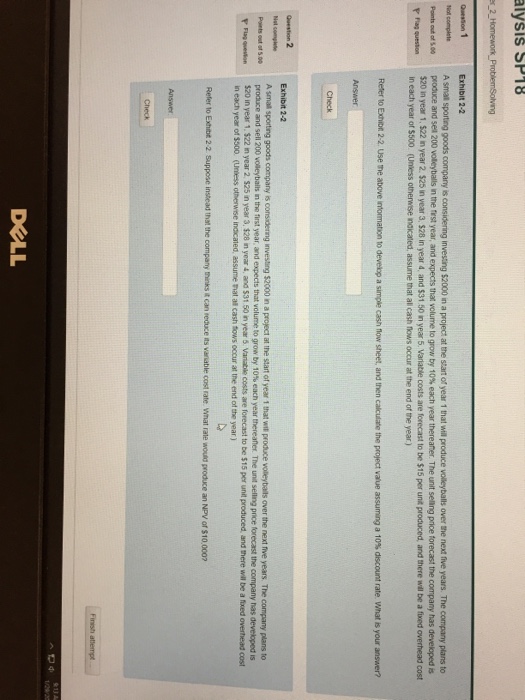

Question: alysis SP18 Questson 1 Not complete e too Exhibit 2-2 A small sporting goods company is considering investing $2000 in a project at the start

alysis SP18 Questson 1 Not complete e too Exhibit 2-2 A small sporting goods company is considering investing $2000 in a project at the start of year 1 that will produce volleyballs over the next five years. The company plans to pro uce and set 200 w eybas n the frst year, and expects that volume to $20 in year 1, $22 in year 2 $25 in year 3, $28 in year 4, and $31.50 in year 5. Variable costs are forecast to be $15 per unt produced, and there will be a fixed overhead cost in each year of $500. (Unless otherwise indicated, assume that all cash hlows occur at the end of the year) ow by 10% each year thereaner The unit selang pnce torecast the company has developed is Reter o Exhot 2-2 Use me above rt mation to deveip a si pe cash no r st eet, and then calculate the project value assumg a 10% discount rate what is your answer? Exhibit 2-2 Net compet A small sporting goods company is considerng investing $2000 in a project at the start of year 1 that wit produce volleybails over the next five years. The Ports out-500 produce and se 1 200 voleybats in the first year and expects that volume to grow by 10% each year thereaner The unt selling price forecast the company has deveoped is n each year of $500 (Uiess otherwse indicated, assume nat all cash tows occur at the end of the year) Referto Exhitt 22 Suppose instead that the company thnks can seduce s var able cost rate what rate would produce an NPV or $10,000? F Flsg oveston $20 in year 1, $22 in year 2 $25 in year 3, $28 in year 4, and $31 50 in year 6 Vanable costs are forecast to be $15 per unit produced, and there wil be a fixed overhead cost company plans to DELL

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts