Question: Allowing entities to estimate rather than physically count inventories at interim periods is an example of a trade-off between a. Verifiability and comparability b. Timeliness

- Allowing entities to estimate rather than physically count inventories at interim periods is an example of a trade-off between

a. Verifiability and comparability

b. Timeliness and verifiability

c. Neutrality and consistency

d. Timeliness and comparability

2.A candidate who obtains the rating of 75% and above in at least majority of the subjects shall receive a conditional credit for the subjects passed. He/she shall take an examination in the remaining subjects within how many years from the preceding examination?

a. 1

b. 2

c. 3

d. 4

3.The following are within the scope of the Conceptual Framework EXCEPT

a. Qualitative characteristics of useful financial information

b. Accounting assumptions including accrual basis, accounting entity, and monetary unit assumptions

c. Objective of financial reporting

d. Concepts of capital maintenance

4.Effective communication makes information more useful. Effective communication requires all of the following EXCEPT

a. Aggregating information in such a way that it is not obscured either by unnecessary detail or by excessive aggregation.

b. using standardized descriptions, rather than entity-specific information.

c. Classifying information in a manner that groups similar items and separates dissimilar items

d. focusing on presentation and disclosure objectives and principle rather than focusing on rules

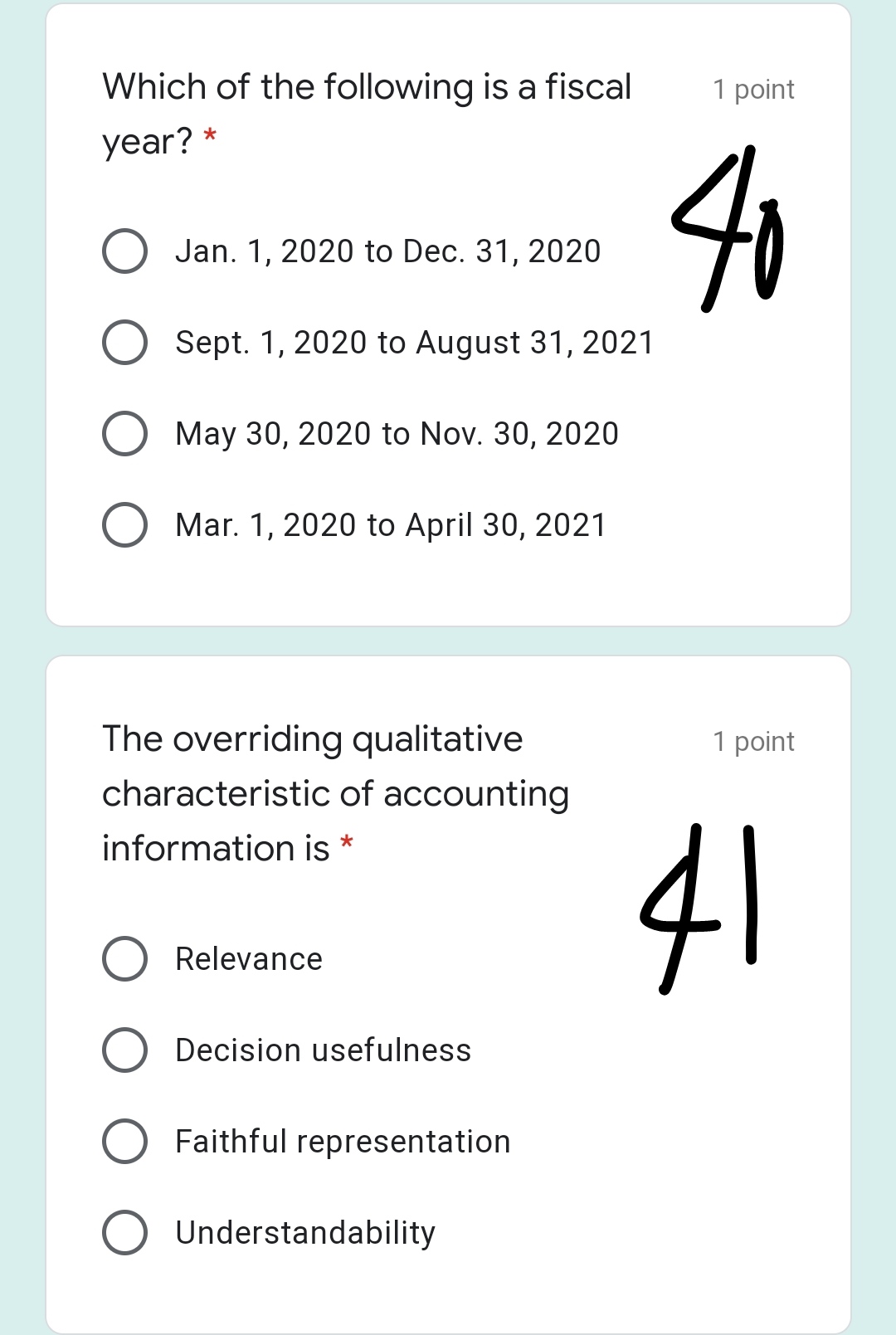

40.Which of the following is a fiscal year?

a. Jan 1, 2020 to Dec 31, 2020

b. September 1, 2020 to August 31, 2021

c. May 30, 2020 to Nov. 30, 2020

d. March 2, 2020 to April 30, 2021

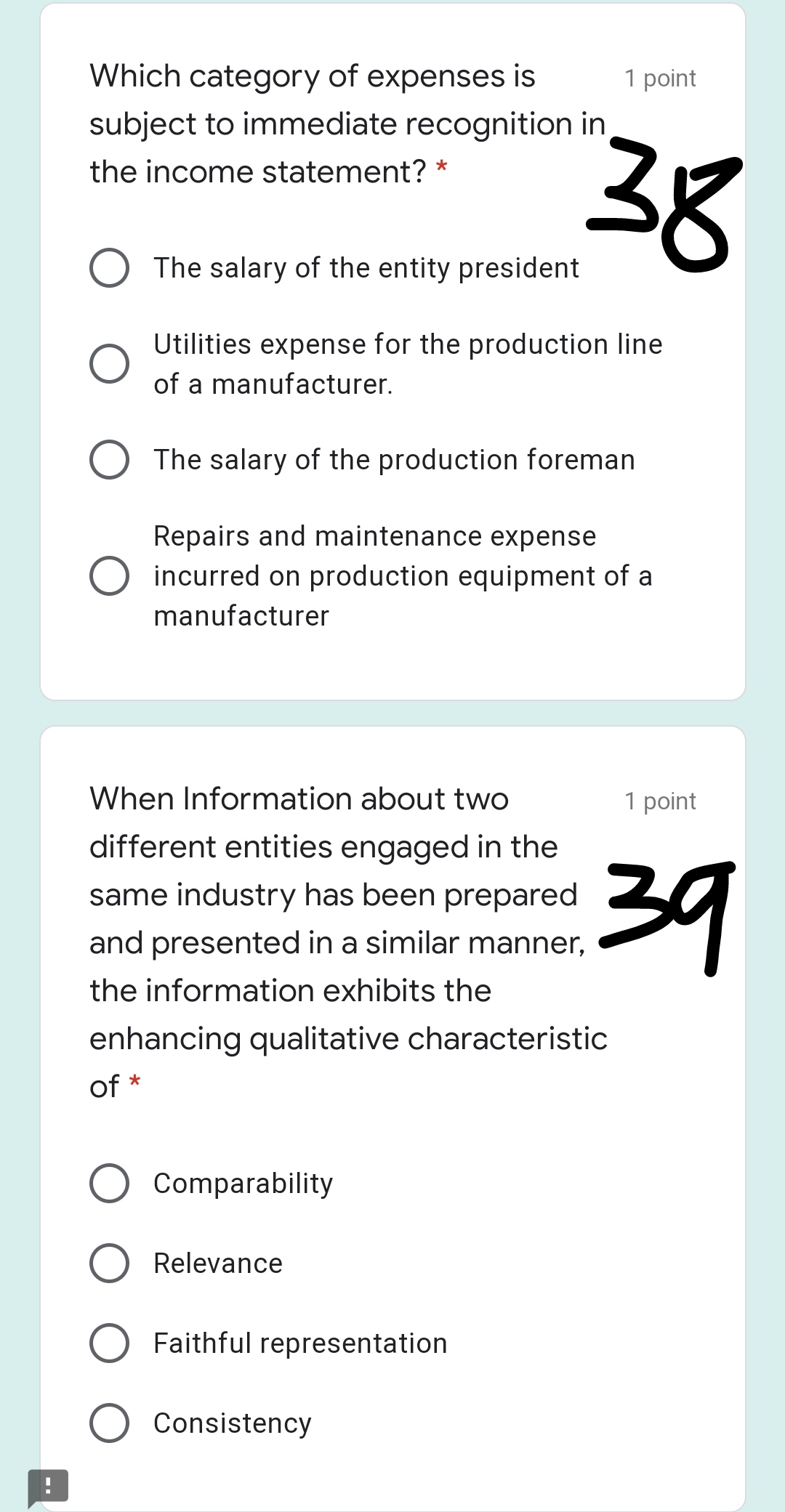

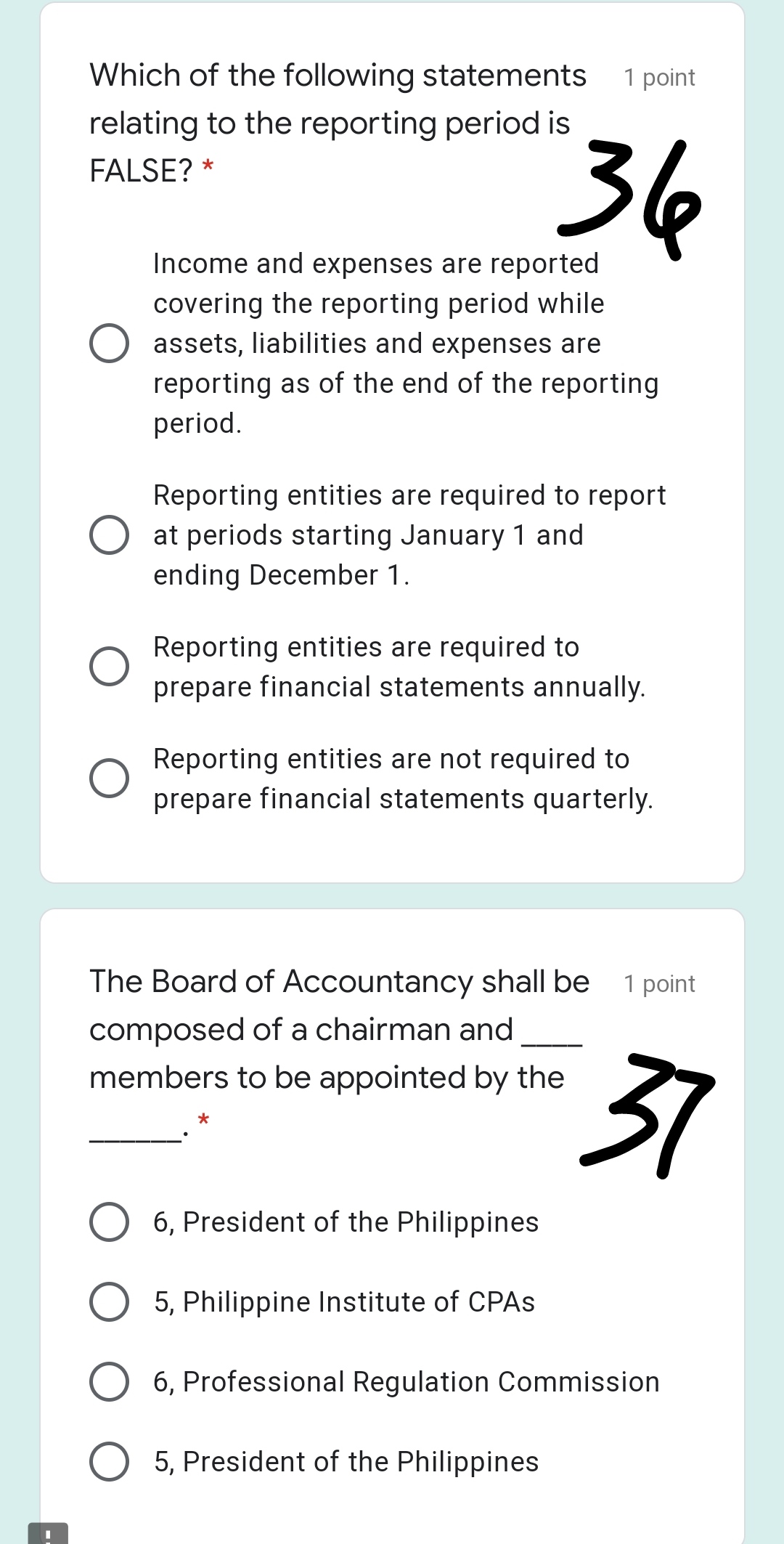

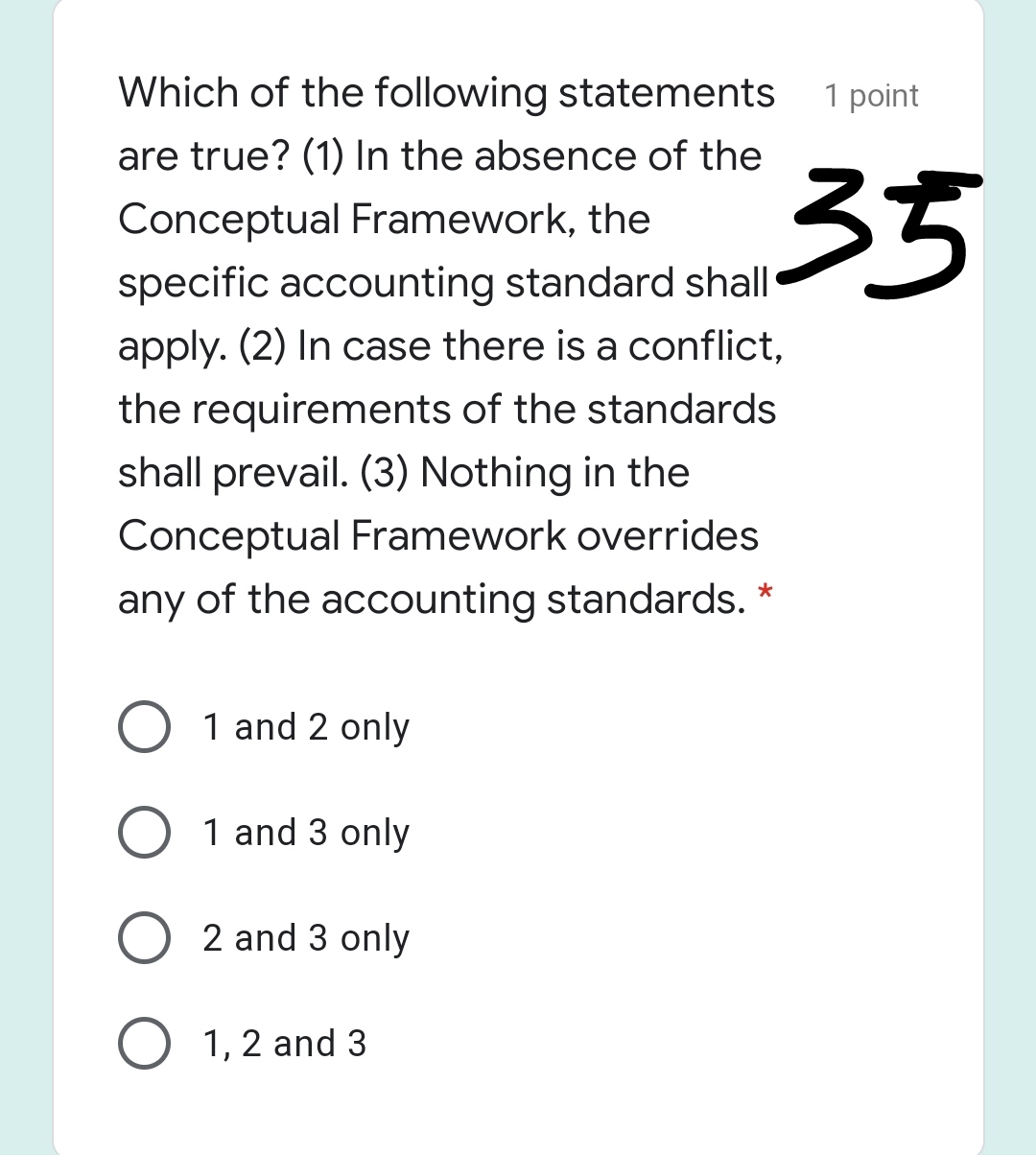

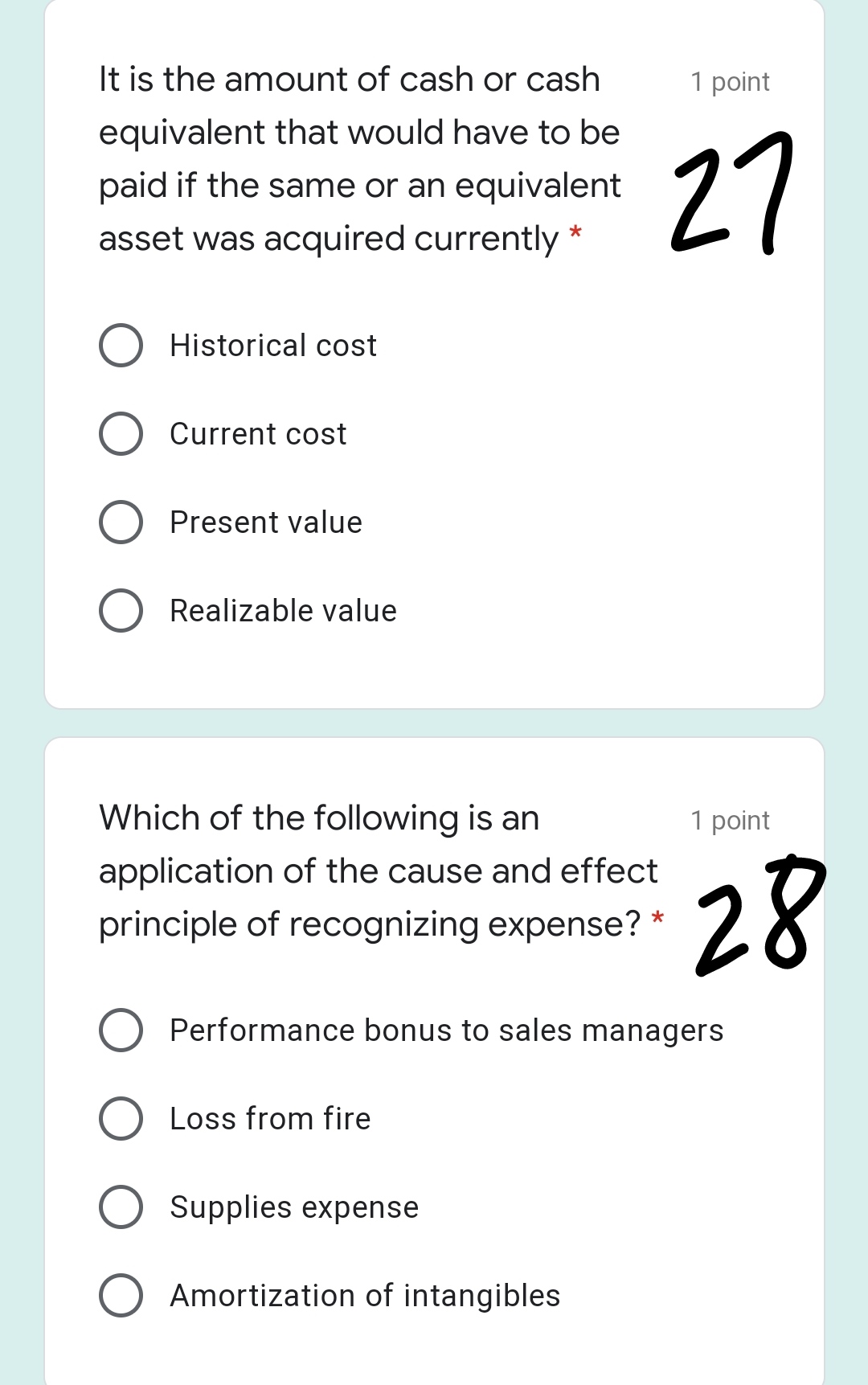

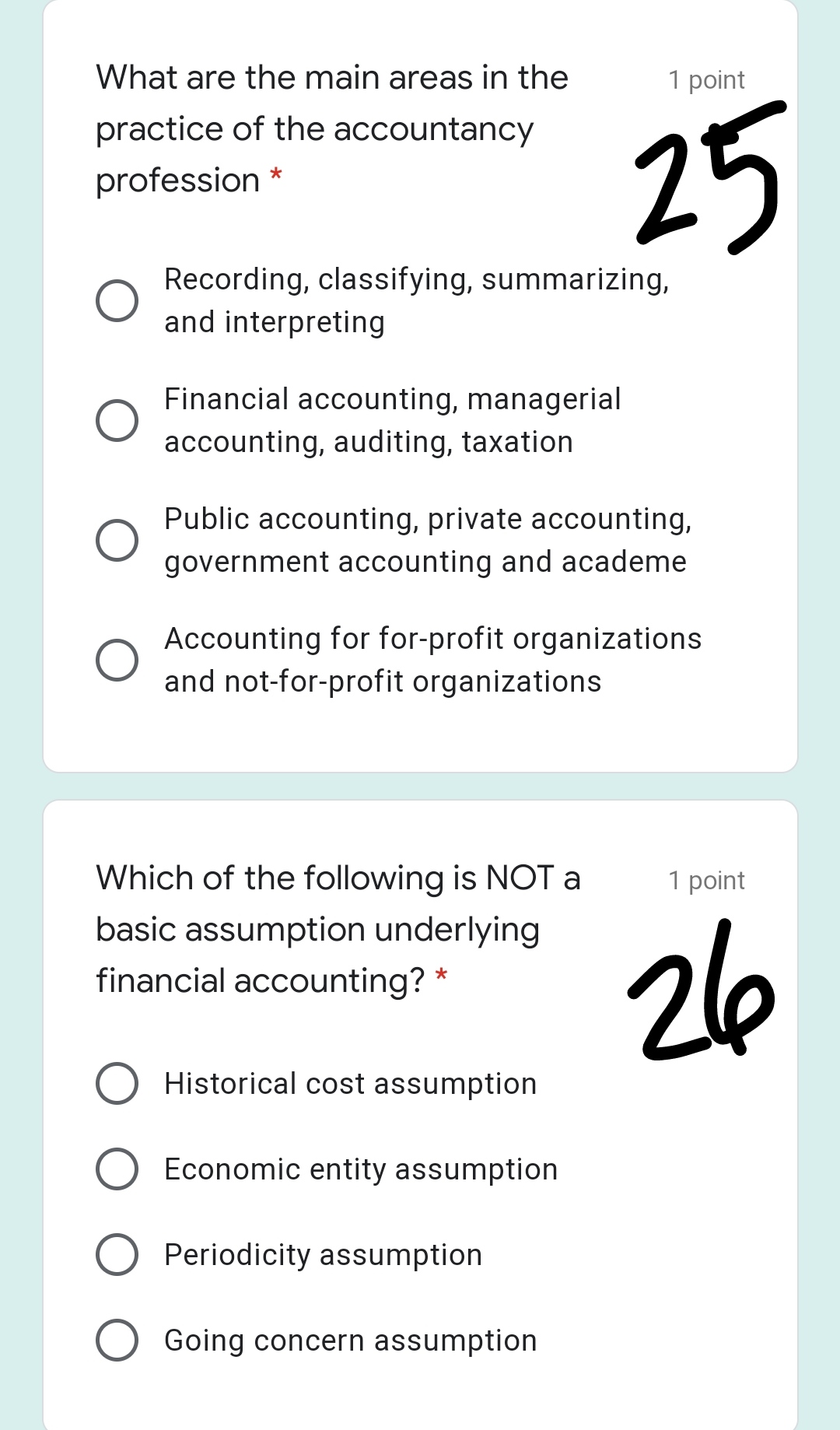

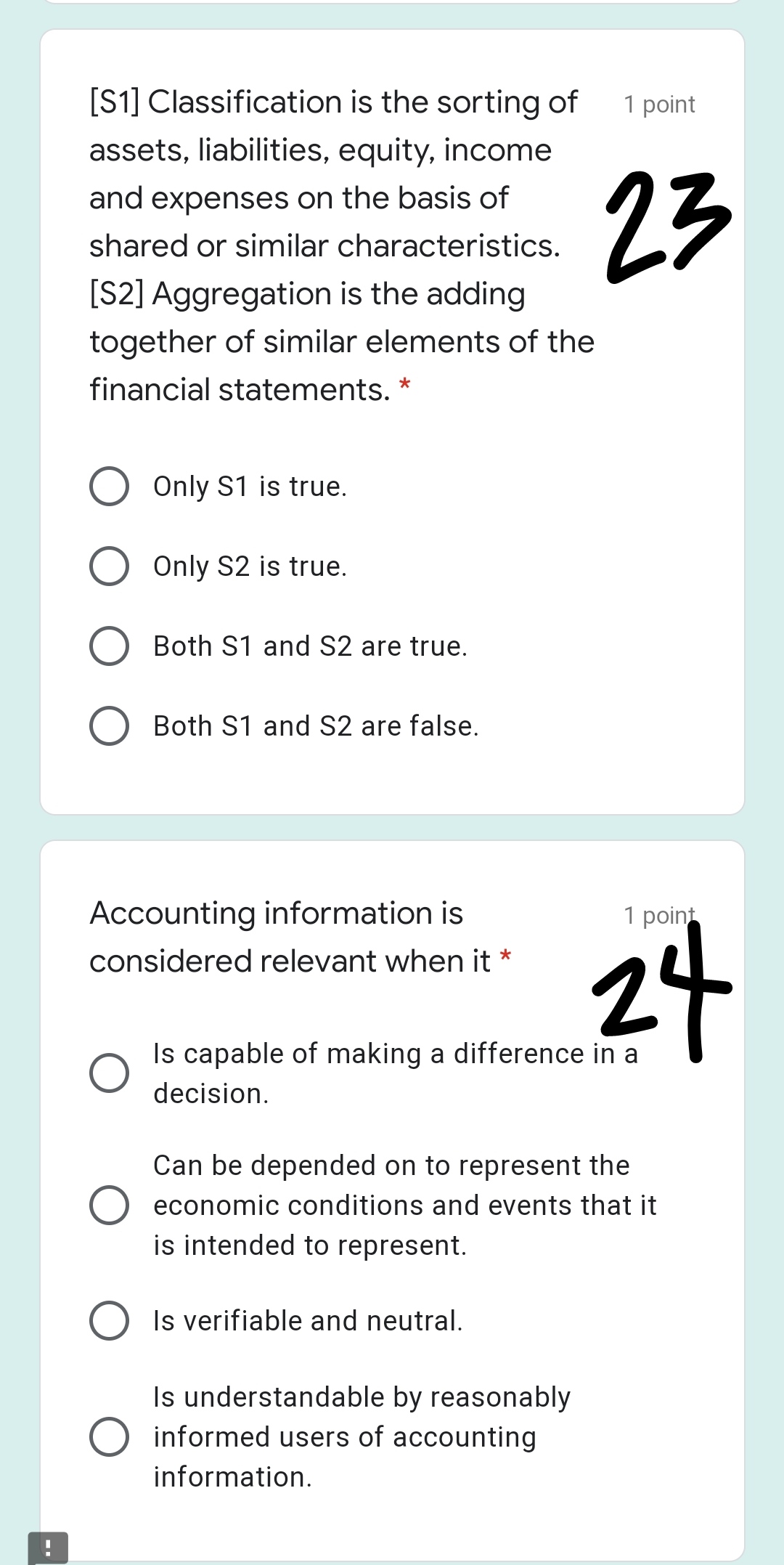

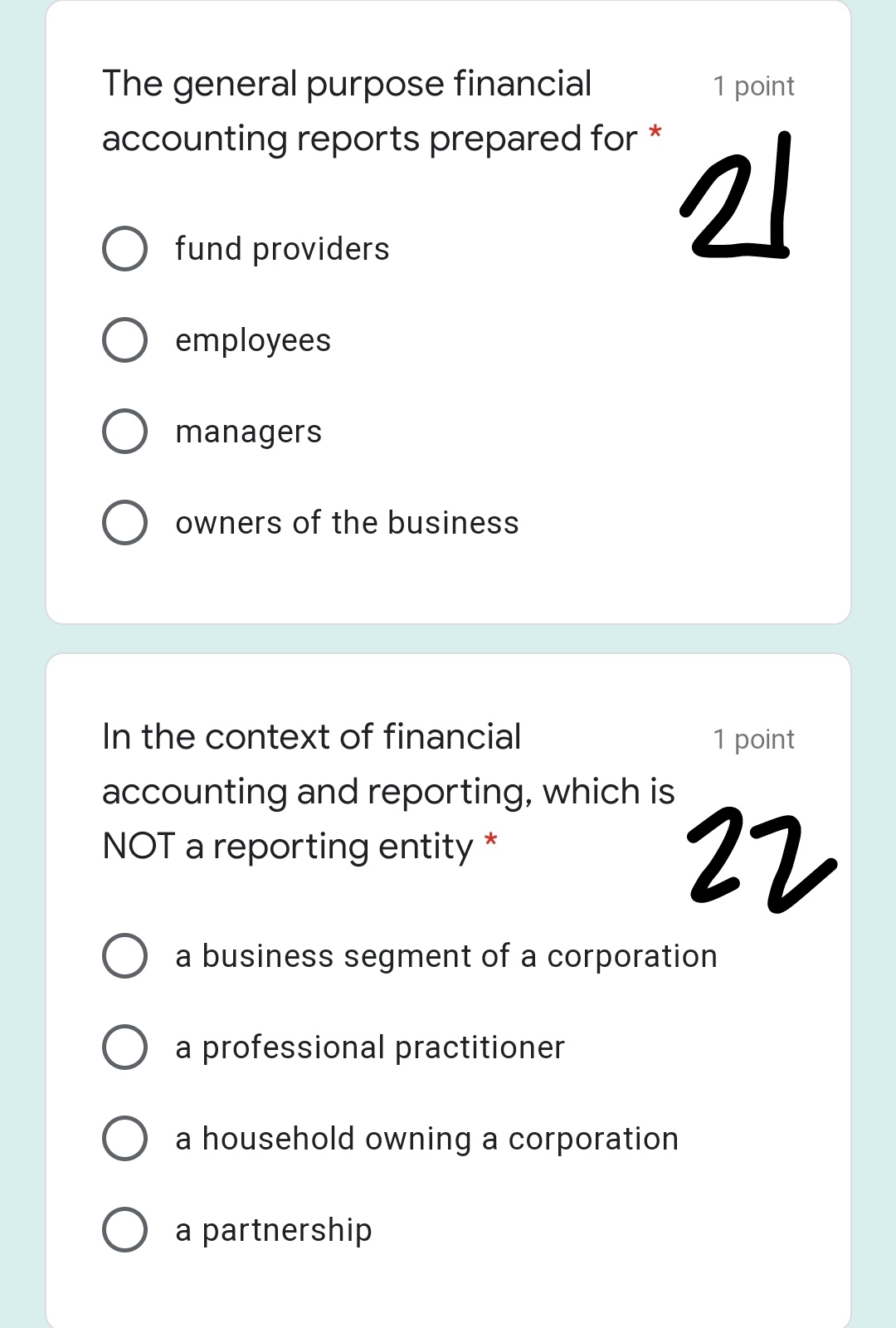

Which of the following is a fiscal 1 point year? * Jan. 1, 2020 to Dec. 31, 2020 Sept. 1, 2020 to August 31, 2021 May 30, 2020 to Nov. 30, 2020 Mar. 1, 2020 to April 30, 2021 The overriding qualitative 1 point characteristic of accounting information is * 4 O Relevance Decision usefulness O Faithful representation UnderstandabilityWhich category of expenses is 1 point subject to immediate recognition in the income statement? * O The salary of the entity president 0 Utilities expense for the production line of a manufacturer. 0 The salary of the production foreman Repairs and maintenance expense 0 incurred on production equipment of a manufacturer When Information about two 1 point different entities engaged in the same industry has been prepared and presented in a similar manner, the information exhibits the enhancing qualitative characteristic of * O Comparability 0 Relevance 0 Faithful representation 0 Consistency Which of the following statements 1 point relating to the reporting period is FALSE? * 5 Income and expenses are reported covering the reporting period while 0 assets, liabilities and expenses are reporting as of the end of the reporting period. Reporting entities are required to report 0 at periods starting Januaryi and ending December 1. 