Question: Although annual compounding-interest compounded once per year is very common and an instructive way to introduce future value calculations, other compounding periods are possible. For

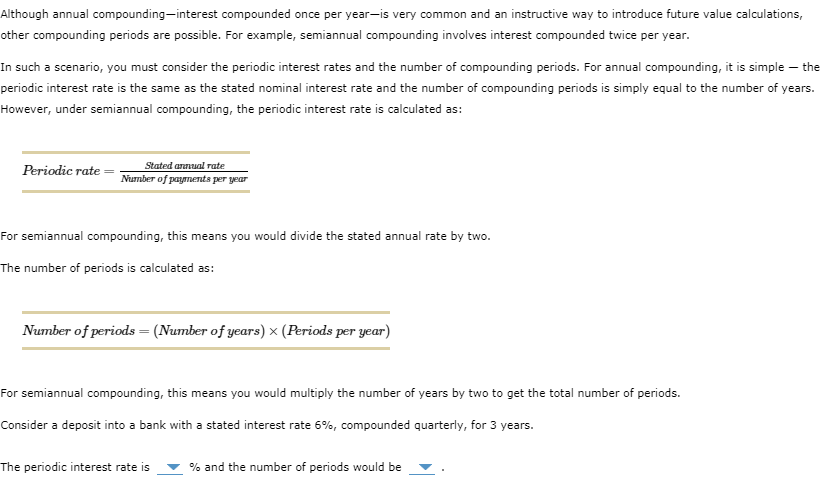

Although annual compounding-interest compounded once per year is very common and an instructive way to introduce future value calculations, other compounding periods are possible. For example, semiannual compounding involves interest compounded twice per year. In such a scenario, you must consider the periodic interest rates and the number of compounding periods. For annual compounding, it is simple - the periodic interest rate is the same as the stated nominal interest rate and the number of compounding periods is simply equal to the number of years. However, under semiannual compounding, the periodic interest rate is calculated as: Periodic rate Stated annual rate Number of payments per year For semiannual compounding, this means you would divide the stated annual rate by two. The number of periods is calculated as: Number of periods = (Number of years) (Periods per year) For semiannual compounding, this means you would multiply the number of years by two to get the total number of periods. Consider a deposit into a bank with a stated interest rate 5%, compounded quarterly, for 3 years. The periodic interest rate is % and the number of periods would be

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts