Question: Allocating Joint Costs Using the Weighted Average Method Sunny Lane, Inc., purchases peaches from local orchards and sorts them into four categories. Grade A are

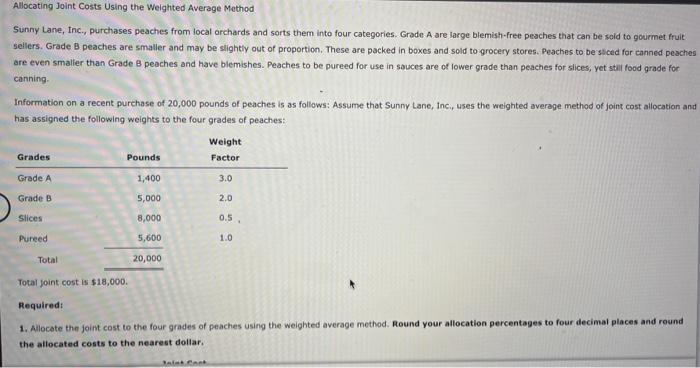

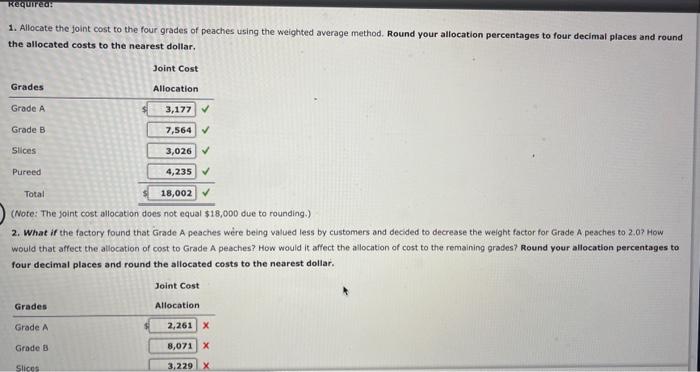

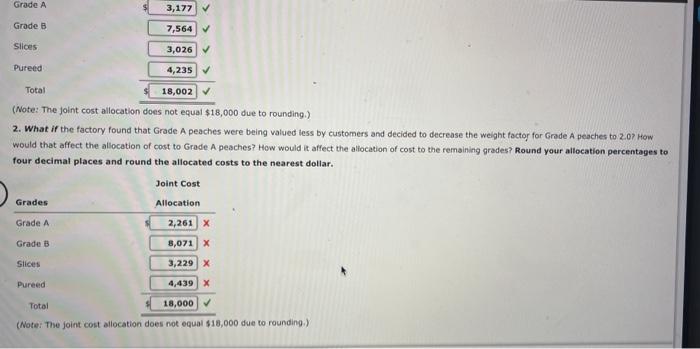

Allocating Joint Costs Using the Weighted Average Method Sunny Lane, Inc., purchases peaches from local orchards and sorts them into four categories. Grade A are large blemish-free peaches that can be sold to gourmet fruit sellers. Grade B peaches are smaller and may be slightiy out of proportion. These are packed in boxes and sold to qrocery stores. Peaches to be siced for canned peaches are even smalier than Grade 8 peaches and have blemishes. Peaches to be pureed for use in sauces are of lower grade than peaches for slices, yet stall food grade for canning. Information on a recent purchase of 20,000 pounds of peaches is as follows: Assume that Sunny Lane, Inci, uses the weighted average method of joint cast allocation and has assigned the following weights to the four grades of peaches: Total foint cost is $18,000. Mequiredt 1. Allocate the joint cost to the four grades of peaches using the weighted average method. Round your allocation percentages to four decimal places and round the allocated costs to the nearest dollar. 1. Allocate the joint cost to the four grades of peaches using the weighted average method. Round your allocation percentages to four decimal places and round the allocated costs to the nearest dollar. (Note: The foint cost allocation does not equal $18,000 due to rounding.) 2. What if the factory found that Grade A peaches were being valued less by customers and decided to decrease the weight factor for Grade A pesches to 2.0? How would that affect the allocation of cost to Grade A peaches? How would it affect the allocation of cost to the remaining grades? Round your allocation percentages to four decimal places and round the allocated costs to the nearest dollar. (Wote: The joint cost allocation does not equal $18,000 due to rounding.) 2. What if the factory found that Grade A peaches were being valued less by customers and decided to decrease the weight foctor for Grade A peaches to Z.07 How would that affect the aliocation of cost to Grade A peaches? How would it affect the allocation of cost to the remaining grades? Round your allocation percentages to four decimal places and round the allocated costs to the nearest dollar. (Note: The joint cost allocation does not equal 318,000 due to rounding.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts