Question: Allied Managed Care Company is evaluating two different computer systems for handling provider claims. There are no incremental revenues attached to the projects, so the

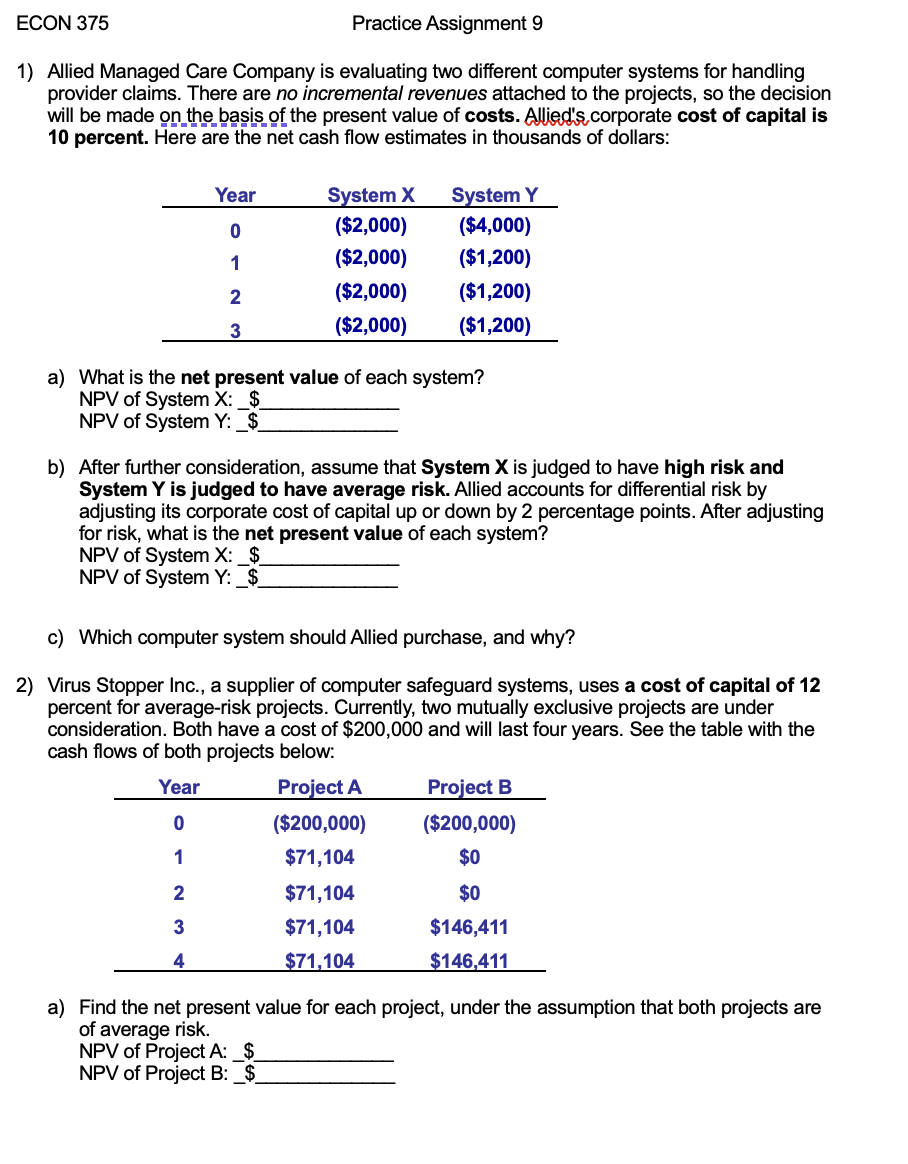

Allied Managed Care Company is evaluating two different computer systems for handling

provider claims. There are no incremental revenues attached to the projects, so the decision

will be made on the basis of the present value of costs. Allied'scorporate cost of capital is

percent. Here are the net cash flow estimates in thousands of dollars:

a What is the net present value of each system?

NPV of System X: $

NPV of System Y:

b After further consideration, assume that System is judged to have high risk and

System is judged to have average risk. Allied accounts for differential risk by

adjusting its corporate cost of capital up or down by percentage points. After adjusting

for risk, what is the net present value of each system?

NPV of System X:

NPV of System Y:

c Which computer system should Allied purchase, and why?

Virus Stopper Inc., a supplier of computer safeguard systems, uses a cost of capital of

percent for averagerisk projects. Currently, two mutually exclusive projects are under

consideration. Both have a cost of $ and will last four years. See the table with the

cash flows of both projects below:

a Find the net present value for each project, under the assumption that both projects are

of average risk.

NPV of Project A:

NPV of Project B: Allied Managed Care Company is evaluating two different computer systems for handling provider claims. There are no incremental revenues attached to the projects, so the decision will be made on the basis of the present value of costs. Allied's corporate cost of capital is percent. Here are the net cash flow estimates in thousands of dollars: a Assume initially that the systems both have average risk and the corporate cost of capital is What is the net present value NPV of each system? Which one should be chosen? Why? b Assume that System X is judged to have high risk. Allied accounts for differential risk by adjusting its corporate cost of capital up or down by percentage points. After adjusting for risk, what is the net present value of each system? Which one should be chosen? Why?

Please answer both questions fully

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock