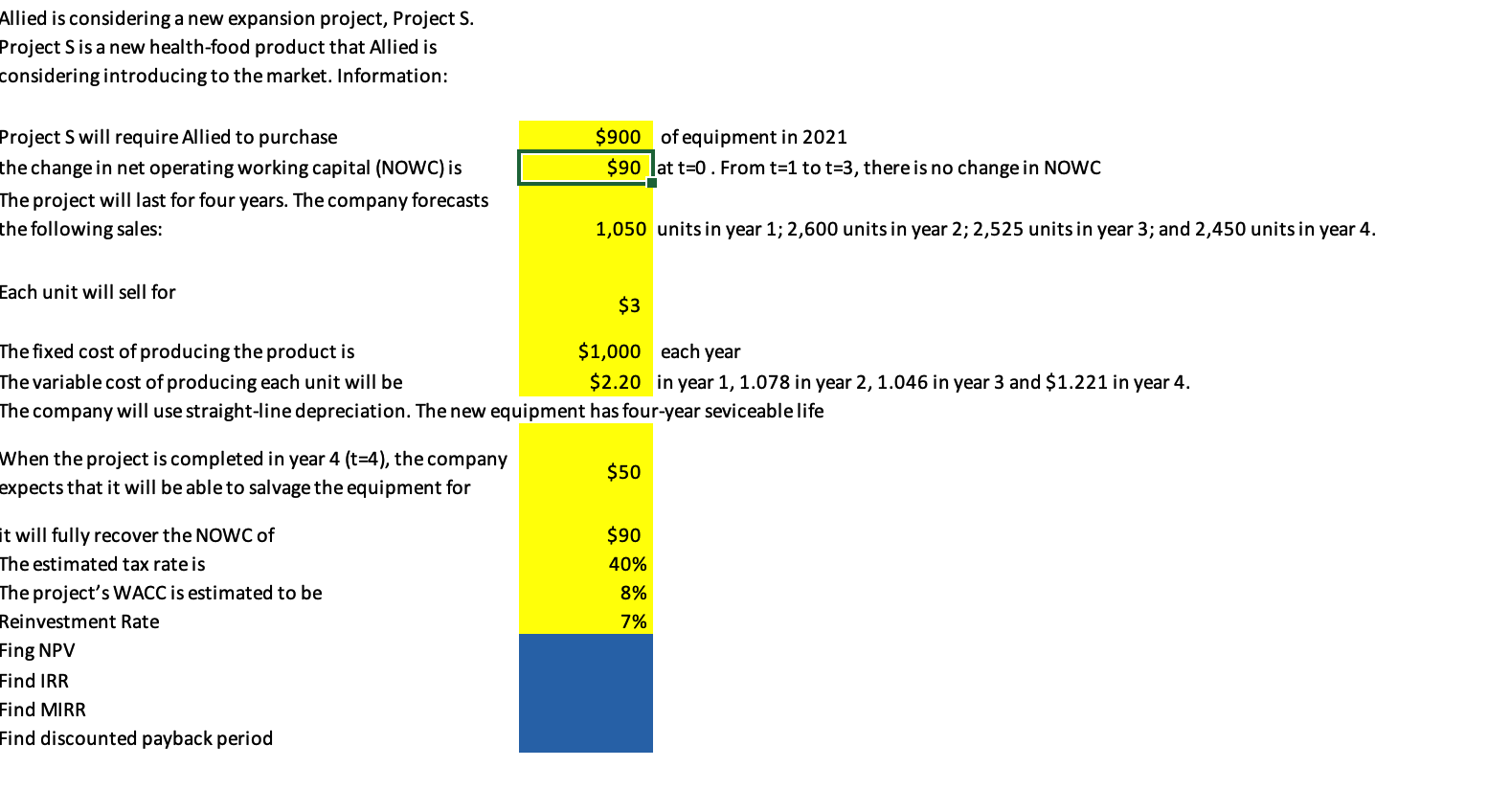

Question: Allied is considering a new expansion project, Project S. Project Sis a new health-food product that Allied is considering introducing to the market. Information: $900

Allied is considering a new expansion project, Project S. Project Sis a new health-food product that Allied is considering introducing to the market. Information: $900 of equipment in 2021 $90 lat t=0. From t=1 to t=3, there is no change in NOWC Project S will require Allied to purchase the change in net operating working capital (NOWC) is The project will last for four years. The company forecasts the following sales: 1,050 units in year 1; 2,600 units in year 2; 2,525 units in year 3; and 2,450 units in year 4. Each unit will sell for $3 The fixed cost of producing the product is $1,000 each year The variable cost of producing each unit will be $2.20 in year 1, 1.078 in year 2, 1.046 in year 3 and $1.221 in year 4. The company will use straight-line depreciation. The new equipment has four-year seviceable life When the project is completed in year 4 (t=4), the company expects that it will be able to salvage the equipment for $50 $90 40% 8% 7% it will fully recover the NOWC of The estimated tax rate is The project's WACC is estimated to be Reinvestment Rate Fing NPV Find IRR Find MIRR Find discounted payback period Allied is considering a new expansion project, Project S. Project Sis a new health-food product that Allied is considering introducing to the market. Information: $900 of equipment in 2021 $90 lat t=0. From t=1 to t=3, there is no change in NOWC Project S will require Allied to purchase the change in net operating working capital (NOWC) is The project will last for four years. The company forecasts the following sales: 1,050 units in year 1; 2,600 units in year 2; 2,525 units in year 3; and 2,450 units in year 4. Each unit will sell for $3 The fixed cost of producing the product is $1,000 each year The variable cost of producing each unit will be $2.20 in year 1, 1.078 in year 2, 1.046 in year 3 and $1.221 in year 4. The company will use straight-line depreciation. The new equipment has four-year seviceable life When the project is completed in year 4 (t=4), the company expects that it will be able to salvage the equipment for $50 $90 40% 8% 7% it will fully recover the NOWC of The estimated tax rate is The project's WACC is estimated to be Reinvestment Rate Fing NPV Find IRR Find MIRR Find discounted payback period

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts