Question: already did A and B I just need help with C since it is wrong James Jones is the owner of a small retail business

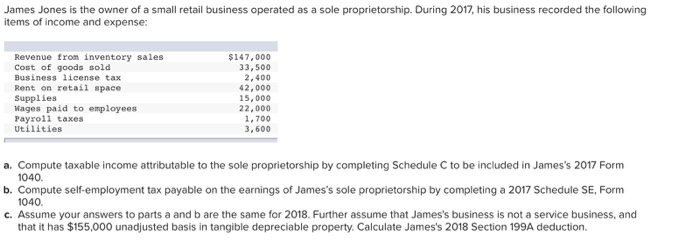

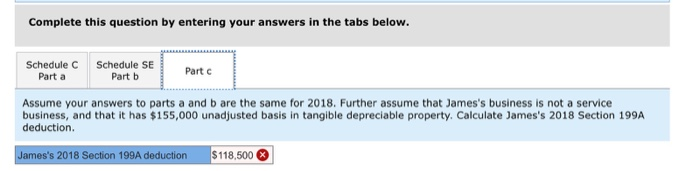

James Jones is the owner of a small retail business operated as a sole proprietorship. During 2017, his business recorded the following items of income and expense: Revenue from inventory sales Cost of goods sold Business license tax Rent on retail space Supplies Wages paid to employees Payroll taxes Utilities $147,000 33, 500 2, 400 42,000 15,000 22,000 1,700 3,600 a. Compute taxable income attributable to the sole proprietorship by completing Schedule C to be included in James's 2017 Form b. Compute self-employment tax payable on the earnings of James's sole proprietorship by completing a 2017 Schedule SE, Form c. Assume your answers to parts a and b are the same for 2018. Further assume that James's business is not a service business, and that it has $155,000 unadjusted basis in tangible depreciable property. Calculate James's 2018 Section 199A deduction. Complete this question by entering your answers in the tabs below. Schedule SE Part b Schedule C Part c Part a Assume your answers to parts a and b are the same for 2018. Further assume that James's business is not a service business, and that it has $155,000 unadjusted basis in tangible depreciable property. Calculate James's 2018 Section 199A deduction James's 2018 Section 199A deduction $118,500

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts