Question: Alternative Production Procedures and Operating Leverage Assume Paper Mate is planning to introduce a new executive pen that can be manufactured using either a capital-intensive

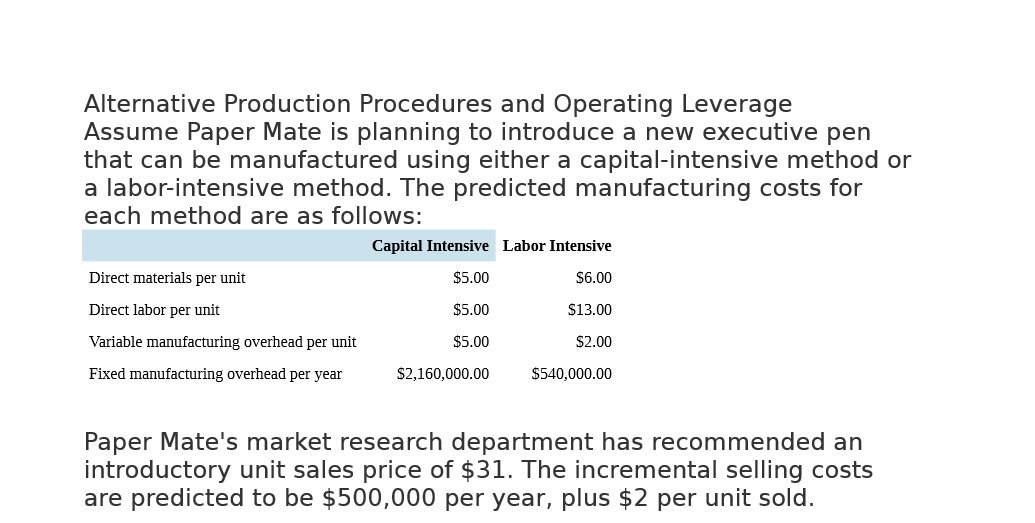

Alternative Production Procedures and Operating Leverage Assume Paper Mate is planning to introduce a new executive pen that can be manufactured using either a capital-intensive method or a labor-intensive method. The predicted manufacturing costs for each method are as follows: Capital Intensive Labor Intensive Direct materials per unit $5.00 $6.00 Direct labor per unit $5.00 $13.00 Variable manufacturing overhead per unit $5.00 $2.00 Fixed manufacmrirlg overhead per year $2,160,000. 00 $5l0,000.00 Paper Mate's market research department has recommended an introductory unit sales price of $31. The incremental selling costs are predicted to be $500,000 per year, plus $2 per unit sold

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts