Question: Alvvays company allocates manufacturing overhead (variable and fixed) on the basis of budgeted direct manufacturing labor-hours per unit. For June 2020, each unit is budgeted

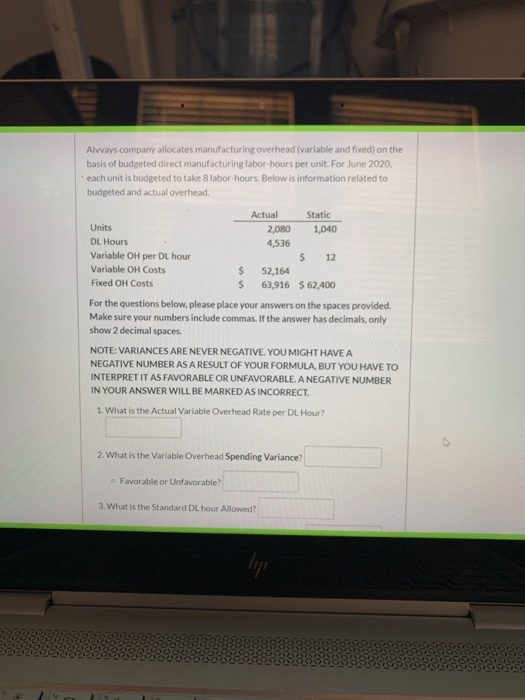

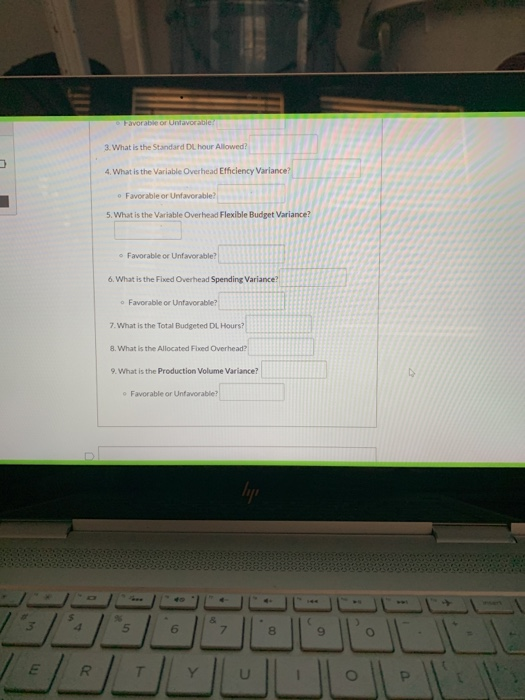

Alvvays company allocates manufacturing overhead (variable and fixed) on the basis of budgeted direct manufacturing labor-hours per unit. For June 2020, each unit is budgeted to take 8 labor-hours. Below is information related to budgeted and actual overhead. Actual Static Units 2,080 1,040 DL Hours 4,536 Variable OH per DL hour $ 12 Variable OH Costs $ 52,164 Fixed OH Costs $ 63,916 $ 62,400 For the questions below, please place your answers on the spaces provided. Make sure your numbers include commas. If the answer has decimals, only show 2 decimal spaces. NOTE: VARIANCES ARE NEVER NEGATIVE. YOU MIGHT HAVE A NEGATIVE NUMBER AS A RESULT OF YOUR FORMULA, BUT YOU HAVE TO INTERPRET IT AS FAVORABLE OR UNFAVORABLE. A NEGATIVE NUMBER IN YOUR ANSWER WILL BE MARKED AS INCORRECT. 1. What is the Actual Variable Overhead Rate per DL Hour? 2. What is the Variable Overhead Spending Variance? Favorable or Unfavorable? 3. What is the Standard DL hour Allowed? 10 Favorable or Unavorable 3. What is the Standard DL hour Allowed? 4. What is the Variable Overhead Efficiency Variance? Favorable or Unfavorable? 5. What is the Variable Overhead Flexible Budget Variance? Favorable or Unfavorable? 6. What is the Fixed Overhead Spending Variance? Favorable or Unfavorable? 7. What is the Total Budgeted DL Hours? 8. What is the Allocated Fixed Overhead? 9. What is the Production Volume Variance? Favorable or Unfavorable

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts