Question: ALSO FOUND ON https://www.chegg.com/homework-help/healthy-hound-inc-makes-two-lines-dog-food-basic-chunks-2-cu-chapter-17-problem-8psa-solution-9780077641320-exc Healthy Hound. Inc.. makes two lines of dog food: (I) Basic Chunks, and (2) Custom Cuts. The Basic Chunks line is

ALSO FOUND ON https://www.chegg.com/homework-help/healthy-hound-inc-makes-two-lines-dog-food-basic-chunks-2-cu-chapter-17-problem-8psa-solution-9780077641320-exc

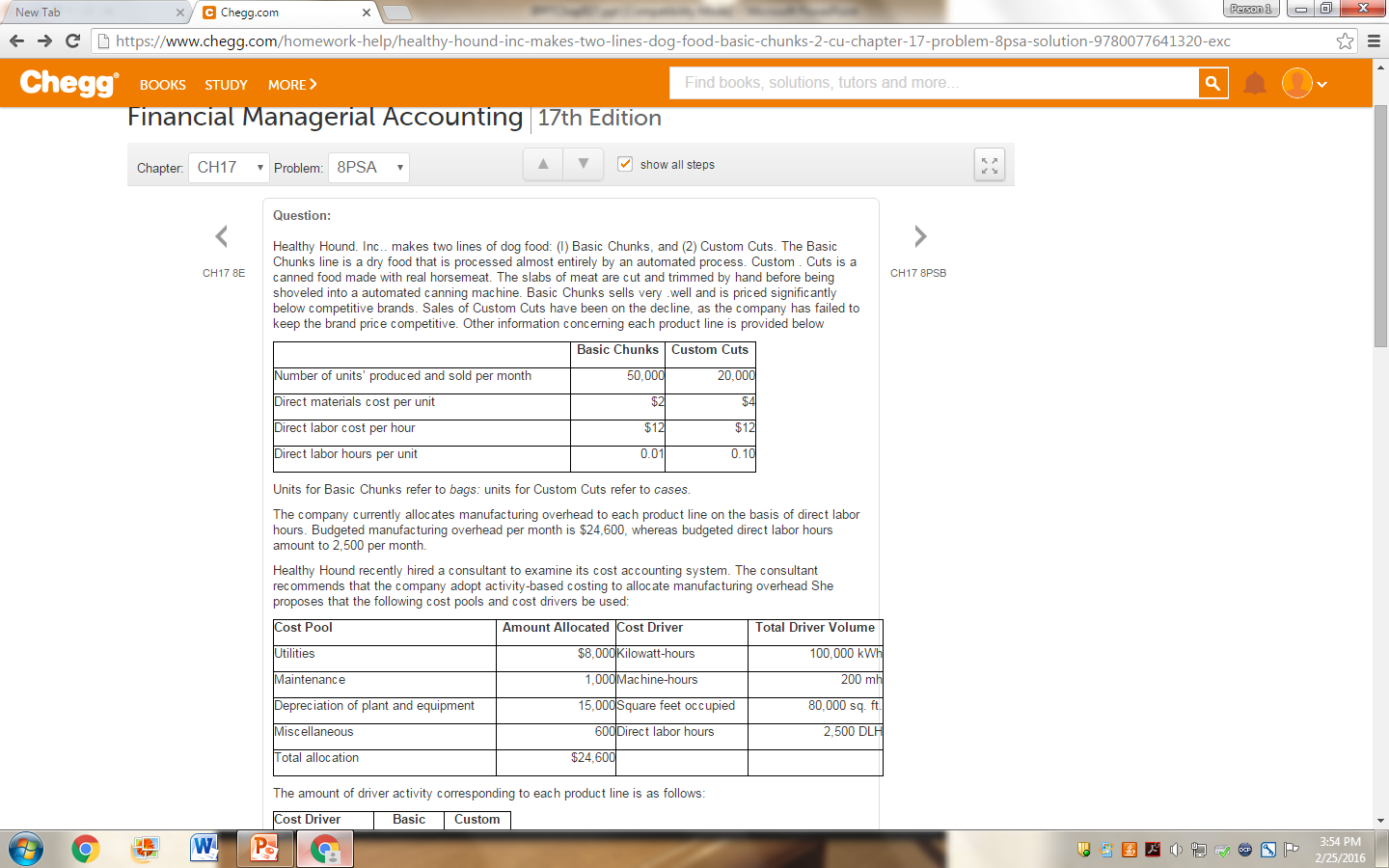

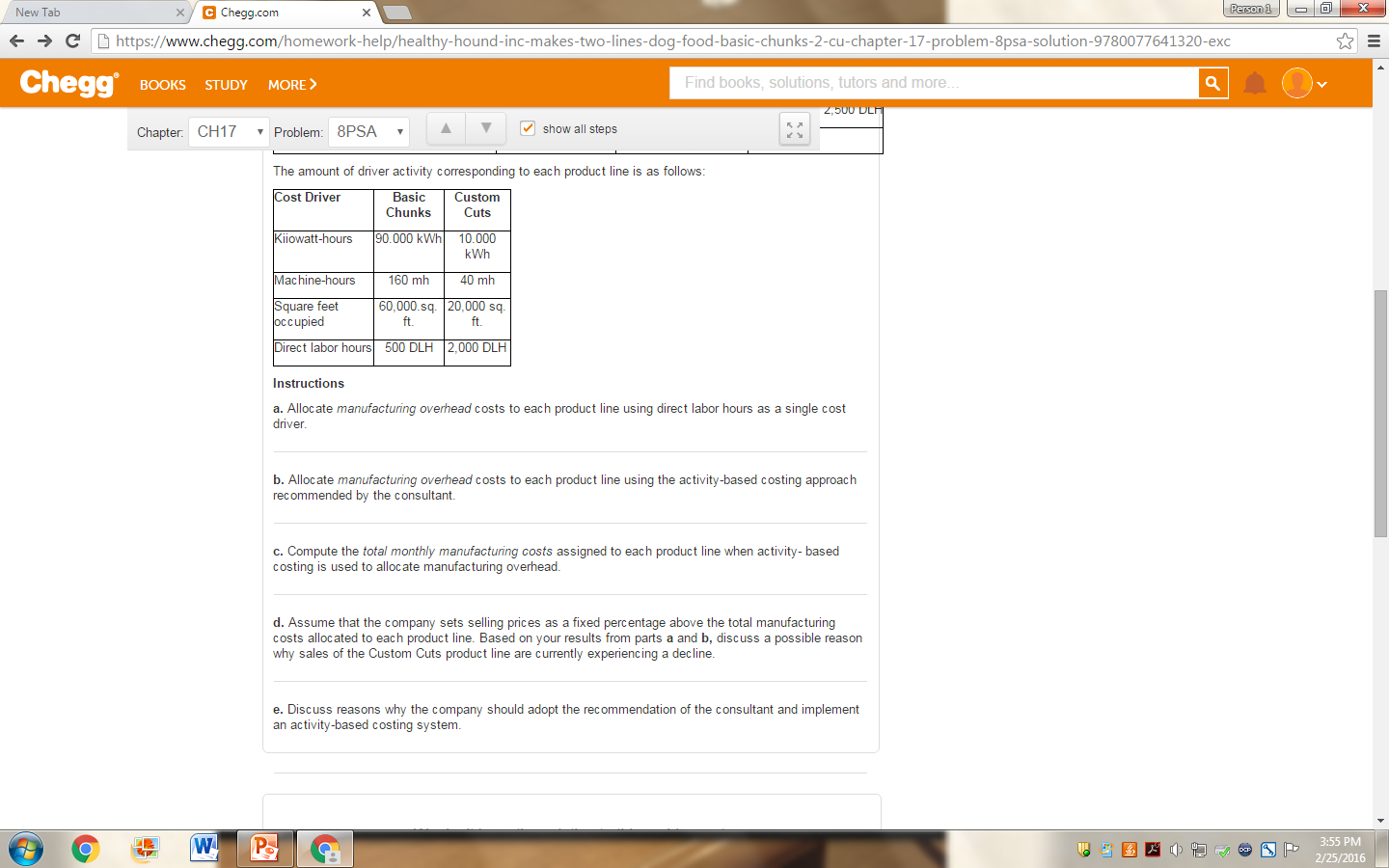

Healthy Hound. Inc.. makes two lines of dog food: (I) Basic Chunks, and (2) Custom Cuts. The Basic Chunks line is a dry food that is processed almost entirely by an automated process. Custom. Cuts is a canned food made with real horsemeat. The slabs of meat are cut and trimmed by hand before being shoveled into a automated canning machine. Basic Chunks sells very.well and is priced significantly below competitive brands. Sales of Custom Cuts have been on the decline, as the company has failed to keep the brand price competitive. Other information concerning each product line is provided below Units for Basic Chunks refer to bags: units for Custom Cuts refer to cases. The company currently allocates manufacturing overhead to each product line on the basis of direct labor hours. Budgeted manufacturing overhead per month is $24,600. whereas budgeted direct labor hours amount to 2,500 per month. Healthy Hound recently hired a consultant to examine its cost accounting system. The consultant recommends that the company adopt activity-based costing to allocate manufacturing overhead She proposes that the following cost pools and cost drivers be used: Allocate manufacturing overhead costs to each product line using direct labor hours as a single cost driver. Allocate manufacturing overhead costs to each product line using the activity-based costing approach recommended by the consultant. Compute the total monthly manufacturing costs assigned to each product line when activity- based costing is used to allocate manufacturing overhead. Assume that the company sets selling prices as a fixed percentage above the total manufacturing costs allocated to each product line. Based on your results from parts a and b, discuss a possible reason why sales of the Custom Cuts product line are currently experiencing a decline. Discuss reasons why the company should adopt the recommendation of the consultant and implement an activity-based costing system

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts