Question: also need to know: what is an approximate risk free rate and market risk premium? what is the cost of equity for this project? what

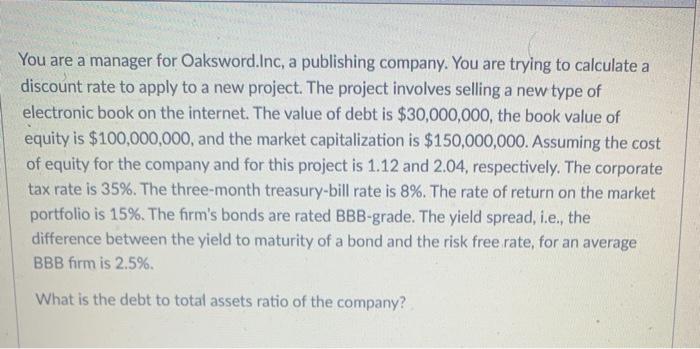

You are a manager for Oaksword.Inc, a publishing company. You are trying to calculate a discount rate to apply to a new project. The project involves selling a new type of electronic book on the internet. The value of debt is $30,000,000, the book value of equity is $100,000,000, and the market capitalization is $150,000,000. Assuming the cost of equity for the company and for this project is 1.12 and 2.04, respectively. The corporate tax rate is 35%. The three month treasury-bill rate is 8%. The rate of return on the market portfolio is 15%. The firm's bonds are rated BBB-grade. The yield spread, i.e., the difference between the yield to maturity of a bond and the risk free rate, for an average BBB firm is 2.5% What is the debt to total assets ratio of the company

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts