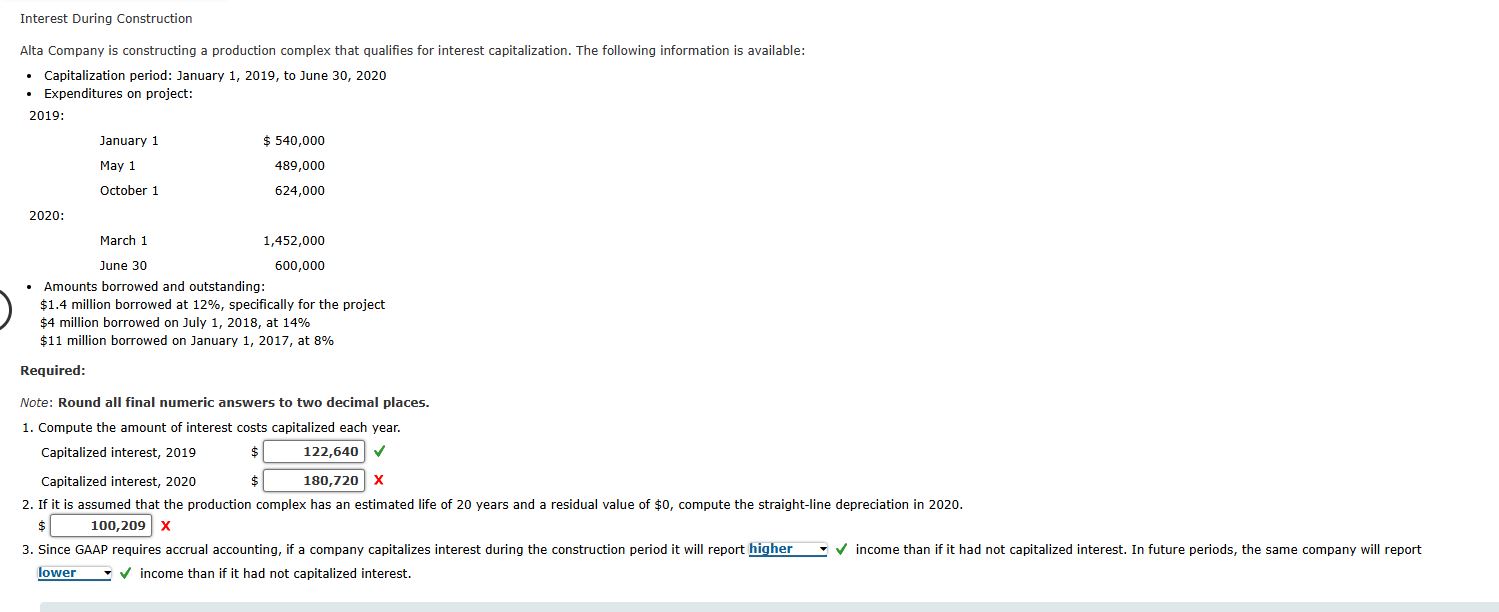

Question: Alta Company is constructing a production complex that qualifies for interest capitalization. The following information is available: Capitalization period: January 1 , 2 0 1

Alta Company is constructing a production complex that qualifies for interest capitalization. The following information is available:

Capitalization period: January to June

Expenditures on project:

:January $ May October :March June

Amounts borrowed and outstanding:

$ million borrowed at specifically for the project

$ million borrowed on July at

$ million borrowed on January at

Required:

Note: Round all final numeric answers to two decimal places.

Compute the amount of interest costs capitalized each year.

Capitalized interest, $fill in the blank Capitalized interest, $fill in the blank

If it is assumed that the production complex has an estimated life of years and a residual value of $ compute the straightline depreciation in

$fill in the blank

Since GAAP requires accrual accounting, if a company capitalizes interest during the construction period it will report

higherlowerthe same amount ofhigher

income than if it had not capitalized interest. In future periods, the same company will report

higherlowerthe same amount oflower

income than if it had not capitalized interest. Interest During Construction

Alta Company is constructing a production complex that qualifies for interest capitalization. The following information is available:

Capitalization period: January to June

Expenditures on project:

:

Amounts borrowed and outstanding:

$ million borrowed at specifically for the project

$ million borrowed on July at

$ million borrowed on January at

Required:

Note: Round all final numeric answers to two decimal places.

Compute the amount of interest costs capitalized each year.

Capitalized interest, $

Capitalized interest, $ X

If it is assumed that the production complex has an estimated life of years and a residual value of $ compute the straightline depreciation in

$ checkmark income than if it had not capitalized interest.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock