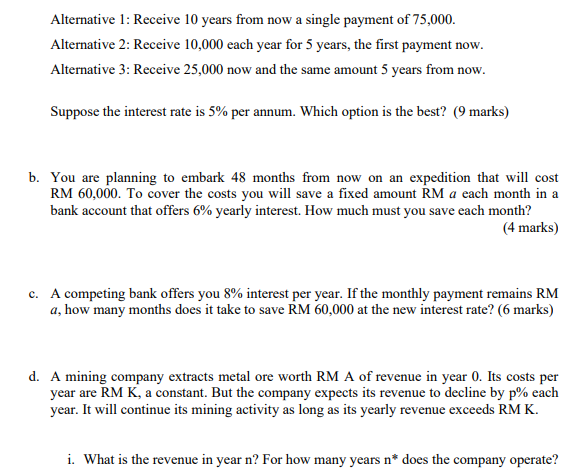

Question: Alternative 1: Receive 10 years from now a single payment of 75,000. Alternative 2: Receive 10,000 each year for 5 years, the first payment now.

Alternative 1: Receive 10 years from now a single payment of 75,000. Alternative 2: Receive 10,000 each year for 5 years, the first payment now. Alternative 3: Receive 25,000 now and the same amount 5 years from now. Suppose the interest rate is 5% per annum. Which option is the best? (9 marks) b. You are planning to embark 48 months from now on an expedition that will cost RM 60,000. To cover the costs you will save a fixed amount RM a each month in a bank account that offers 6% yearly interest. How much must you save each month? (4 marks) c. A competing bank offers you 8% interest per year. If the monthly payment remains RM a, how many months does it take to save RM 60,000 at the new interest rate? (6 marks) d. A mining company extracts metal ore worth RM A of revenue in year 0. Its costs per year are RM K, a constant. But the company expects its revenue to decline by p% each year. It will continue its mining activity as long as its yearly revenue exceeds RMK. i. What is the revenue in year n? For how many years n* does the company operate

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts