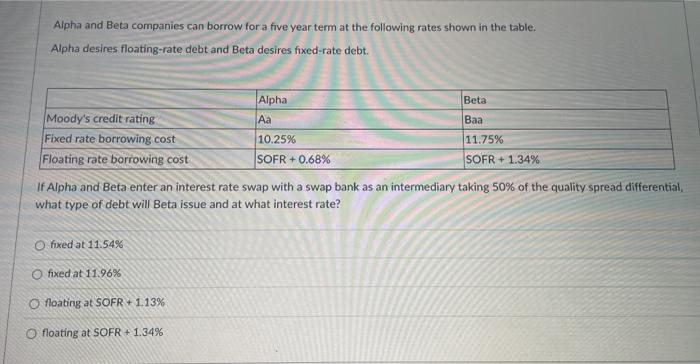

Question: Alpha and Beta companies can borrow for a five year term at the following rates shown in the table. Alpha desires floating-rate debt and Beta

Alpha and Beta companies can borrow for a five year term at the following rates shown in the table. Alpha desires floating-rate debt and Beta desires fixed-rate debt. If Alpha and Beta enter an interest rate swap with a swap bank as an intermediary taking 50% of the quality spread differential, what type of debt will Beta issue and at what interest rate? fixed at 11.54% fixed at 11.96% floating at SOFR + 1.13\% floating at SOFR +1.34%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts