Question: Am I doing this correctly? Can someone please post the answers? This Question: 15 pts This Quiz: 70 pts possib 24 of 27 (27 complete)

Am I doing this correctly? Can someone please post the answers?

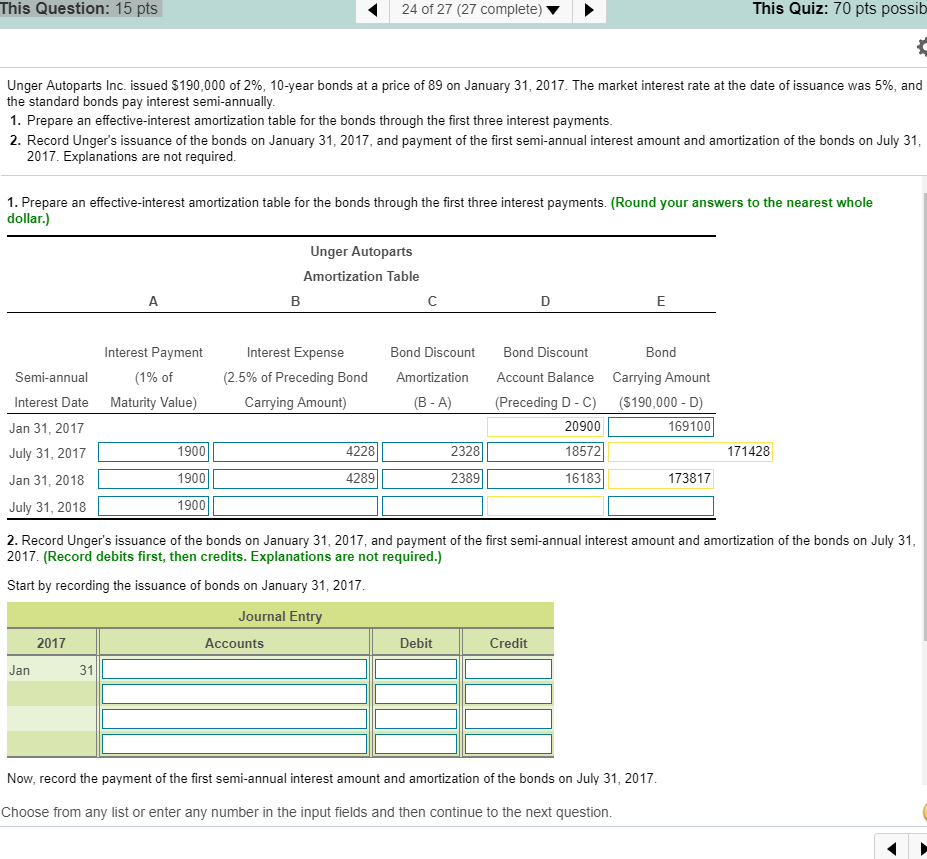

This Question: 15 pts This Quiz: 70 pts possib 24 of 27 (27 complete) Unger Autoparts Inc. issued $190,000 of 2%, 10-year bonds at a price of 89 on January 31, 2017. The market interest rate at the date of issuance was 5%, and the standard bonds pay interest semi-annually. 1. Prepare an effective-interest amortization table for the bonds through the first three interest payments. 2. Record Unger's issuance of the bonds on January 31, 2017, and payment of the first semi-annual interest amount and amortization of the bonds on July 31, 2017. Explanations are not required 1. Prepare an effective-interest amortization table for the bonds through the first three interest payments. (Round your answ dollar.) ers to the nearest whole Unger Autoparts Amortization Table A D E Interest Payment Interest Expense Bond Discount Bond Discount Bond Semi-annual (1% of (2.5% of Preceding Bond Amortization Account Balance Carrying Amount Interest Date Maturity Value) Carrying Amount) (B-A) (Preceding D - C) ($190,000 D) 20900 169100 Jan 31, 2017 4228 171428 1900 2328 18572 July 31, 2017 4289 16183 1900 2389 173817 Jan 31, 2018 1900 July 31, 2018 2. Record Unger's issuance of the bonds on January 31, 2017, and payment of the first semi-annual interest amount and amortization of the bonds on July 31, 2017. (Record debits first, then credits. Explanations are not required.) Start by recording the issuance of bonds on January 31, 2017. Journal Entry 2017 Accounts Debit Credit Jan 31 Now, record the payment of the first semi-annual interest amount and amortization of the bonds on July 31, 2017 Choose from any list or enter any number in the input fields and then continue to the next

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts