Question: also, how do you find IRR? (for the example table) The additional $10 earns you 30 Shigher IRK wonal $10 earns you 30%, which is

also, how do you find IRR? (for the example table)

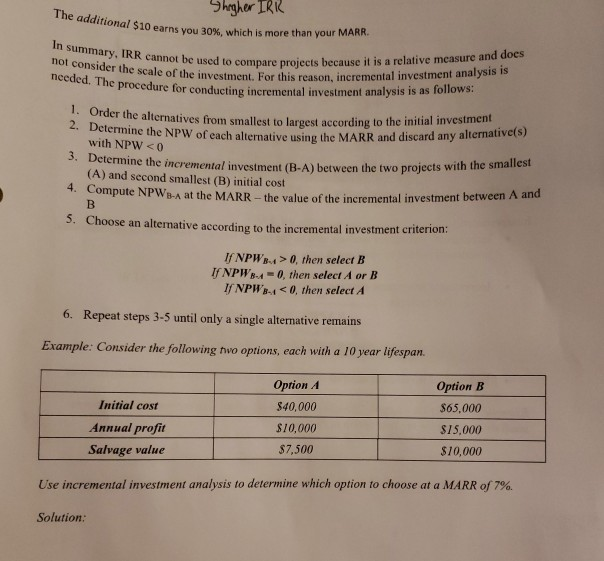

The additional $10 earns you 30 Shigher IRK wonal $10 earns you 30%, which is more than your MARR m summary, IRR cannot be used to compare projects because not consider the scale of the investmen needed. The procedure for com mpare projects because it is a relative measure and does e of the investment. For this reason, incremental investment analysis is procedure for conducting incremental investment analysis is as follows: 1. Order the alternatives from the alternatives from smallest to largest according to the initial investment 2. Determine the NPW of each alternative using NPW of each alternative using the MARR and discard any alternative(s) with NPW 0, then select B If NPW -0, then select A or B 1/ NPW40, then select A 6. Repeat steps 3-5 until only a single alternative remains Example: Consider the following two options, each with a 10 year lifespan. Initial cost Annual profit Salvage value Option 4 $40,000 $10,000 $7,500 Option B $65.000 $15.000 $10,000 Use incremental investment analysis to determine which option to choose at a MARR of 7%. Solution

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts