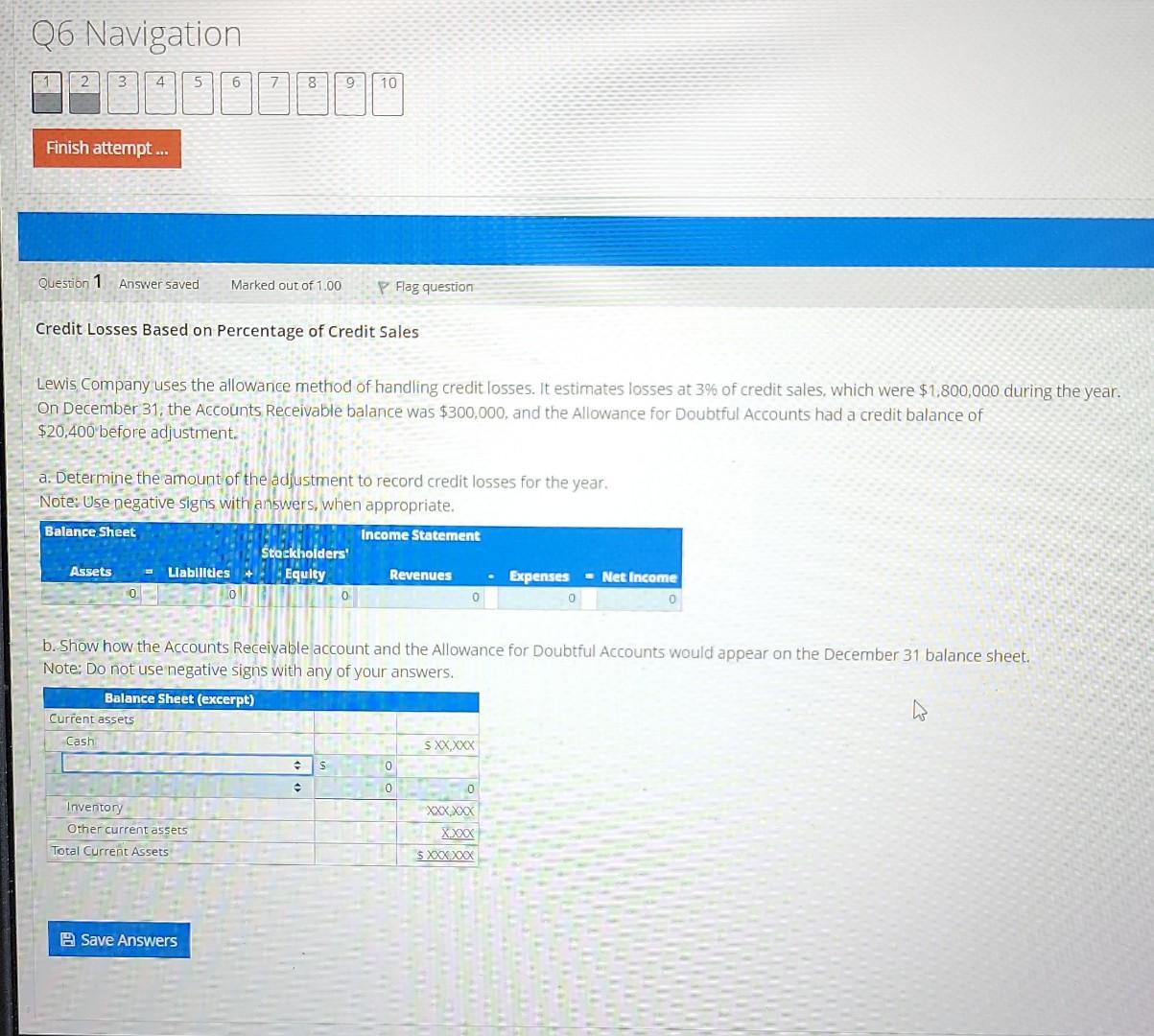

Question: also answer what the two missing labels on balance sheet. they can be [accounts recievable, bad debt expense, sales revenue, or less allowance for doubtful

also answer what the two missing labels on balance sheet. they can be [accounts recievable, bad debt expense, sales revenue, or less allowance for doubtful accounts]

Q6 Navigation 3 4 5 6 7 8 9 10 Finish attempt... Question 1 Answer saved Marked out of 1.00 P Flag question Credit Losses Based on Percentage of Credit Sales Lewis Company uses the allowance method of handling credit losses. It estimates losses at 3% of credit sales, which were $1,800,000 during the year. On December 31, the Accounts Receivable balance was $300.000, and the Allowance for Doubtful Accounts had a credit balance of $20,400 before adjustment. a. Determine the amount of the adjustment to record credit losses for the year. Note: Use negative signs with answers, when appropriate. Balance Sheet Income Statement Stockholders' Equity Assets Liabilities Revenues - Net Income Expenses 0 0 b. Show how the Accounts Receivable account and the Allowance for Doubtful Accounts would appear on the December 31 balance sheet. Note: Do not use negative signs with any of your answers. Balance Sheet (excerpt) Current assets Cash S XX.XXX 0 . 0 0 Inventory XXX.XXX Other current assets Xxxx Total Current Assets S XXXXX S Save Answers

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts