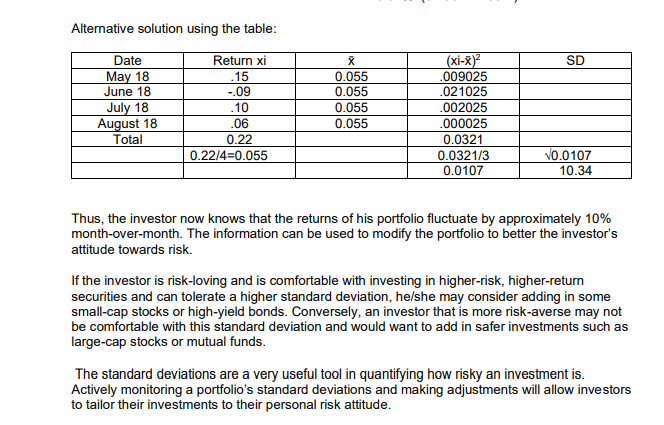

Question: Alternative solution using the table: Date Return xi X (xi-x)2 SD May 18 15 0.055 009025 June 18 -.09 0.055 021025 July 18 10 0.055

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock