Question: ALLIU TALLEUL Compatibility Mode - Excel File Home Insert Page Layout Formulas Data Review View Help Search thx Arial Accounting - Paste Wrap Text Merge

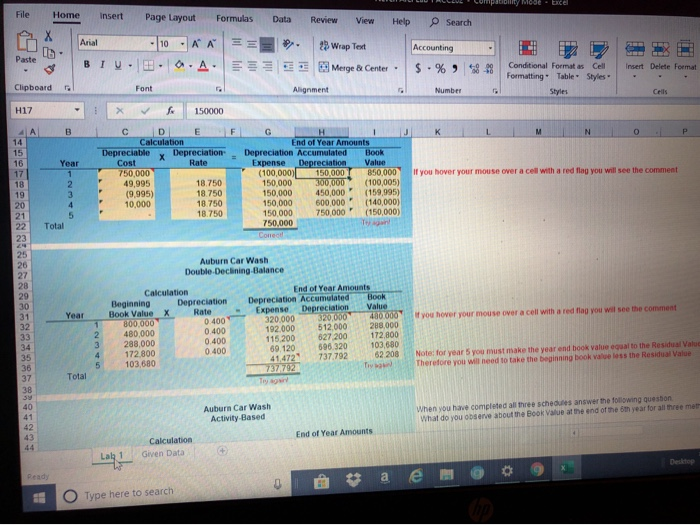

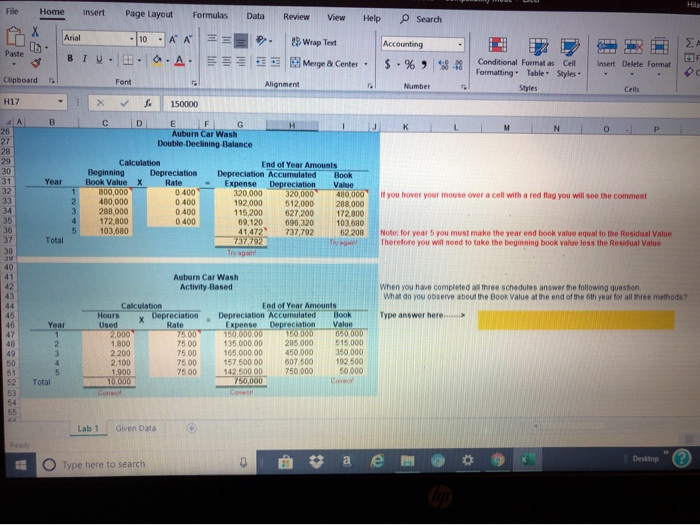

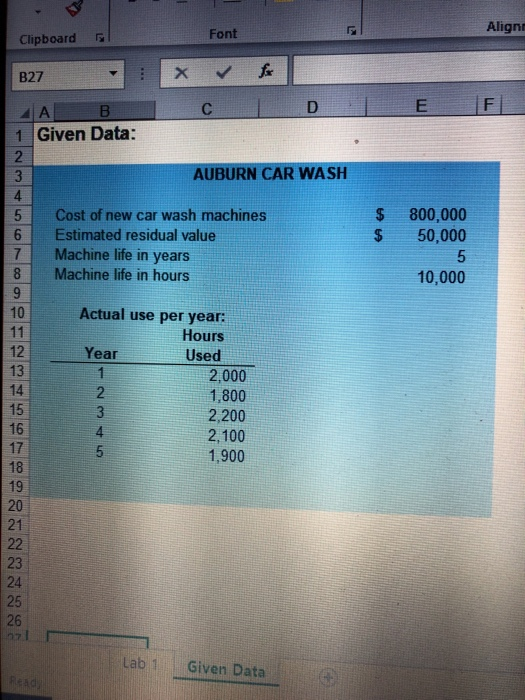

ALLIU TALLEUL Compatibility Mode - Excel File Home Insert Page Layout Formulas Data Review View Help Search thx Arial Accounting - Paste Wrap Text Merge Center . B T U . . .A. .% 42 - Clipboard LES CHO Conditional Format as Cell Insert Delete format Formatting Table Styles Styles Font Alignment Cell H17 - : * fr 150000 AB F KLMNOP Year C D E Calculation Depreciable D epreciation Cost 750,000 49,995 18.750 (9,995) 18.750 10,000 18.750 18.750 if you G H End of Year Amounts Depreciation Accumulated Hook Expense Depreciation Value (100,000) 150,000 850.000 150.000 300000 (100,005) 150.000 450.000 (159,995) 150 000 600,000" (140,000) 150.000 750.000 (150.000) 750,000 Collect Book Auburn Car Wash Double Declining Balance Calculation End of Year Amounts Beginning Depreciation Depreciation Accumulated Book Value X Rate Expense Depreciation BOO OOO 0.400 320 000 20 000 20000 480.000 0400 192.000 512.000 288.000 288,000 0.400 115 200 627.200 1 72 800 172 800 89 120 596 320 103,680 103.680 41.472 737 792 62 208 737792 To cell with a red flag you will see the comment you how 3 0400 Noted for year 5 you must make the year end book value equal to the Residual Value Therefore you will need to take the beginning book valuess the Residual Value 5 Total Auburn Car Wash Activity Based When you have completed all three schedules answer the following queston What do you observe about the Book Value at the end of the oth year for all three met End of Year Amounts Calculation Desktop X Ready Lakin Type here to search a e Home Insert Page Layout Formulas Data Review View Help Search Arial 29 Wrap Text Accounting Paste -10 AA . .A. BIU. E E Merge & Center . $ . % 49 Insert Delete Forma Clipboard Conditional Format as Cell Formatting Table Styles Styles Font H17 - : A B C D 150000 E F G Auburn Car Wash Double Declining Balance IKILMINTO.PL Year Rate Calculation Beginning Depreciation Book Value 800,000 0 400 480.000 0400 288,000 0.400 172.800 0400 103.680 over a cell with a red flag you will see the comment End of Year Amounts Depreciation Accumulated Book Expense Depreciation Value 320,000 320,000 480,000 192.000 512.000 288.000 115 200 627 200 172800 69,120 695.320 103 680 41.472 737,792 6 2 208 737,792 Tey Try again Total Note: for year 5 you must make the year end book valve equal to the Residual Value Therefore you will need to take the beginning book value less the Residual Value Auburn Car Wash Activity Based When you have completed the schedules answer the following question What do you observe about the Book Value at the end of the 6th year for all three methods? Depreciation Rate Hours Used 2.000 1.800 2 200 2.100 75 00 75 00 7500 75 00 End of Year Amounts Depreciation Accumulated Book Expense Depreciation Value 10. OOO OO OOO 0 000 135,000.00 285 000 515 000 165.000 OD 450.000 157.500.00 607 500 192.500 142.500 OD 750 000 50 000 750,000 350.000 15.00 10 000 Lab 1 Given Data # | Type here to search a Desktop e (?) x Aligno Clipboard 6 Font B27 1 Given Data: X for E F AUBURN CAR WASH Cost of new car wash machines Estimated residual value Machine life in years Machine life in hours 800,000 50,000 10,000 Actual use per year: Hours Year Used 2,000 1,800 2,200 2,100 1,900 AWN Lab 1 Given Data Ready

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts