Question: Am I doing this right? SHOW YOUR WORK FOR FULL CREDIT Use the following information on the various borrowing and leasing alternatives for an item

Am I doing this right?

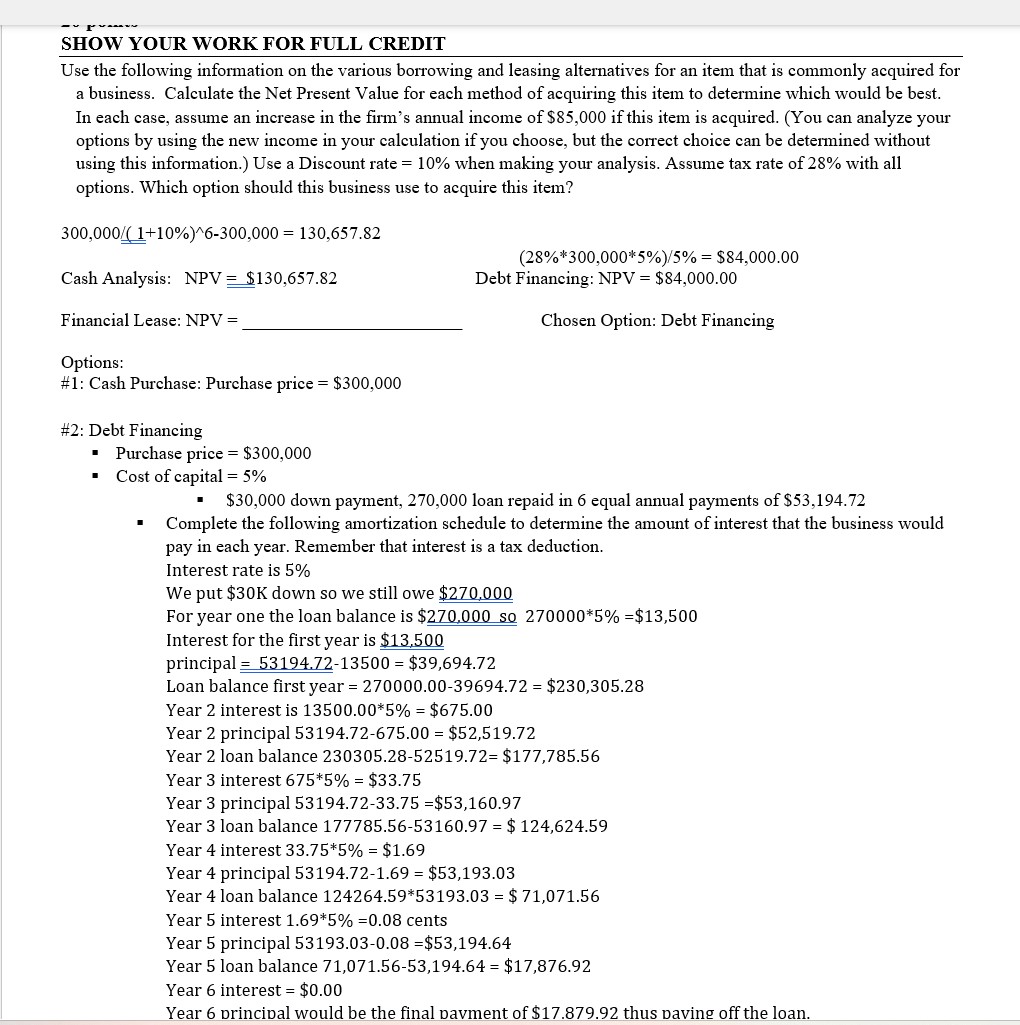

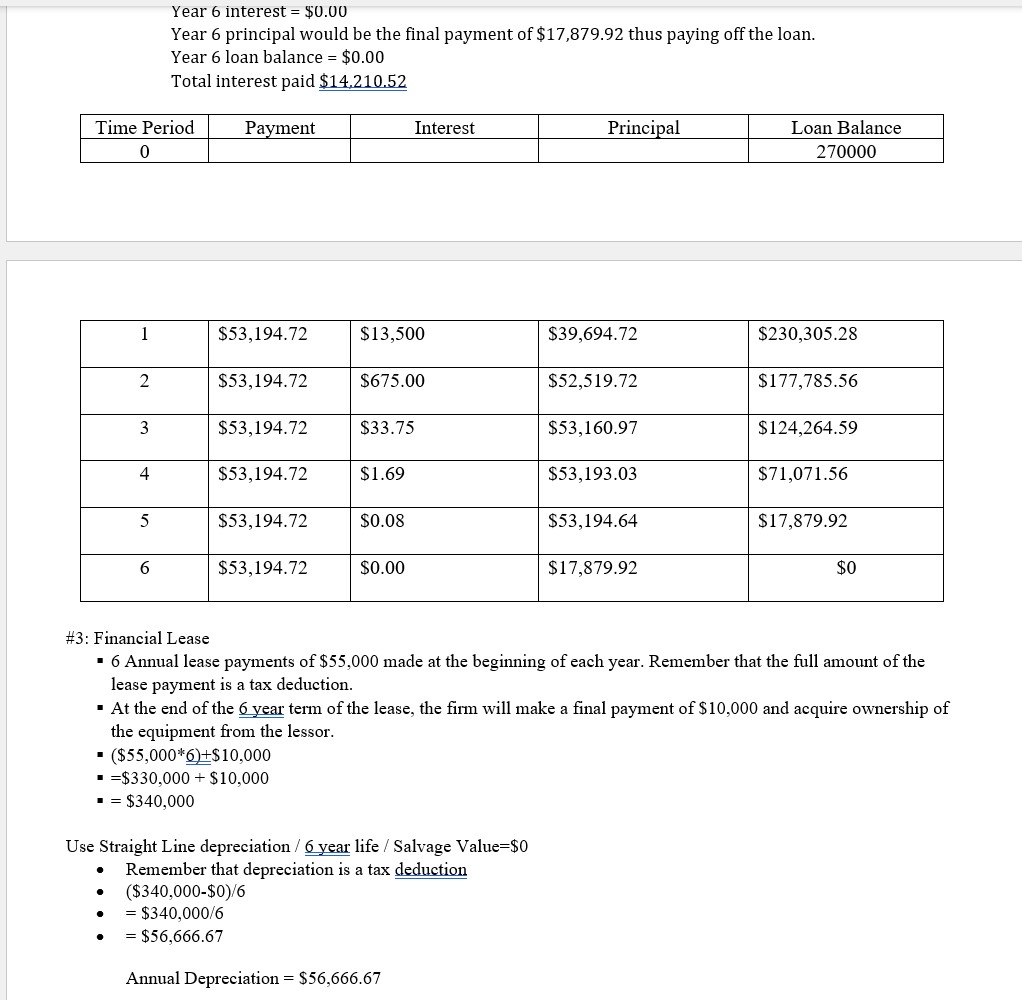

SHOW YOUR WORK FOR FULL CREDIT Use the following information on the various borrowing and leasing alternatives for an item that is commonly acquired for a business. Calculate the Net Present Value for each method of acquiring this item to determine which would be best. In each case, assume an increase in the firm's annual income of $85,000 if this item is acquired. (You can analyze your options by using the new income in your calculation if you choose, but the correct choice can be determined without using this information.) Use a Discount rate =10% when making your analysis. Assume tax rate of 28% with all options. Which option should this business use to acquire this item? 300,000/(1+10%)6300,000=130,657.82 Cash Analysis: NPV 130,657.82 Financial Lease: NPV= Options: \#1: Cash Purchase: Purchase price =$300,000 \#2: Debt Financing - Purchase price =$300,000 - Cost of capital =5% (28%300,0005%)/5%=$84,000.00 Debt Financing: NPV =$84,000.00 Chosen Option: Debt Financing - $30,000 down payment, 270,000 loan repaid in 6 equal annual payments of $53,194.72 - Complete the following amortization schedule to determine the amount of interest that the business would pay in each year. Remember that interest is a tax deduction. Interest rate is 5% We put $30K down so we still owe $270,000 For year one the loan balance is $2270,000so2700005%=$13,500 Interest for the first year is $13,500 principal =53194.7213500=$39,694.72 Loan balance first year =270000.0039694.72=$230,305.28 Year 2 interest is 13500.005%=$675.00 Year 2 principal 53194.72-675.00 =$52,519.72 Year 2 loan balance 230305.28-52519.72= $177,785.56 Year 3 interest 6755%=$33.75 Year 3 principal 53194.7233.75=$53,160.97 Year 3 loan balance 177785.56-53160.97 =$124,624.59 Year 4 interest 33.755%=$1.69 Year 4 principal 53194.72-1.69 =$53,193.03 Year 4 loan balance 124264.5953193.03=$71,071.56 Year 5 interest 1.695%=0.08 cents Year 5 principal 53193.03-0.08 =$53,194.64 Year 5 loan balance 71,071.56-53,194.64 =$17,876.92 Year 6 interest =$0.00 Year 6 princival would be the final pavment of $17.879.92 thus vaving off the loan. Year 6 interest =$0.00 Year 6 principal would be the final payment of $17,879.92 thus paying off the loan. Year 6 loan balance =$0.00 Total interest paid $14,210.52 \#3: Financial Lease - 6 Annual lease payments of $55,000 made at the beginning of each year. Remember that the full amount of the lease payment is a tax deduction. - At the end of the 6 year term of the lease, the firm will make a final payment of $10,000 and acquire ownership of the equipment from the lessor. - ($55,0006)+$10,000 - =$330,000+$10,000 - =$340,000 Use Straight Line depreciation / 6year life / Salvage Value =$0 - Remember that depreciation is a tax deduction - ($340,000$0)/6 - =$340,000/6 - =$56,666.67 Annual Depreciation =$56,666.67

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts