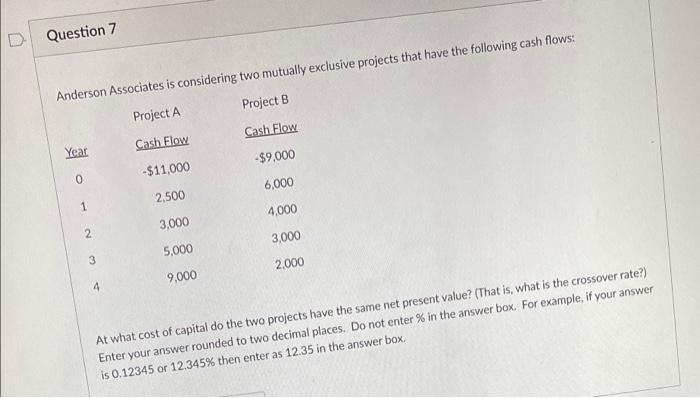

Question: also Question 7 Anderson Associates is considering two mutually exclusive projects that have the following cash flows: Project A Project B Year Cash Flow Cash

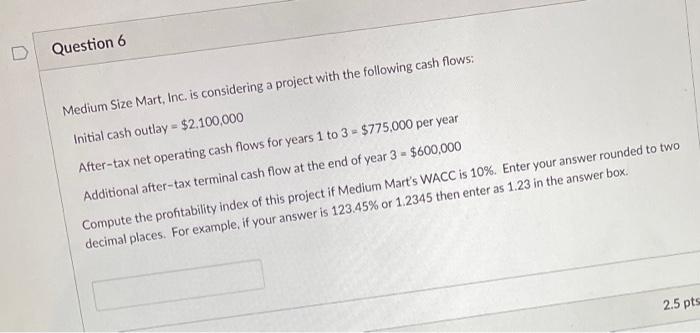

Question 7 Anderson Associates is considering two mutually exclusive projects that have the following cash flows: Project A Project B Year Cash Flow Cash Flow -$9,000 -$11,000 0 6,000 2.500 1 4,000 3,000 2 3,000 5,000 3 2,000 9,000 4 At what cost of capital do the two projects have the same net present value? (That is what is the crossover rate?) Enter your answer rounded to two decimal places. Do not enter % in the answer box. For example, if your answer is 0.12345 or 12.345% then enter as 12.35 in the answer box Question 6 Medium Size Mart, Inc. is considering a project with the following cash flows: Initial cash outlay - $2.100,000 After-tax net operating cash flows for years 1 to 3 - $775,000 per year Additional after-tax terminal cash flow at the end of year 3 = $600,000 Compute the profitability index of this project if Medium Mart's WACC is 10%. Enter your answer rounded to two decimal places. For example, if your answer is 123.45% or 1.2345 then enter as 1.23 in the answer box 2.5 pts

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts