Question: ALT 3 6 0 AWA 2 . ( 2 0 pts ) Mando is considering two different packI am considering an investment ( cash outflow

ALT

AWA

pts Mando is considering two different packI am considering an investment cash outflow at time of $ The project life is years. At year one, the project net benefits cash inflows are $ at year two they are $ at year three they are $ and at year four they are $

a points Are the cash flows simple or nonsimple? Why?

ion raind

tableSimple or NonSimple?,SimpleReasonThe carn fiow stayed positivethe whole time

Q Qunel?

b points Make at least two iterations of the "trial and error" method of internal rate of return IRR to find an interval for IRR. Hint: IRRThe range of the interval cannot be greater than eg

rci

ALT

AWA

pts Mando is considering two different packI am considering an investment cash outflow at time of $ The project life is years. At year one, the project net benefits cash inflows are $ at year two they are $ at year three they are $ and at year four they are $

a points Are the cash flows simple or nonsimple? Why?

ion raind

tableSimple or NonSimple?,SimpleReasonThe carn fiow stayed positivethe whole time

Q Qunel?

b points Make at least two iterations of the "trial and error" method of internal rate of return IRR to find an interval for IRR. Hint: IRRThe range of the interval cannot be greater than eg

rci

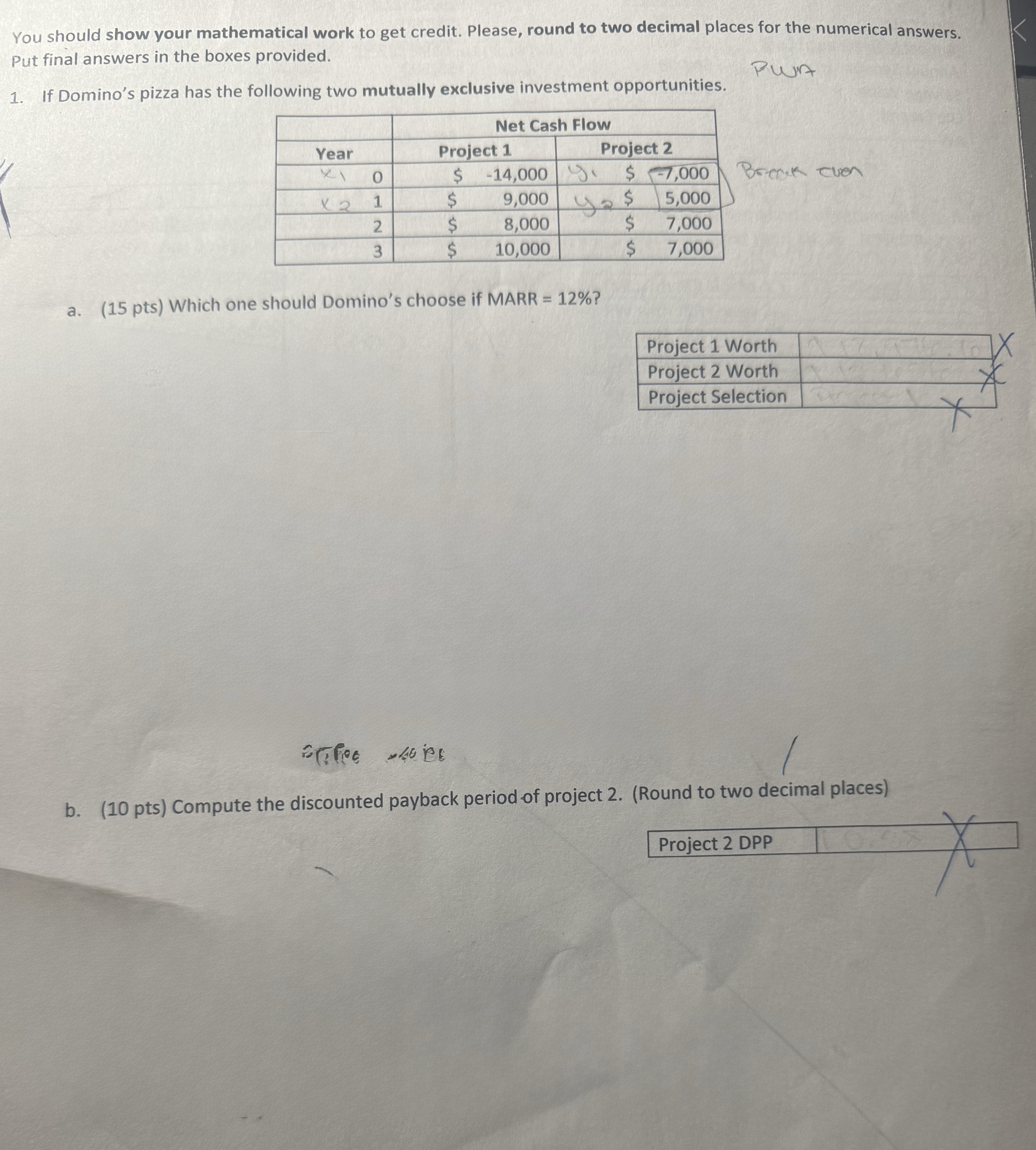

You should show your mathematical work to get credit. Please, round to two decimal places for the numerical answers.

Put final answers in the boxes provided.

If Domino's pizza has the following two mutually exclusive investment opportunities.

tableYearNet Cash FlowProject Project $y $$$$$$$

a pts Which one should Domino's choose if MARR

b pts Compute the discounted payback period of project Round to two decimal places

pts Mando is considering two different packaging machines for its plant in Opelika. The relevant information about the two machines is listed below note that the annual cost and the annual benefit occur identically at the end of each year Mando uses a MARR of Which machine do you recommend to Mando? Explain why?

First Cost

Annual Maintenance Cost

Annual Benefit

Salvage Value

Life years

AW

tableMachine AMachine B$$

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock