Question: Also include, what is the salvage value using the general depreciation system (GDS) method? In 2022, Leo construction traded in a light duty pickup truck

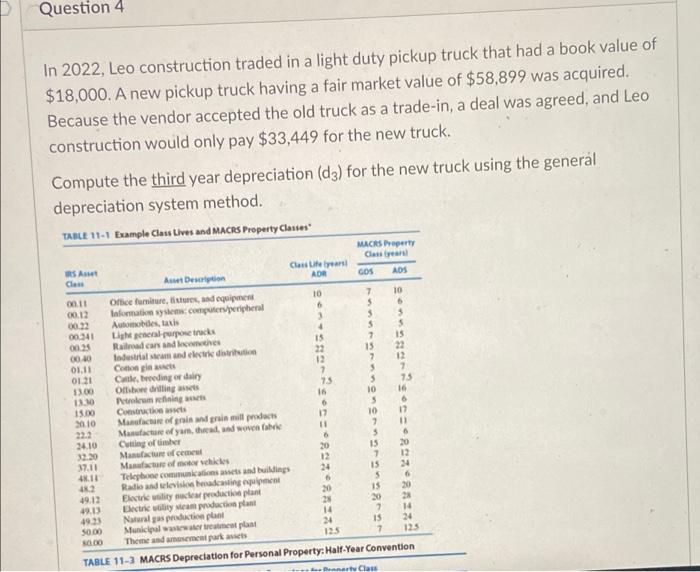

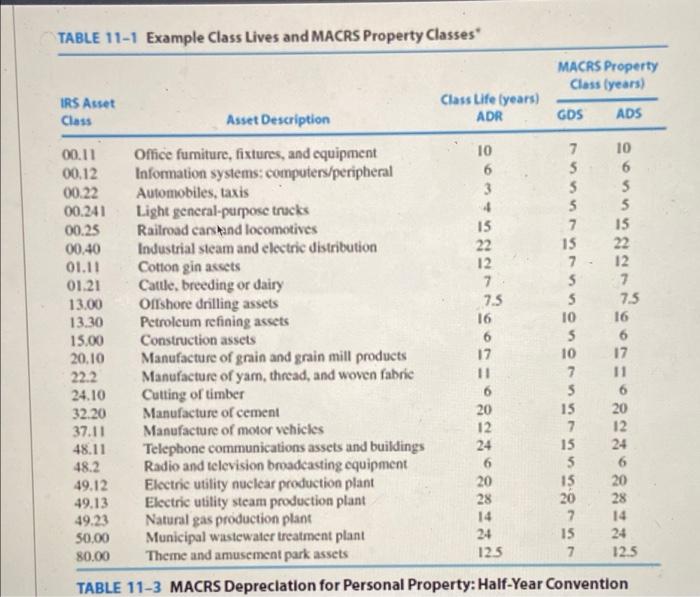

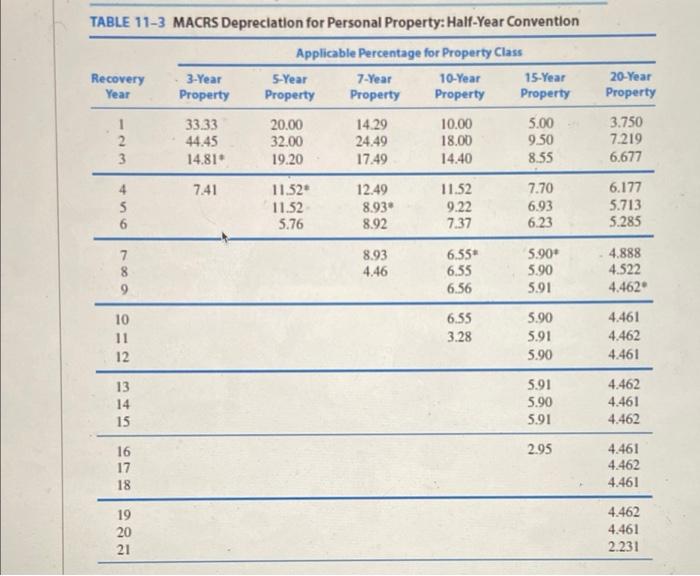

In 2022, Leo construction traded in a light duty pickup truck that had a book value of $18,000. A new pickup truck having a fair market value of $58,899 was acquired. Because the vendor accepted the old truck as a trade-in, a deal was agreed, and Leo construction would only pay $33,449 for the new truck. Compute the third year depreciation (d3) for the new truck using the general depreciation system method. TABLE 11-1 Example Class Lives and MACRS Property Classes* TABLE 11-3 MACRS Depreciation for Personal Property: Half-Year Convention

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts