Question: Although the three capital budgeting methods are equivalent, they all can have difficulties making computation impossible at times. The most useful methods or tools from

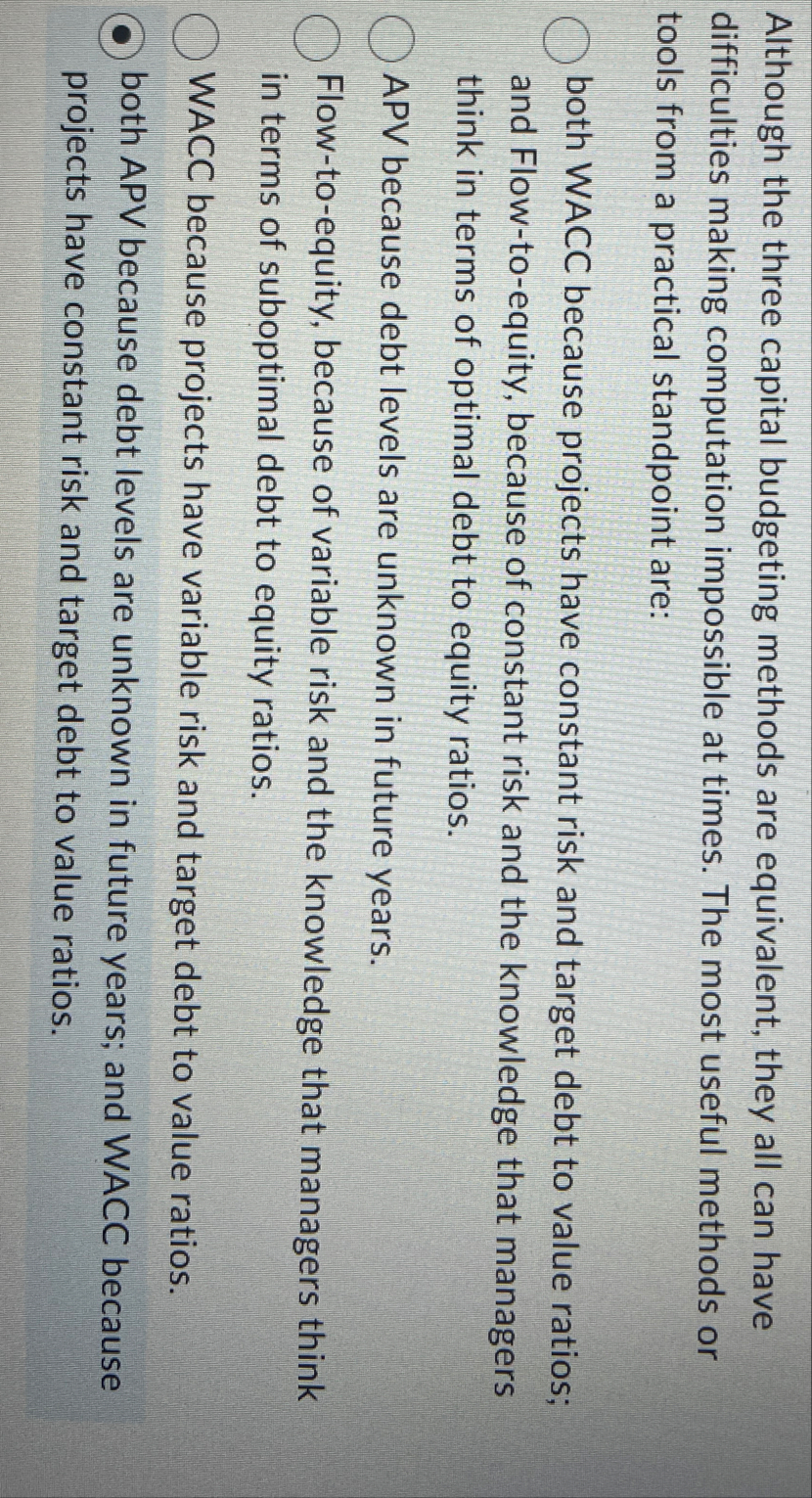

Although the three capital budgeting methods are equivalent, they all can have difficulties making computation impossible at times. The most useful methods or tools from a practical standpoint are:

both WACC because projects have constant risk and target debt to value ratios; and Flowtoequity, because of constant risk and the knowledge that managers think in terms of optimal debt to equity ratios.

APV because debt levels are unknown in future years.

Flowtoequity, because of variable risk and the knowledge that managers think in terms of suboptimal debt to equity ratios.

WACC because projects have variable risk and target debt to value ratios. both APV because debt levels are unknown in future years; and WACC because projects have constant risk and target debt to value ratios.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock