Question: Allowance Method for Accounting for Bad Debts At the beginning of 2017, EZ Tech Company's Accounts Receivable balance was $198,000, and the balance in Allowance

Allowance Method for Accounting for Bad Debts

At the beginning of 2017, EZ Tech Company's Accounts Receivable balance was $198,000, and the balance in Allowance for Doubtful Accounts was $3,350. EZ Tech's sales in 2017 were $1,490,000, 90% of which were on credit. Collections on account during the year were $950,000. The company wrote off $6,000 of uncollectible accounts during the year.

Assume

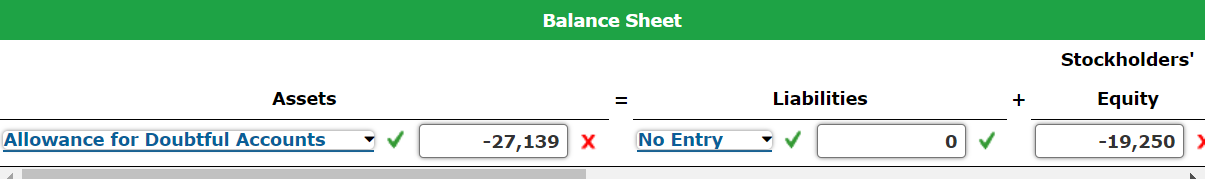

Identify and analyze the adjustments to recognize bad debts assuming that (a) bad debts expense is 3% of credit sales and (b) amounts expected to be uncollectible are 5% of the year-end accounts receivable.

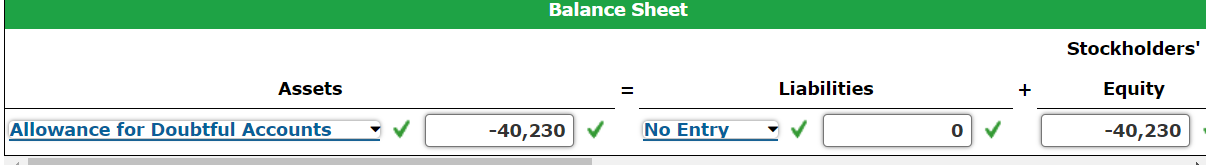

a. Identify and analyze the adjustments to recognize bad debts assuming that bad debts expense is 3% of credit sales.

Balance Sheet Stockholders' Assets Liabilities + Equity Allowance for Doubtful Accounts V V' J No Entry v \\I ~/ ' Balance Sheet Stockholders' Assets Liabilities + Equity Allowance for Doubtful Accounts V v/ -27'139 X No Entry V J i 0' J ' -19,250' ) A L

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts