Question: Alpha industries is considering a project with an initial cost of $7.9 million. The project will produce cash inflows of $1.63 million per year for

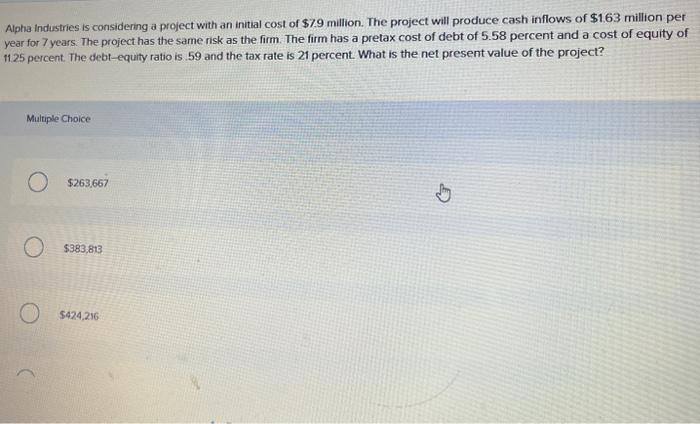

Alpha industries is considering a project with an initial cost of $7.9 million. The project will produce cash inflows of $1.63 million per year for 7 years. The project has the same risk as the firm. The firm has a pretax cost of debt of 5.58 percent and a cost of equity of 11.25 percent. The debt-equity ratio is 59 and the tax rate is 21 percent. What is the net present value of the project? Mialtiple Choice $263,667 $383.813 $424.216 5263,667 $383.813 5424,216 5445,426 $514.715

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts