Question: Always A Winner Ltd. is considering expanding its gambling network. The Managing Director of the company, Mr GG, has offered you a good tip

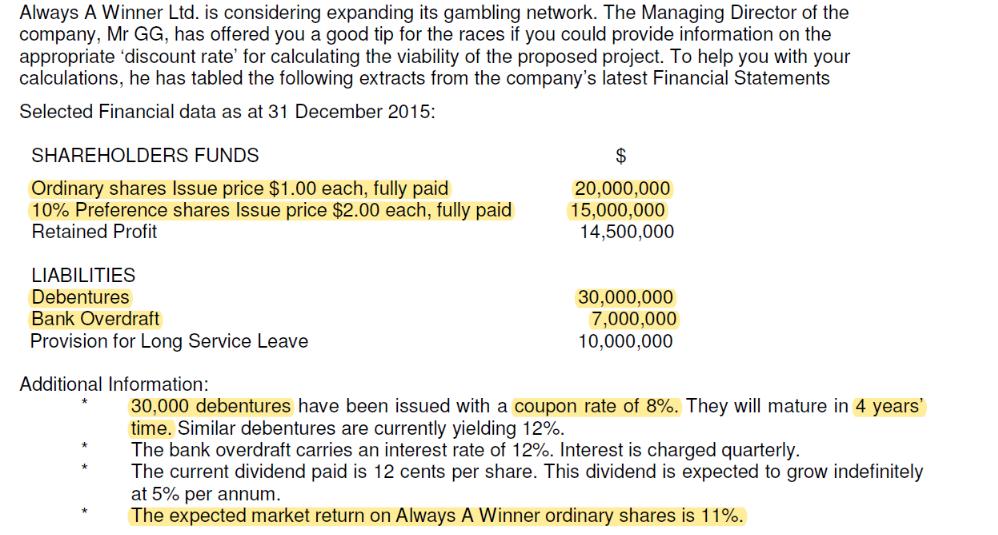

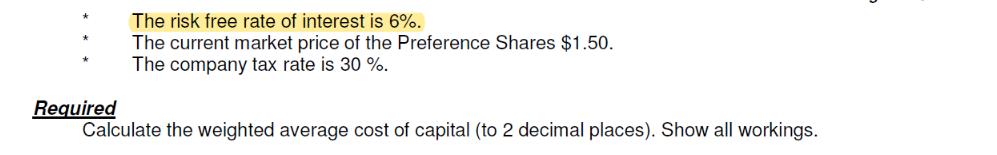

Always A Winner Ltd. is considering expanding its gambling network. The Managing Director of the company, Mr GG, has offered you a good tip for the races if you could provide information on the appropriate 'discount rate' for calculating the viability of the proposed project. To help you with your calculations, he has tabled the following extracts from the company's latest Financial Statements Selected Financial data as at 31 December 2015: SHAREHOLDERS FUNDS Ordinary shares Issue price $1.00 each, fully paid 10% Preference shares Issue price $2.00 each, fully paid Retained Profit LIABILITIES Debentures Bank Overdraft Provision for Long Service Leave Additional Information: $ 20,000,000 15,000,000 14,500,000 30,000,000 7,000,000 10,000,000 30,000 debentures have been issued with a coupon rate of 8%. They will mature in 4 years' time. Similar debentures are currently yielding 12%. The bank overdraft carries an interest rate of 12%. Interest is charged quarterly. The current dividend paid is 12 cents per share. This dividend is expected to grow indefinitely at 5% per annum. The expected market return on Always A Winner ordinary shares is 11%. Required The risk free rate of interest is 6%. The current market price of the Preference Shares $1.50. The company tax rate is 30 %. Calculate the weighted average cost of capital (to 2 decimal places). Show all workings.

Step by Step Solution

3.42 Rating (149 Votes )

There are 3 Steps involved in it

Here are the steps involved Calculate the cost of equity for ordinary shares We can use the Gordon Growth Model GM to do this which is Cost of equity ... View full answer

Get step-by-step solutions from verified subject matter experts