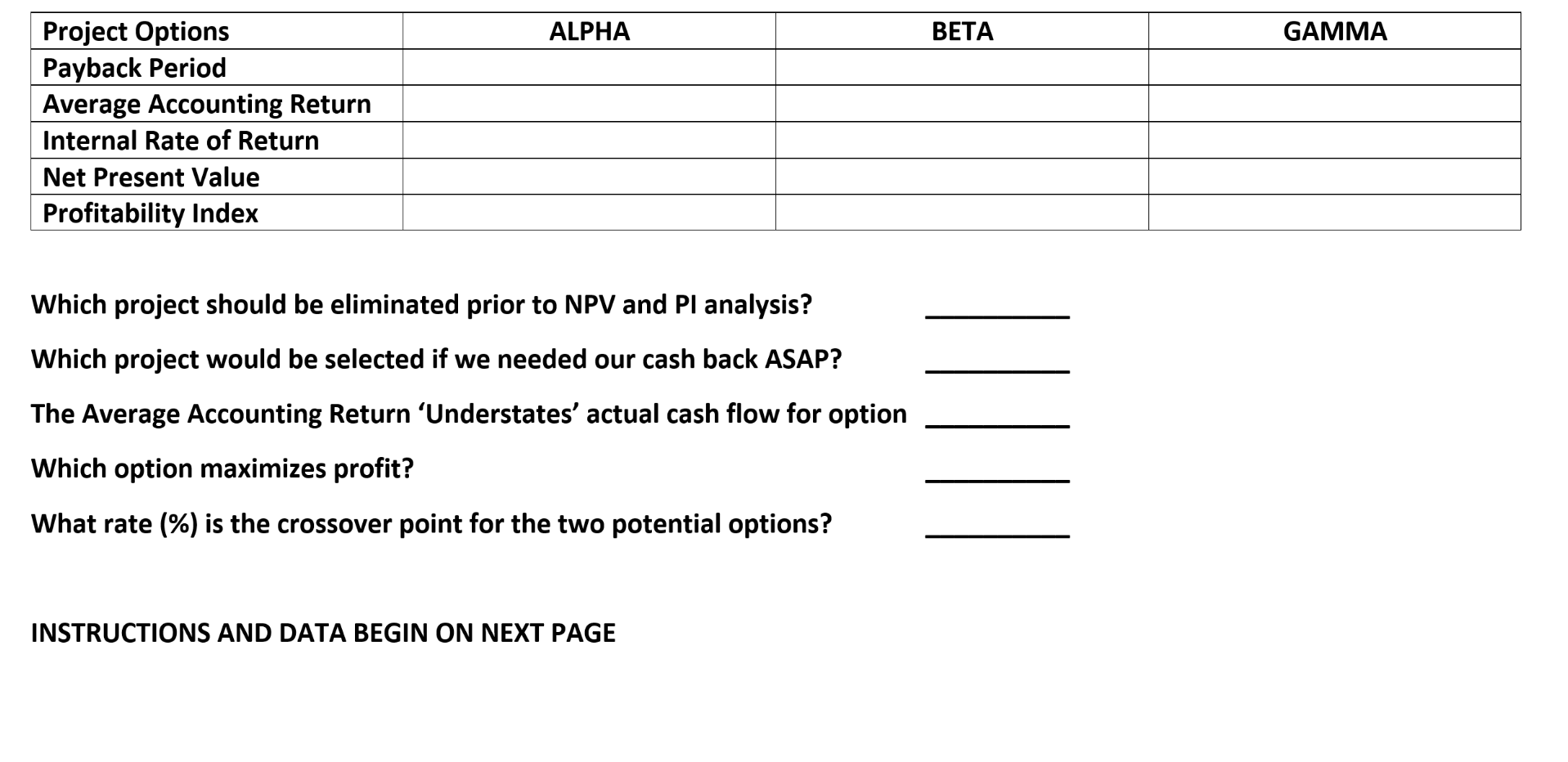

Question: ALPHA BETA GAMMA Project Options Payback Period | Average Accounting Return Internal Rate of Return Net Present Value Profitability Index Which project should be eliminated

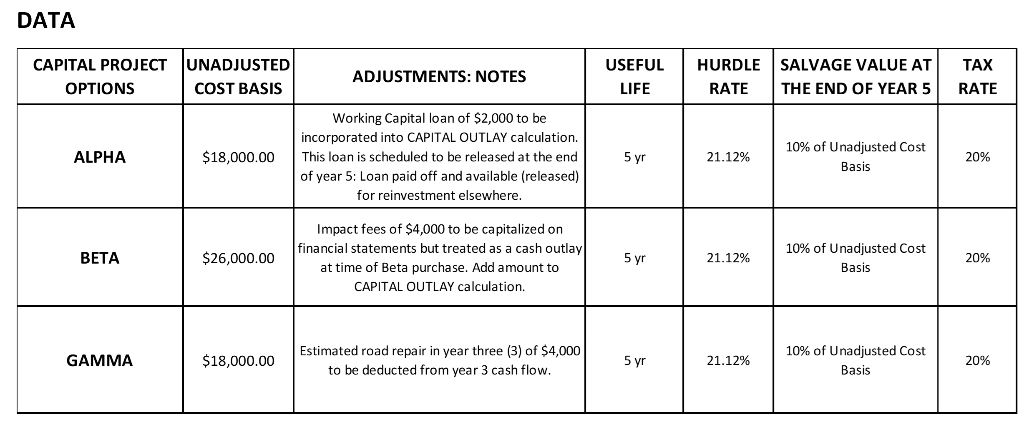

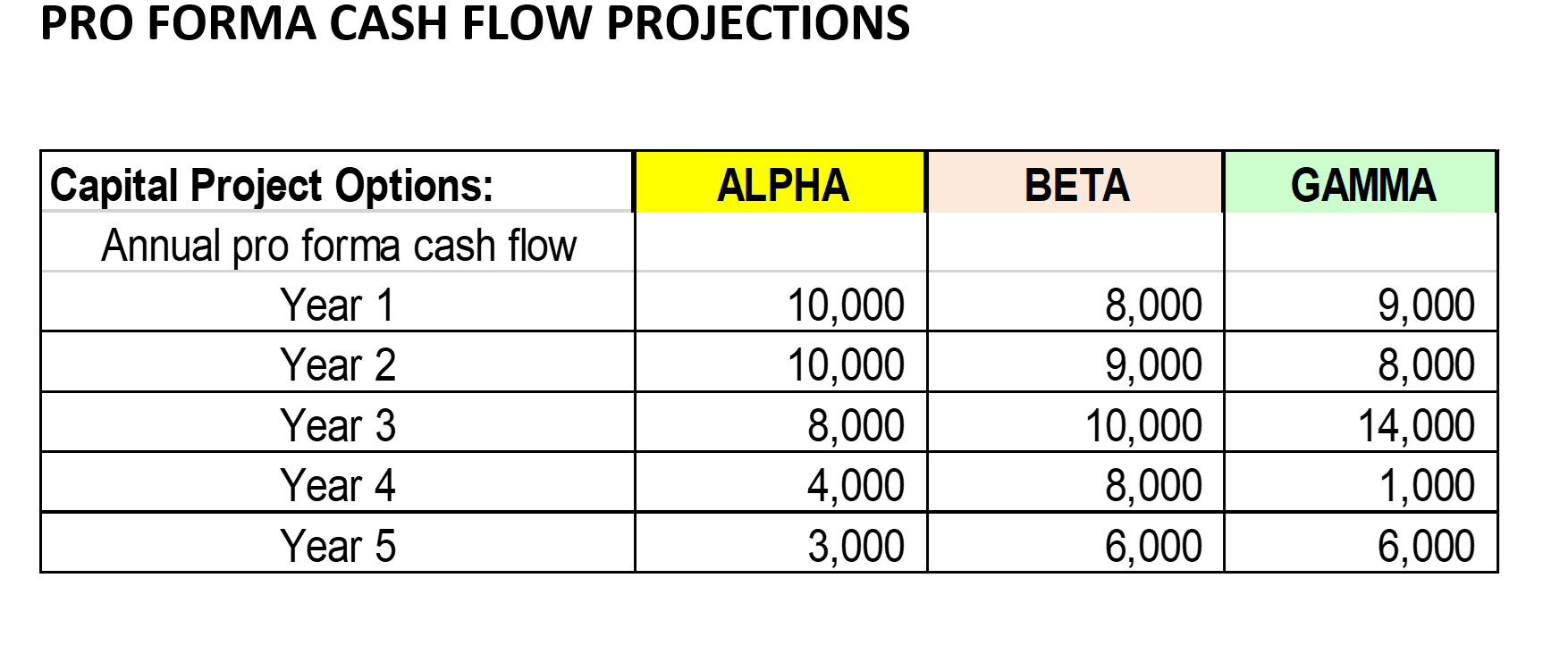

ALPHA BETA GAMMA Project Options Payback Period | Average Accounting Return Internal Rate of Return Net Present Value Profitability Index Which project should be eliminated prior to NPV and Pl analysis? Which project would be selected if we needed our cash back ASAP? The Average Accounting Return Understates' actual cash flow for option Which option maximizes profit? What rate (%) is the crossover point for the two potential options? "on_ INSTRUCTIONS AND DATA BEGIN ON NEXT PAGE DATA TAX CAPITAL PROJECT UNADJUSTED OPTIONS COST BASIS ADJUSTMENTS: NOTES USEFUL LIFE HURDLE SALVAGE VALUE AT RATE THE END OF YEAR 5 RATE ALPHA $18,000.00 Working Capital loan of $2,000 to be incorporated into CAPITAL OUTLAY calculation. This loan is scheduled to be released at the end of year 5: Loan paid off and available (released) for reinvestment elsewhere. 5 yr 21.12% 10% of Unadjusted Cost Basis 20% BETA $26,000.00 Impact fees of $4,000 to be capitalized on financial statements but treated as a cash outlayl at time of Beta purchase. Add amount to CAPITAL OUTLAY calculation. 5 yr 21.12% 10% of Unadjusted Cost Basis 20% GAMMA $18,000.00 Estimated road repair in year three (3) of $4,000 to be deducted from year 3 cash flow. 5 yr 21.12% 10% of Unadjusted Cost Basis 20% PRO FORMA CASH FLOW PROJECTIONS ALPHA BETA | GAMMA Capital Project Options: Annual pro forma cash flow Year 1 Year 2 Year 3 Year 4 Year 5 10,000 10,000 8,000 4,000 3,000 8,000 9,000 10,000 8,000 6,000 9,000 8,000 14,000 1,000 6,000 ALPHA BETA GAMMA Project Options Payback Period | Average Accounting Return Internal Rate of Return Net Present Value Profitability Index Which project should be eliminated prior to NPV and Pl analysis? Which project would be selected if we needed our cash back ASAP? The Average Accounting Return Understates' actual cash flow for option Which option maximizes profit? What rate (%) is the crossover point for the two potential options? "on_ INSTRUCTIONS AND DATA BEGIN ON NEXT PAGE DATA TAX CAPITAL PROJECT UNADJUSTED OPTIONS COST BASIS ADJUSTMENTS: NOTES USEFUL LIFE HURDLE SALVAGE VALUE AT RATE THE END OF YEAR 5 RATE ALPHA $18,000.00 Working Capital loan of $2,000 to be incorporated into CAPITAL OUTLAY calculation. This loan is scheduled to be released at the end of year 5: Loan paid off and available (released) for reinvestment elsewhere. 5 yr 21.12% 10% of Unadjusted Cost Basis 20% BETA $26,000.00 Impact fees of $4,000 to be capitalized on financial statements but treated as a cash outlayl at time of Beta purchase. Add amount to CAPITAL OUTLAY calculation. 5 yr 21.12% 10% of Unadjusted Cost Basis 20% GAMMA $18,000.00 Estimated road repair in year three (3) of $4,000 to be deducted from year 3 cash flow. 5 yr 21.12% 10% of Unadjusted Cost Basis 20% PRO FORMA CASH FLOW PROJECTIONS ALPHA BETA | GAMMA Capital Project Options: Annual pro forma cash flow Year 1 Year 2 Year 3 Year 4 Year 5 10,000 10,000 8,000 4,000 3,000 8,000 9,000 10,000 8,000 6,000 9,000 8,000 14,000 1,000 6,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts