Question: Also Prepare income statement, equity statement, balance sheet, cash flow statement Instructions Prepare the adjusting entries at December 31,2012. (Show all computations.) P3-5A On September

Also Prepare income statement, equity statement, balance sheet, cash flow statement

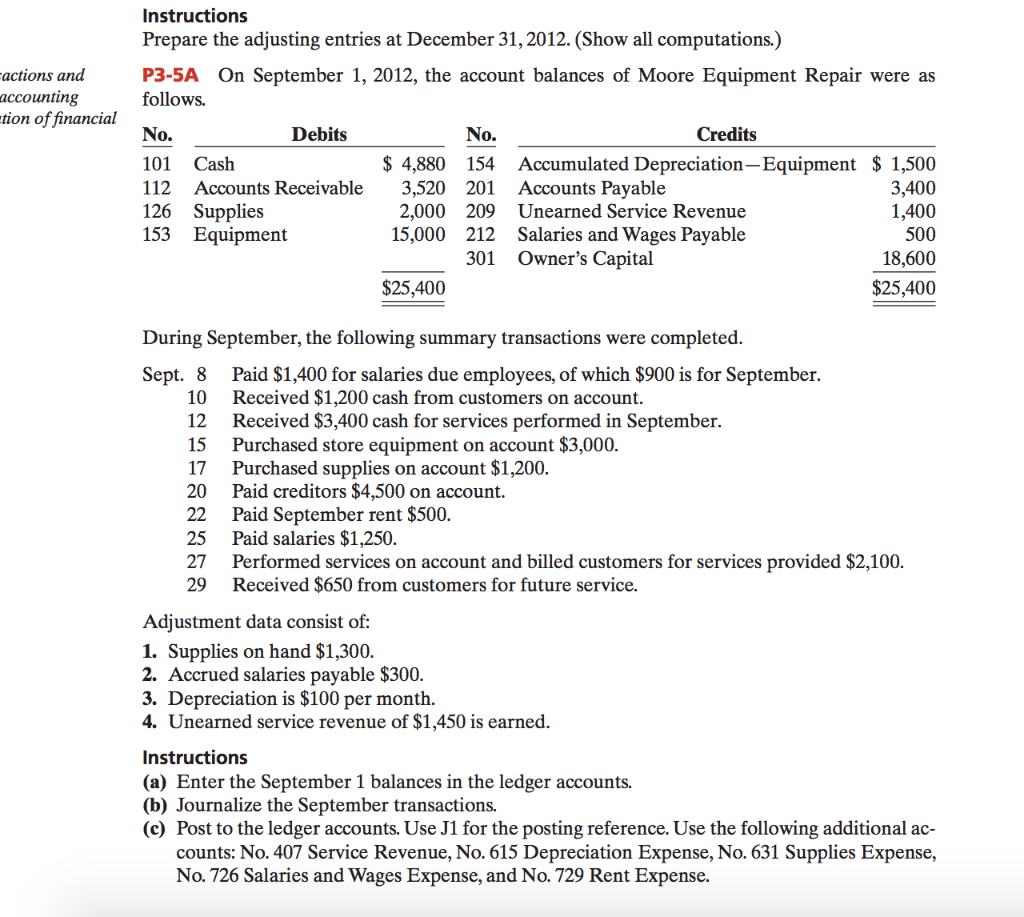

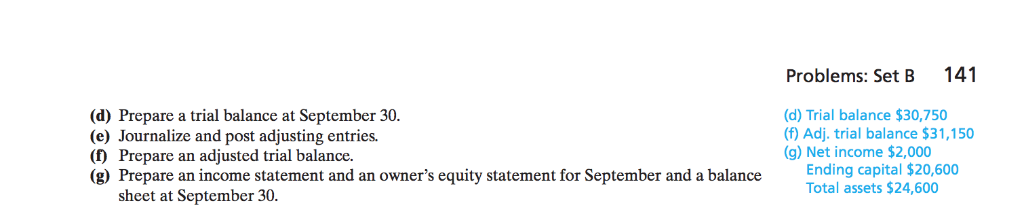

Instructions Prepare the adjusting entries at December 31,2012. (Show all computations.) P3-5A On September 1, 2012, the account balances of Moore Equipment Repair were as follows. No. 101 Cash 112 Accounts Receivable3,520 201 Accounts Payable 126 Supplies 53 Equipment actions and accounting tion of financial Debits No. Credits $ 4,880 154 Accumulated Depreciation-Equipment 1,500 3,400 1,400 500 18,600 $25,400 2,000 15,000 209 212 301 Owner's Capital Unearned Service Revenue Salaries and Wages Payable $25,400 During September, the following summary transactions were completed Sept. 8 Paid $1,400 for salaries due employees, of which $900 is for September. 10 12 15 17 20 22 25 27 29 Received $1,200 cash from customers on account. Received $3,400 cash for services performed in September. Purchased store equipment on account $3,000 Purchased supplies on account $1,200 Paid creditors $4,500 on account. Paid September rent $500 Paid salaries $1,250. Performed services on account and billed customers for services provided $2,100. Received $650 from customers for future service. Adjustment data consist of: 1. Supplies on hand $1,300. 2. Accrued salaries payable $300. 3. Depreciation is $100 per month. 4. Unearned service revenue of $1,450 is earned. Instructions (a) Enter the September 1 balances in the ledger accounts. (b) Journalize the September transactions. (c) Post to the ledger accounts. Use J1 for the posting reference. Use the following additional ac- counts: No. 407 Service Revenue, No. 615 Depreciation Expense, No. 631 Supplies Expense, No. 726 Salaries and Wages Expense, and No. 729 Rent Expense. Problems: Set B 141 (d) Prepare a trial balance at September 30. (e) Journalize and post adjusting entries. (f) Prepare an adjusted trial balance. (g) Prepare an income statement and an owner's equity statement for September and a balance (d) Trial balance $30,750 (f) Adj. trial balance $31,150 g) Net income $2,000 satement for September and a balance d0 ing capital 00 Total assets $24,600 sheet at September 30

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts