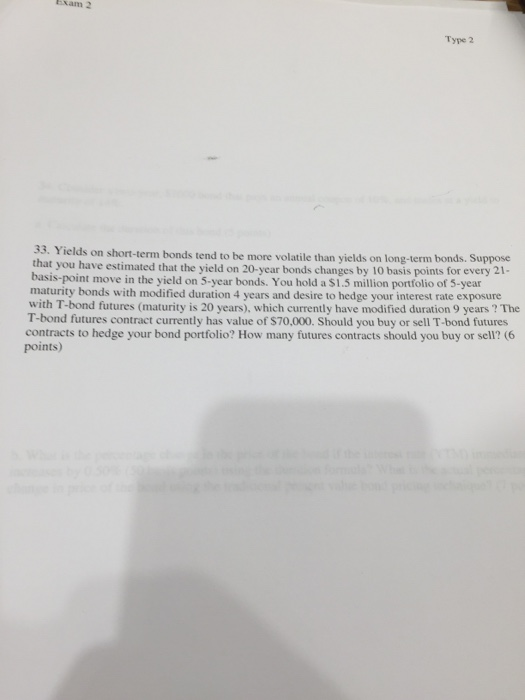

Question: am 2 Type 2 33. Yields on short-term bonds tend to be more volatile than yields on long-term bonds. that you have estimated that the

am 2 Type 2 33. Yields on short-term bonds tend to be more volatile than yields on long-term bonds. that you have estimated that the yield on 20-year bonds changes by basis-point move in the yield on 5-year bonds. You hold a Si.5 million portfolio of 5-year maturity bonds with modified duration 4 years and desire to hedge your interest rate exposure with T-bond futures (maturity is 20 years), which currently have modified duration 9 years? The T-bond futures contract currently has value of $70,000. Should you buy or sell T-bond futures contracts to hedge your bond portfolio? How many futures contracts should you buy or sel? (6 points) Suppose 10 basis points for every 21

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts