Question: Although Stock J and Stock K have the same average return (= 10%), explain which stock is riskier based on the bell-shaped curves. Include

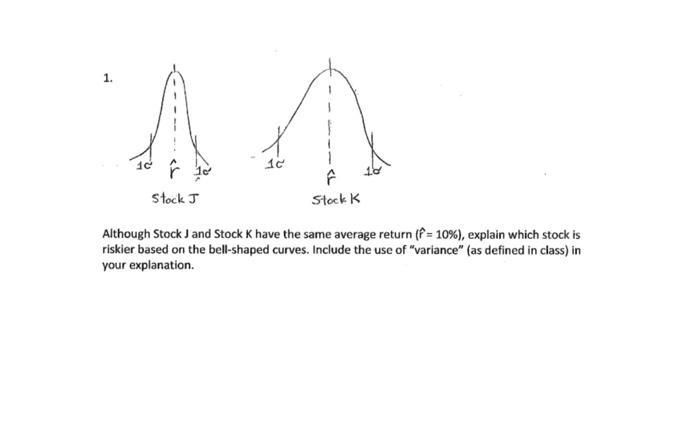

Although Stock J and Stock K have the same average return (= 10%), explain which stock is riskier based on the bell-shaped curves. Include the use of "variance" (as defined in class) in your explanation. 1. 10 Stock J Stock K Although Stock J and Stock K have the same average return (= 10%), explain which stock is riskier based on the bell-shaped curves. Include the use of "variance" (as defined in class) in your explanation.

Step by Step Solution

3.36 Rating (162 Votes )

There are 3 Steps involved in it

To determine which stock is riskier we need to consider the concept of variance Variance measures th... View full answer

Get step-by-step solutions from verified subject matter experts