0 Reporting entities are required to prepare financial statements annually. 0 Reporting entities are not required to prepare financial statements quarterly. The Board of Accountancy shall be 1 point composed of a chairman and members to be appointed by the \"k 6, President of the Philippines 5, Philippine Institute of CPAs 6, Professional Regulation Commission 0000 5, President of the Philippines Which of the following statements 1 point are true? (1) In the absence of the Conceptual Framework, the 53 specific accounting standard shall apply. (2) In case there is a conflict, the requirements of the standards shall prevail. (3) Nothing in the Conceptual Framework overrides any of the accounting standards. * O 1 and 2 only 0 1 and 3 only O 2 and 3 only O1,2and3 Over the past 5 years, the entity 1 point was able to report income. However, it realized that income was not enough to allow the business to acquire new sets of equipment. Which of the following is true? [81] The entity was able to maintain its financial capital. [82] The entity was able to maintain its physical capital. * 0 Only 82 is true. 0 Both 81 and 82 are false. 0 Both S1 and82 are true. 0 Only S1 is true. What is the accounting standard 1 poin setting body in the Philippines at the present time? * 0 Financial Reporting Standards Council 0 Philippine Accounting Standards Board 0 Accounting Standards Council 0 Auditing and Assurance Standards CouncH The following statements relate to 1 point the exemption from CPE requirements. Which is FALSE? * O A registered professional shall be permanently exempted from CPE requirements upon reaching the age of 60. A registered professional applying for permanent CPE exemption is required to submit an authentic or authenticated copy of his/her birth certificate or, if not available, his/her voter's ID or driver's Hcense. A registered professional who is furthering his/her studies abroad shall be temporarily exempted from compliance with CPD requirements during the period of his/her stay abroad provided that he/she has been out of the country for at least two years immediately prior to the date of renewal. A registered professional who is working or practicing his/her profession abroad shall be temporarily exempted from compliance with CPD requirements during the period of his/her stay abroad provided that he/she has been out of the country for at least two years immediately prior to the date of renewal. The economic entity assumption * of O Requires periodic income measurement. O Is applicable to all forms of business organizations. O Is inapplicable to unincorporated businesses. O Recognizes the legal aspects of business organizations.Which statement is NOT true about 1 point derecognition? * O Derecognition is the removal of a recognized income or expense from the income statement. Derecognition for an asset normally occurs when the entity loses control of the recognized asset. Derecognition for a liability normally occurs when the entity no longer has a present obligation for the recognized liability. Derecognition is the removal of a recognized asset or liability from the statement of financial position. When a parent and subsidiary 1 point relationship exists; consolidated financial statements are prepared in recognition of * 0 Stable monetary unit 0 Time period 0 Legal entity 0 Economic entity It is the amount of cash or cash 1 point equivalent that would have to be paid if the same or an equivalent 2 asset was acquired currently * 0 Historical cost 0 Current cost 0 Presentvalue O Realizable value Which of the following is an 1 point application of the cause and effect principle of recognizing expense? * 0 Performance bonus to sales managers 0 Loss from fire 0 Supplies expense 0 Amortization of intangibles What are the main areas in the 1 point practice of the accountancy profession * 0 Recording, classifying, summarizing, and interpreting Financial accounting, managerial accounting, auditing, taxation government accounting and academe Accounting for for-profit organizations 0 Public accounting, private accounting, 0 and not-for-profit organizations Which of the following is NOT a 1 point basic assumption underlying financial accounting? * 0 Historical cost assumption 0 Economic entity assumption 0 Periodicity assumption 0 Going concern assumption [81] Classification is the sorting of 1 point assets, liabilities, equity, income and expenses on the basis of shared or similar characteristics. [82] Aggregation is the adding together of similar elements of the financial statements. * Only 31 is true. Only 82 is true. Both 81 and 82 are true. Both 31 and 32 are false. 0000 Accounting information is 1 poin considered relevant when it * 2 0 Is capable of making a difference in a decision. Can be depended on to represent the economic conditions and events that it is intended to represent. ls understandable by reasonably informed users of accounting information. O Q Is verifiable and neutral. 0 The general purpose financial 1 point accounting reports prepared for * O fund providers 0 employees 0 managers 0 owners of the business In the context of financial 1 point accounting and reporting, which is NOT a reporting entity * 2 ' l O a business segment of a corporation 0 a professional practitioner O a household owning a corporation 0 a partnership it is a present obligation of the 1 point entity to transfer an economic resource as a result of past events * Which of the following correctly 1 point applies the monetary unit assumption? * To be globally competitive, the entity 0 prepares financial statements denominated in US Dollars. O The entity prepares financial statements using inflation-adjusted amounts. The entity has P100,000 in its peso 0 savings account and $40,000 in its dollar savings account. It reporting cash in bank of P140,000. The entity computes the cost of the O inventories and reports this peso amount on the financial statements The chairman and the members of 1 point the Financial Reporting Standards Council, and the Auditing and Assurance Standards Council shall have a term of * Once an accounting standard has 1 point been established * I 8 O The standard is not reviewed unless a regulatory authority makes a complaint. 0 The standard is continually reviewed to see if the modification is necessary. The task of reviewing the standard is 0 given to the national accounting organization. The principle of consistency requires 0 that no revisions ever be made to the standard. What is the primary distinction 1 point between revenue and gain? * ,5 O The likelihood that the transaction will recur The materiality of the amount. transaction. The nature of the activity that gives rise to the transaction. 0 O The method of disclosing the Q Which of the following would most 1 point likely provide consolidated financial statements? * I 9 O Chowking Food Corporation 0 Mang Inasal Philippines, Inc. 0 Red Ribbon Bakeshop, Inc. 0 Jollibee Foods Corporation What would be an advantage of 1 point having all countries adopt and follow the same accounting standards? * 0 Lower preparation costs. 0 Comparability. O Aesthetic appeal 0 Comparability and lower preparation costs Which statement is true regarding 1 point managerial and financial accounting? * l O Managerial accounting has a future focus. The emphasis on managerial O accounting is relevance and the emphasis on financial accounting is timeliness. Managerial accounting need not to 0 follow generally accepting accounting principles while financial account must follow these principles. 0 Managerial accounting is generally more precise. What is the measuring component 1 point in the definition of accounting? * I The recognition or nonrecognition of business activities as accountable events. The assigning of peso amounts to the accountable events. The preparation of audit report by CPAs. The preparation and distribution of accounting reports to users of accounting information. 000 0 Which of the following is an 1 point application of the systematic and rational allocation principle of recognizing expense? * 0 Warranty cost 0 Research and development cost 0 Depreciation expense of an equipment 0 Doubtful accounts Which of the following 1 point appropriately describes the relationship of the users of financial information with the reporting entity? * Government agencies are interested in O the regulation of the activities of the entity. Employees are interested in comparing 0 their salaries with the tax paid by the reporting entity. The general public is interested in a sole 0 proprietorship and their ability to force the business's incorporation. Customers would like to know of the O ability of the entity to buy goods from the former. Which of the following practices 1 point may NOT be an acceptable deviation from recognizing revenue D at the point of sale? * 0 During production 0 Upon receipt of order 0 Upon receipt of cash 0 End of production The following cases properly 1 point applies the concept of going concern EXCEPT * 1 0 Cost of sales is recognized when sales is earned. The entity generally values its inventory 0 at the cost less cost to dispose for reporting purposes. Property, plant and equipment are 0 depreciated over its useful life as long as the entity continues to use the asset and to operate as a business. Adjusting journal entries are made so 0 that income and expenses for next year will be recorded for that year. A sole proprietor owns a computer 1 point shop. He reported the cost of his house and lot as an asset of the entity. What accounting assumption was violated? * Periodicity Materiality Monetary unit assumption 0000 Economic entity Which will NOT earn a CPA CPD 1 point units for accreditation and renewal of PRC License? * g 0 Attendance in Webinars/Conference O Earning a Master's or Doctorate Degree 0 Earning of a Professional Certification such as CMA, CIMA, and CISA 0 Attendance in religious activities [81] Financial reports also include 1 point nonfinancial information such as operating segment and the identities of the corporate officers and directors. [82] Financial reporting allows financial information be provided to external users. * O OnlyS1 is true. 0 Only 82 is true. 0 Both 81 and 82 are true. 0 Both 81 and 82 are false