Question: Although Inspiron Inc. has been utilizing a simplified required return of 12% in most of its calculations, the company is seeking to determine its actual

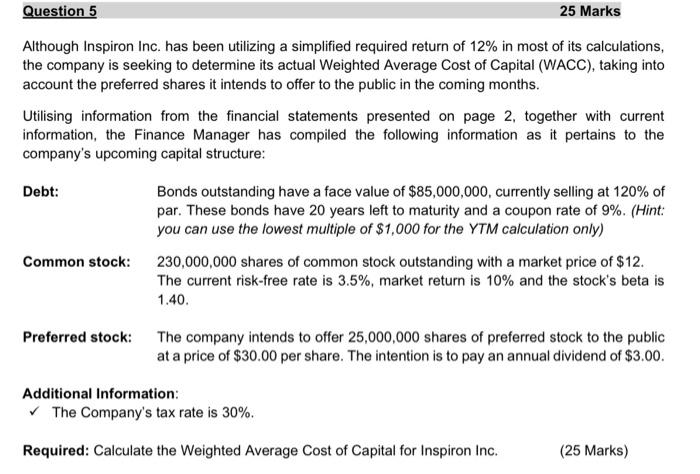

Although Inspiron Inc. has been utilizing a simplified required return of 12% in most of its calculations, the company is seeking to determine its actual Weighted Average Cost of Capital (WACC), taking into account the preferred shares it intends to offer to the public in the coming months. Utilising information from the financial statements presented on page 2, together with current information, the Finance Manager has compiled the following information as it pertains to the company's upcoming capital structure: Debt: Bonds outstanding have a face value of $85,000,000, currently selling at 120% of par. These bonds have 20 years left to maturity and a coupon rate of 9%. (Hint: you can use the lowest multiple of $1,000 for the YTM calculation only) Common stock: 230,000,000 shares of common stock outstanding with a market price of $12. The current risk-free rate is 3.5%, market return is 10% and the stock's beta is 1.40. Preferred stock: The company intends to offer 25,000,000 shares of preferred stock to the public at a price of $30.00 per share. The intention is to pay an annual dividend of $3.00. Additional Information: The Company's tax rate is 30%. Required: Calculate the Weighted Average Cost of Capital for Inspiron Inc. (25 Marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts