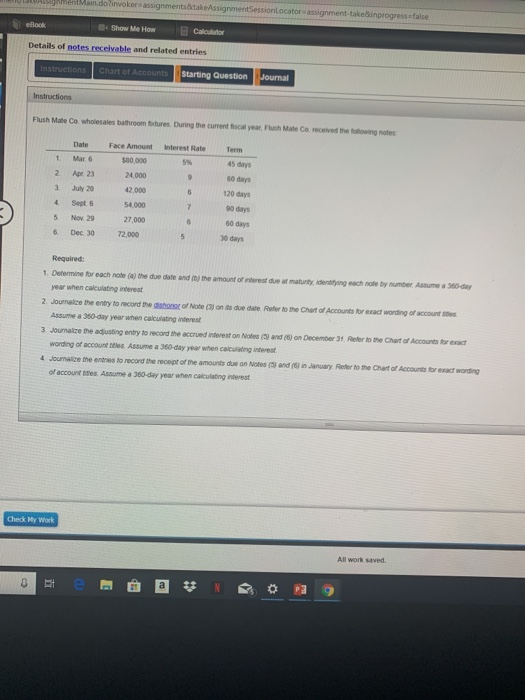

Question: already did rhe first part. akeAssignmentSessionlocator assignment-take&inprogress-false Show Me How Caloulator eBook Details of notes receivable and related entries Starting Question Instruct Flush Mate Co

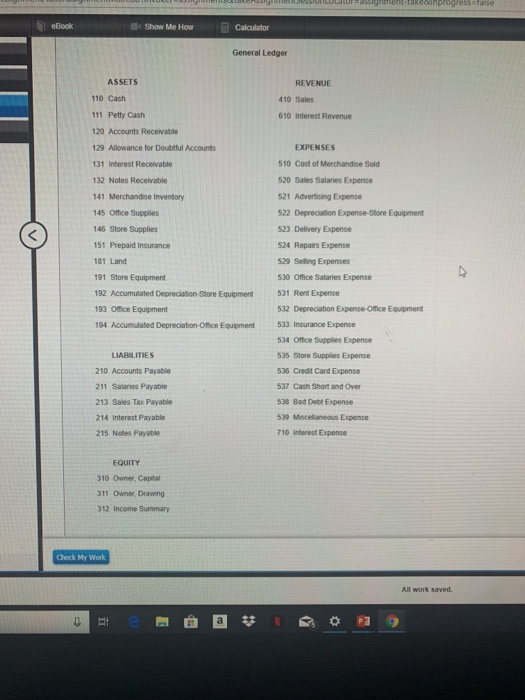

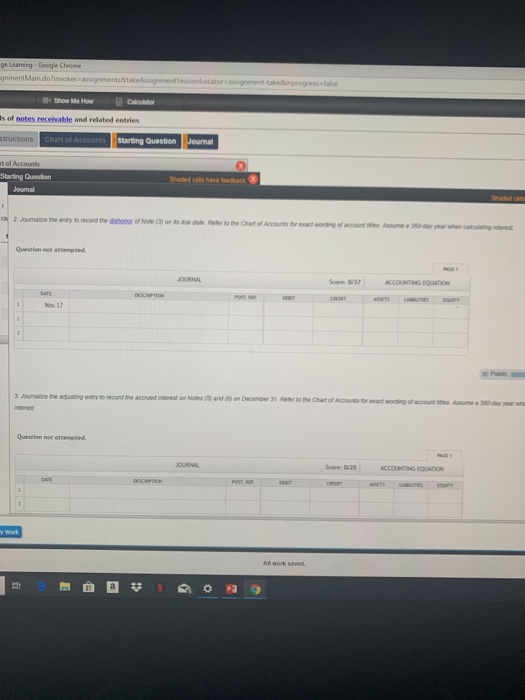

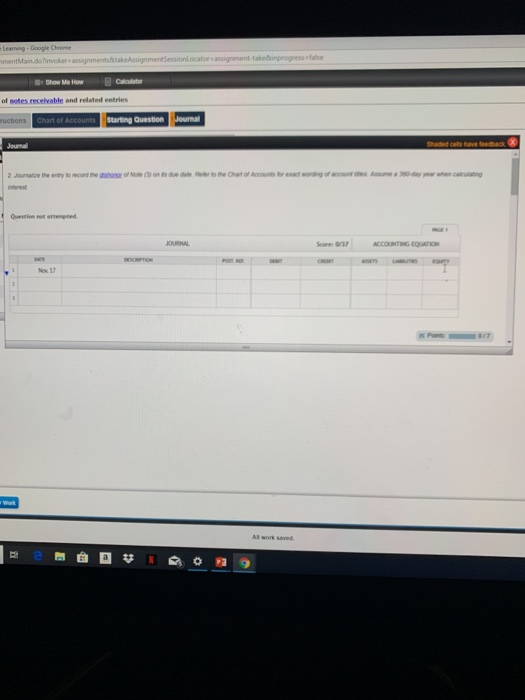

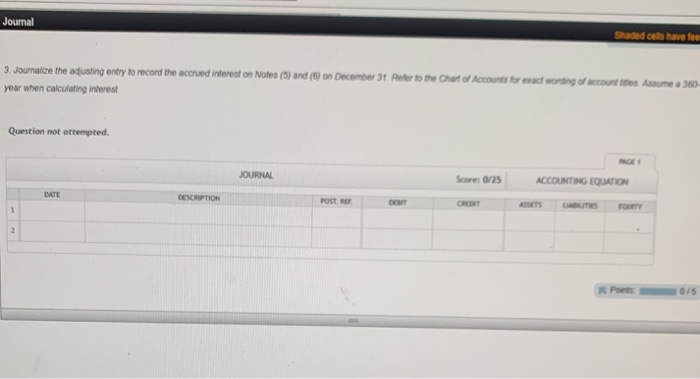

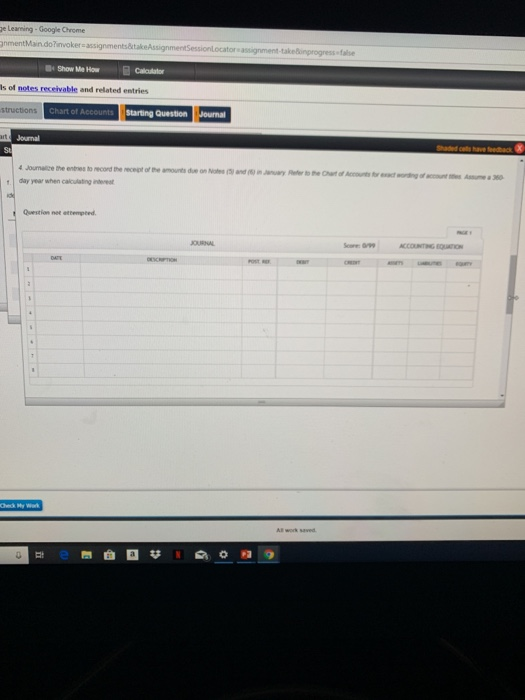

akeAssignmentSessionlocator assignment-take&inprogress-false Show Me How Caloulator eBook Details of notes receivable and related entries Starting Question Instruct Flush Mate Co wholesales bathroom ftixtures. During the current fiscal year, Flush Male Co. received the following notfes Date Face Amount Interest Rate Term 45 days 60 days 120 days 90 days 60 days 5% 1. Mar 6 2 Apr 23 a July 20 4 Sept 6 5 Nov. 25 $80,000 24,000 42,000 54.000 6 Dec. 30 72,00 30 days 1. Determine for each note (a) the due date and (bj the amount of interest due at maturity, identifying each note by number Assume a 360-day 2. Joumalze the entry to record the aishonar of Note (3) on its due date Refer to the Chart of Accounts for exact wording of account ses 3 Joumaize he adjusting entry to recard the accrued interest on Notes (3) and (6) on December 31. Reter to the Chart of Accounts for exact 4 Joumalize the entries to record the recejpt of the amounts due on Notes (3) and (6) in January Reter to the Chart of Accounts ftor exact wording year when calculating interest Assume a 350-day year when calculating interest wording of account teles Assume a 360-day year when calculeting inerest of account ttes. Assume a 350-day year when calculating interest Check My Work All work saved. Journal Shaded cells have fee 3 Journalize the adjusting entry to record the accrued interest on Notes year when calcuilating interest (5) and (6) on December 31 Reter to tihe Chart of Accounts for exact wording of account tes Assume a 360 Question not ettempted JOURNAL Score: 0/25 ACCOUNTING EQIATION DATE CREEIT Ponts5

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts