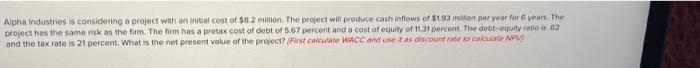

Question: Alpha Industries is considering a project with an initial cost of $8.2 million. The project will produce cash inflows of $1.93 million per year for

Alpha Industries is considering a project with an initial cost of $8.2 million. The project will produce cash inflows of $1.93 million per year for 6 years. The project has the same risk as the firm. The firm has a pretax cost of debt of 5.67 percent and a cost of equity of 11.31 percent. The debt-equity ratio is 62 and the tax rate is 21 percent. What is the net present value of the project? (First calculate WACC and use it as discount rate to calculate NPV)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts