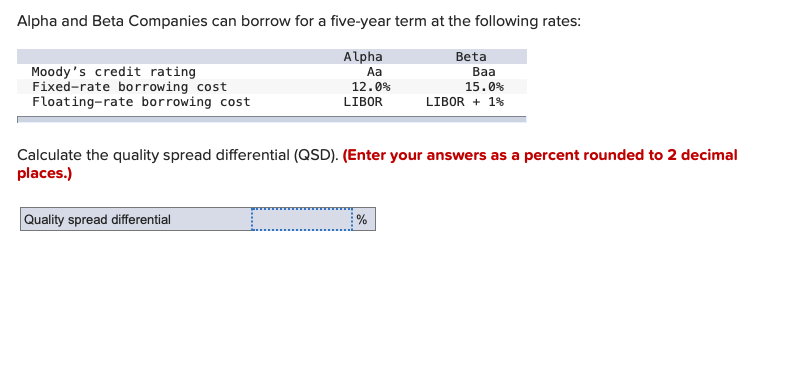

Question: Alpha and Beta Companies can borrow for a five-year term at the following rates: Moody's credit rating Fixed-rate borrowing cost Floating-rate borrowing cost Alpha 12.0%

Alpha and Beta Companies can borrow for a five-year term at the following rates: Moody's credit rating Fixed-rate borrowing cost Floating-rate borrowing cost Alpha 12.0% LIBOR Beta Baa 15.0% LIBOR + 1% Calculate the quality spread differential (QSD). (Enter your answers as a percent rounded to 2 decimal places.) Quality spread differential %

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts