Question: Allocating selling and administrative expenses using activity - based costing shrute Inc. manufactures office coplers, which are sold to retallers. The price and cost of

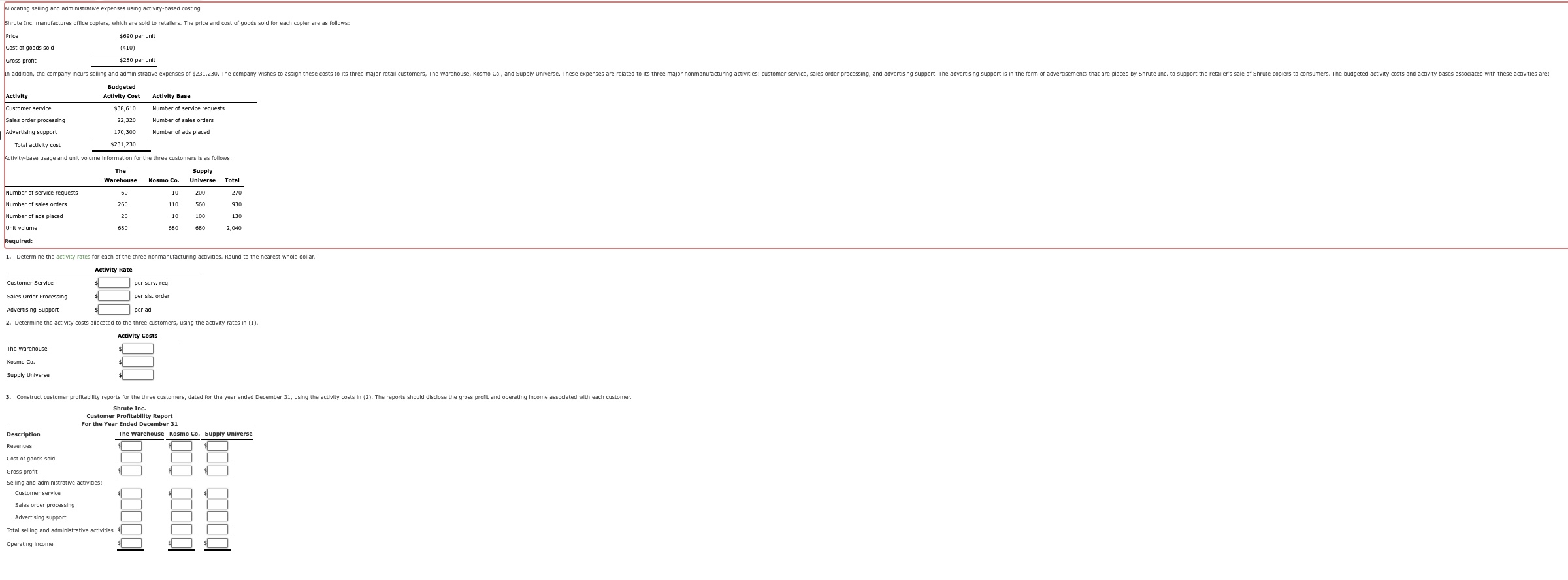

Allocating selling and administrative expenses using activitybased costing

shrute Inc. manufactures office coplers, which are sold to retallers. The price and cost of goods sold for each copler are as follows:

Required:

Determine the activily rates for each of the three nonmanufacturing activitles. Round to the nearest whole dollar

tableActivity RateCustomer ServiceSales Order ProcessingAdvertising Support Determine the activity costs allocated to the three customers, using the activity rates in The WarehouseKosmo CoSupply Universe

Construct customer profltability reports for the three customers, dated for the year ended December using the activity costs in The reports should disclose the gross profit and operating income assoclated with each customer.

Shrute Inc.

Customer Profitability Report

For the Year Ended December

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock