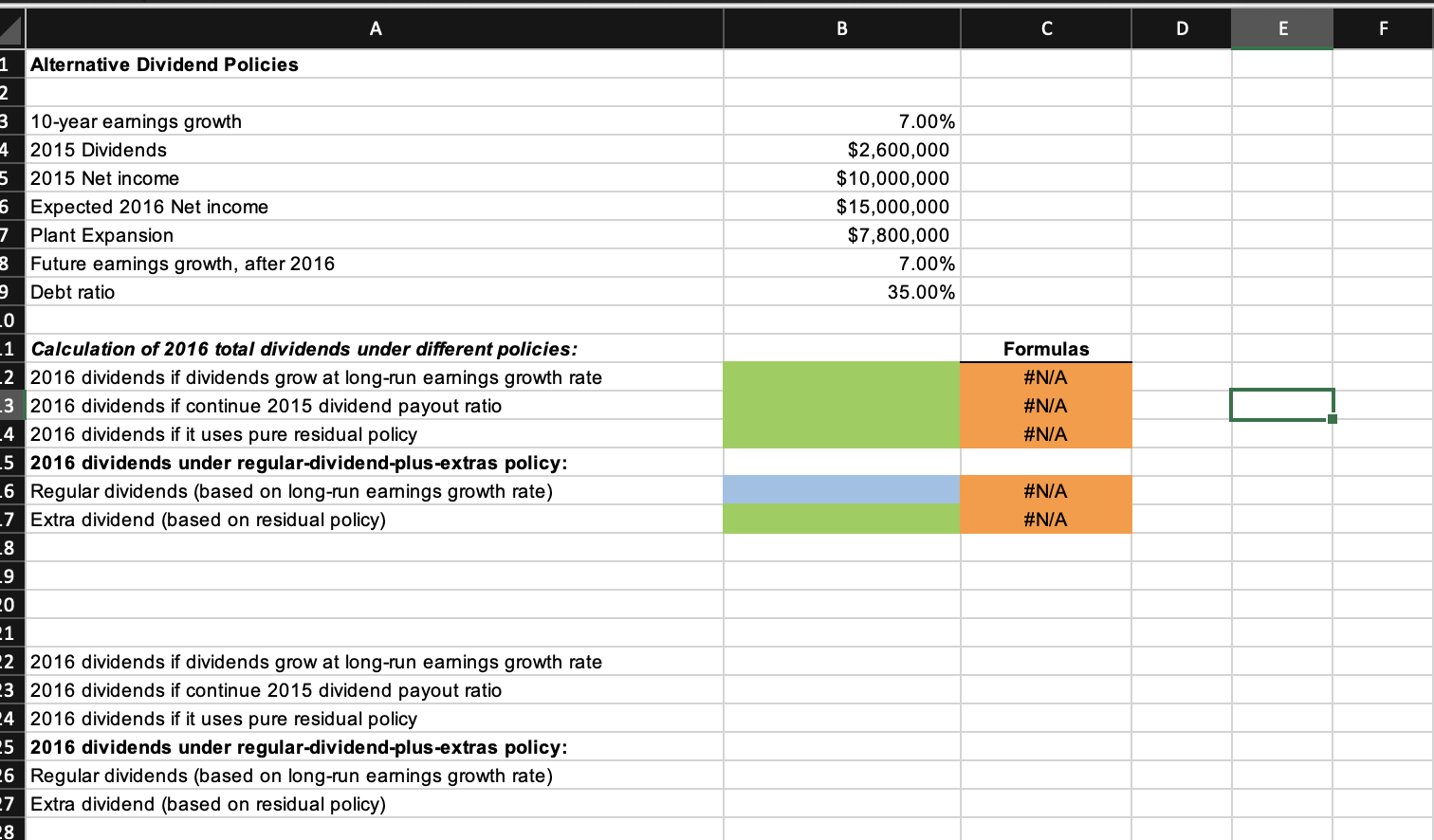

Question: Alternative Dividend Policy A B C D E F 7.00% $2,600,000 $10,000,000 $15,000,000 $7,800,000 7.00% 35.00% Formulas #N/A #N/A #N/A 1 Alternative Dividend Policies 2

Alternative Dividend Policy

A B C D E F 7.00% $2,600,000 $10,000,000 $15,000,000 $7,800,000 7.00% 35.00% Formulas #N/A #N/A #N/A 1 Alternative Dividend Policies 2 3 10-year earnings growth 4 2015 Dividends 5 2015 Net income 6 Expected 2016 Net income 7 Plant Expansion 8 Future earnings growth, after 2016 9 Debt ratio .O .1 Calculation of 2016 total dividends under different policies: _2 2016 dividends if dividends grow at long-run earnings growth rate .3 2016 dividends if continue 2015 dividend payout ratio -4 2016 dividends if it uses pure residual policy -5 2016 dividends under regular-dividend-plus-extras policy: 6 Regular dividends (based on long-run earnings growth rate) -7 Extra dividend (based on residual policy) 18 _9 20 1 2 2016 dividends if dividends grow at long-run earnings growth rate 23 2016 dividends if continue 2015 dividend payout ratio 24 2016 dividends if it uses pure residual policy 25 2016 dividends under regular-dividend-plus-extras policy: 26 Regular dividends (based on long-run earings growth rate) 27 Extra dividend (based on residual policy) 8 #N/A #N/A

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts