Question: Alternative 1: Keep the old machine and have it overhauled. This requires an initial investment of $153,000 and results in $53,000 of net cash flows

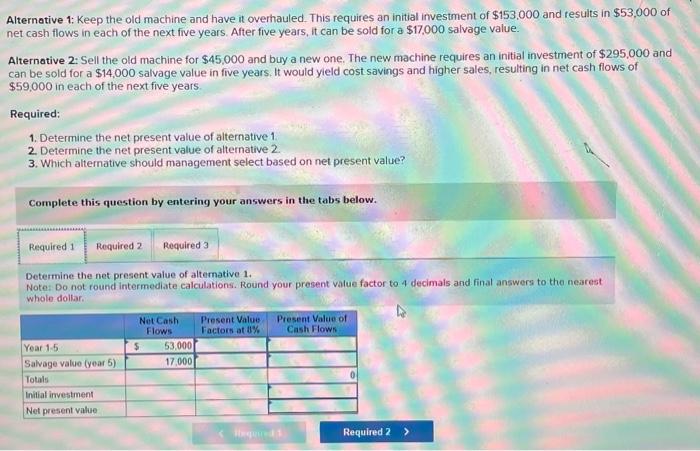

Alternative 1: Keep the old machine and have it overhauled. This requires an initial investment of $153,000 and results in $53,000 of net cash flows in each of the next five years. After five years, it can be sold for a $17,000 salvage value. Alternative 2 : Sell the old machine for $45,000 and buy a new one. The new machine requires an initial investment of $295,000 and can be sold for a $14,000 salvage value in five years. It would yield cost savings and higher sales, resulting in net cash flows of $59,000 in each of the next five years. Required: 1. Determine the net present value of alternative 1. 2. Determine the net present value of alternative 2 3. Which alternative should management select based on net present value? Complete this question by entering your answers in the tabs below. Determine the net present value of alternative 1 . Note: Do not round intermediate calculations. Round your present value factor to 4 decimals and final answers to the nearest whole dollar

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts