Question: Allowance Method for Accounting for Bad Debts At the beginning of 2017, EZ Tech Company's Accounts Receivable balance was $219,000, and the balance in Allowance

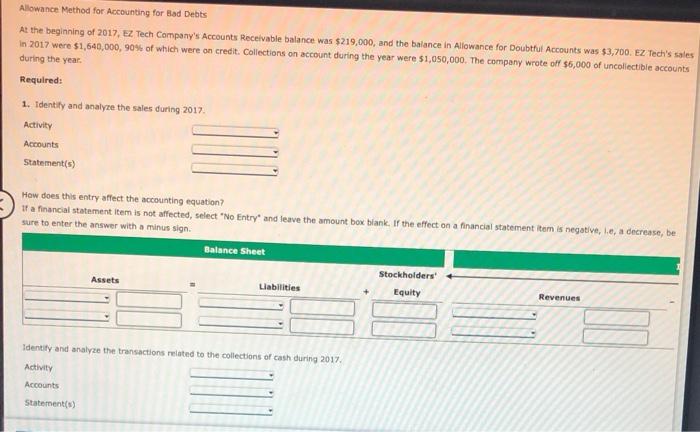

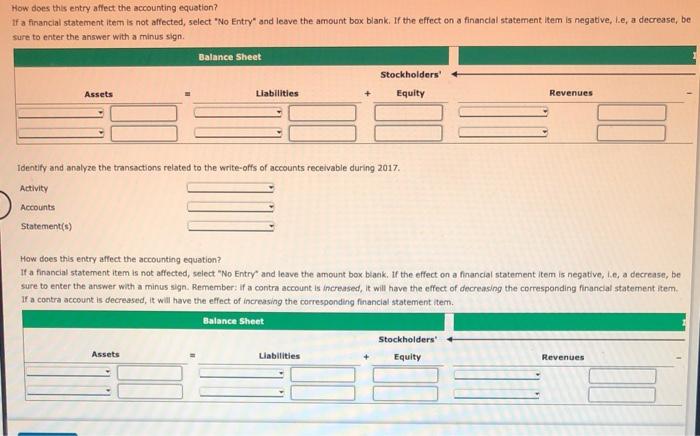

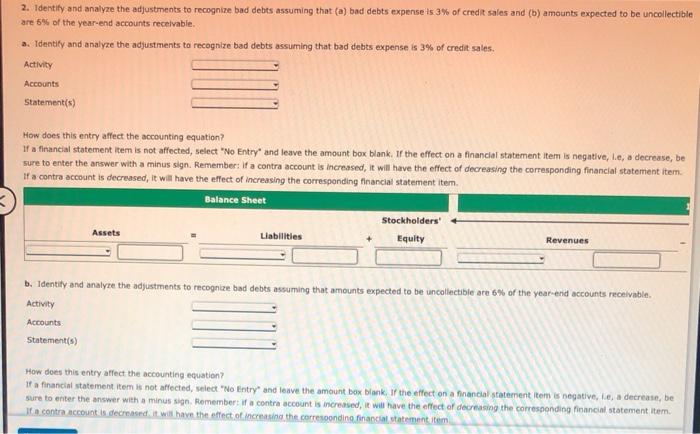

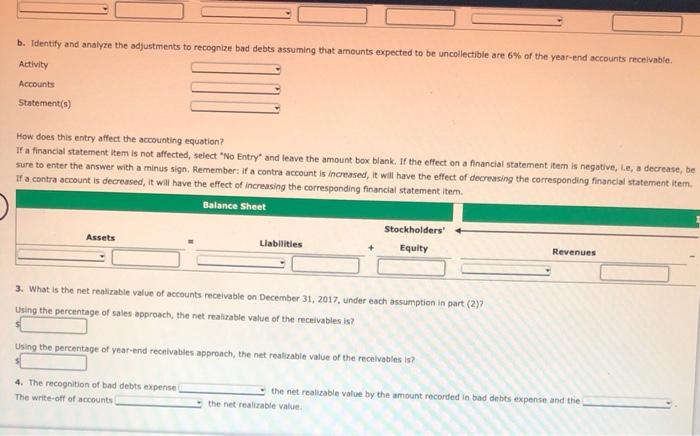

Allowance Method for Accounting for Bad Debts At the beginning of 2017, EZ Tech Company's Accounts Receivable balance was $219,000, and the balance in Allowance for Doubtful Accounts was $3,700. EZ Tech's sales in 2017 were $1,640,000, 90% of which were on credit. Collections on account during the year were $1,050,000. The company wrote off $5,000 of uncollectible accounts during the year. Required: 1. Identity and analyze the sales during 2017 Activity Accounts Statement(s) How does this entry affect the accounting equation? If a financial statement item is not affected, select 'No Entry and leave the amount box blank. If the effect on a financial statement item is negative, le, a decrease, be sure to enter the answer with a minus sign Balance Sheet Assets Liabilities Stockholders' Equity Revenues Identify and analyze the transactions related to the collections of cash during 2017 Activity Accounts Statement(s) How does this entry affect the accounting equation? If a financial statement item is not affected, select "No Entry" and leave the amount box blank. If the effect on a financial statement item is negative, ie, a decrease, be sure to enter the answer with a minus sign Balance Sheet Stockholders Assets Llabilities Equity Revenues Identify and analyze the transactions related to the write-offs of accounts receivable during 2017. Activity Accounts Statement(s) How does this entry affect the accounting equation? If a financial statement item is not affected, select "No Entry and leave the amount box blank. If the effect on a financial statement item is negative, I., a decrease, be sure to enter the answer with a minus sign. Remember: if a contra account is increased, it will have the effect of decreasing the corresponding financial statement item If a contra account is decreased. It will have the effect of increasing the corresponding financial statement item. Balance Sheet Stockholders' Assets Liabilities Equity Revenues 2. Identity and analyze the adjustments to recognize bad debts assuming that (a) bad debts expense is 3% of credit sales and (b) amounts expected to be uncollectible are 6% of the year-end accounts receivable. a. Identity and analyze the adjustments to recognize bad debts assuming that bad debts expense is 3% of credit sales. Activity Accounts Statement(s) How does this entry affect the accounting equation? 1f a financial statement item is not affected, select "No Entry" and leave the amount box blank. If the effect on a financial statement item is negative, le, a decrease, be sure to enter the answer with a minus sign. Remember: If a contra account is increased, it will have the effect of decreasing the corresponding financial statement item. If a contra account is decreased, it will have the effect of increasing the corresponding financial statement item Balance Sheet Stockholders' Assets Liabilities Equity Revenues b. Identity and analyze the adjustments to recognize bad debts assuming that amounts expected to be uncollectible are 6% of the year-end accounts receivable. Activity Accounts Statement(s) How does this entry affect the accounting equation? 17 a financial statement item is not affected, select "No Entry and leave the amount box blank. If the effect on a financial statement item is negative, le, a decrease be sure to enter the answer with a minus sign. Remember if a contra account is increased, it will have the effect of decreasing the corresponding financial statement item. If a contra account is decreased it will have the effect of increasing the corresponding financial statement item b. Identify and analyze the adjustments to recognize bad debts assuming that amounts expected to be uncollectible are 6% of the year-end accounts receivable. Activity Accounts Statement(s) How does this entry affect the accounting equation? If a financial statement item is not affected, select "No Entry and leave the amount box blank. If the effect on a financial statement item is negative, le, a decrease, be sure to enter the answer with a minus sign. Remember: If a contra account is increased, it will have the effect of decreasing the corresponding financial statement item If a contra account is decreased, it will have the effect of increasing the corresponding financial statement item. Balance Sheet Stockholders' Assets Liabilities Equity Revenues 3. What is the net reliable value of accounts receivable on December 31, 2017, under each assumption in part (2) Using the percentage of sales approach, the net realizable value of the receivables is? Using the percentage of year-end receivables approach, the net realizable value of the receivables s? 4. The recognition of bad debts expense The write-off of accounts the net realizable value by the amount recorded in bad debts expense and the the net realizable value

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts