Question: Allowance Method On March 10, Gardner, Inc. declared a $1,350 account receivable from the Gates Company as uncollectible and wrote off the account. On November

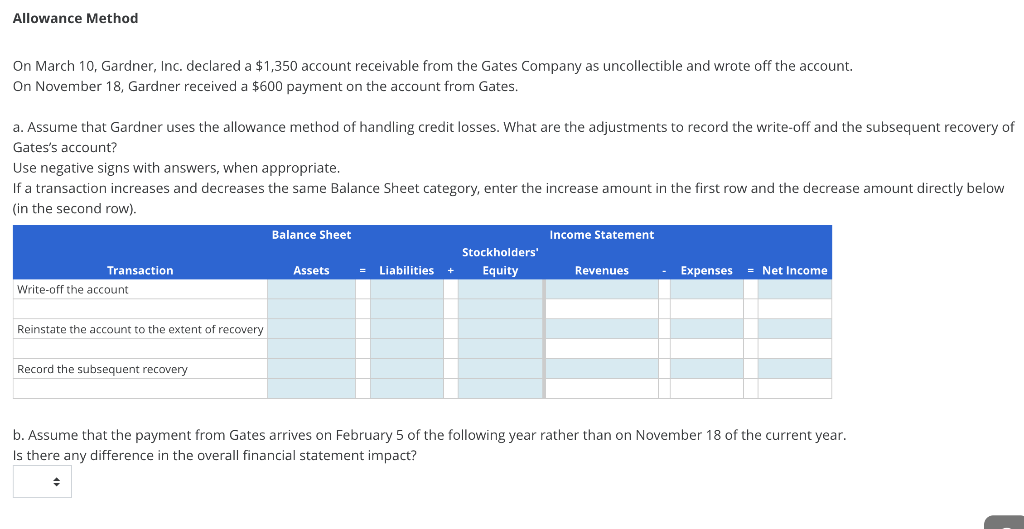

Allowance Method On March 10, Gardner, Inc. declared a $1,350 account receivable from the Gates Company as uncollectible and wrote off the account. On November 18, Gardner received a $600 payment on the account from Gates. a. Assume that Gardner uses the allowance method of handling credit losses. What are the adjustments to record the write-off and the subsequent recovery of Gates's account? Use negative signs with answers, when appropriate. If a transaction increases and decreases the same Balance Sheet category, enter the increase amount in the first row and the decrease amount directly below (in the second row). Transaction Write-off the account Reinstate the account to the extent of recovery Record the subsequent recovery Balance Sheet Income Statement Assets = Liabilities + Stockholders' Equity Revenues Expenses = Net Income b. Assume that the payment from Gates arrives on February 5 of the following year rather than on November 18 of the current year. Is there any difference in the overall financial statement impact

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts