Question: ALSO ATTACH A EXCEL WORKSHEET DISPLAYING THE FOMULAS APPLIED ON THE SIUMULATION Imagine when you started kindergarten (age 5) a savings account was created for

ALSO ATTACH A EXCEL WORKSHEET DISPLAYING THE FOMULAS APPLIED ON THE SIUMULATION

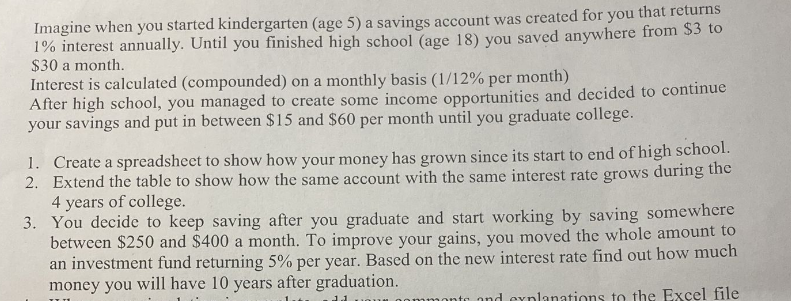

Imagine when you started kindergarten (age 5) a savings account was created for you that returns 1% interest annually. Until you finished high school (age 18) you saved anywhere from $3 to $30 a month. Interest is calculated (compounded) on a monthly basis ( 1/12% per month) After high school, you managed to create some income opportunities and decided to continue your savings and put in between $15 and $60 per month until you graduate college. 1. Create a spreadsheet to show how your money has grown since its start to end of high school. 2. Extend the table to show how the same account with the same interest rate grows during the 4 years of college. 3. You decide to keep saving after you graduate and start working by saving somewhere between $250 and $400 a month. To improve your gains, you moved the whole amount to an investment fund returning 5% per year. Based on the new interest rate find out how much money you will have 10 years after graduation. Imagine when you started kindergarten (age 5) a savings account was created for you that returns 1% interest annually. Until you finished high school (age 18) you saved anywhere from $3 to $30 a month. Interest is calculated (compounded) on a monthly basis ( 1/12% per month) After high school, you managed to create some income opportunities and decided to continue your savings and put in between $15 and $60 per month until you graduate college. 1. Create a spreadsheet to show how your money has grown since its start to end of high school. 2. Extend the table to show how the same account with the same interest rate grows during the 4 years of college. 3. You decide to keep saving after you graduate and start working by saving somewhere between $250 and $400 a month. To improve your gains, you moved the whole amount to an investment fund returning 5% per year. Based on the new interest rate find out how much money you will have 10 years after graduation

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts