Question: Am I missing something heres the worksheet im working off and now there are wholes jn my income statment and Balance sheet not sure what

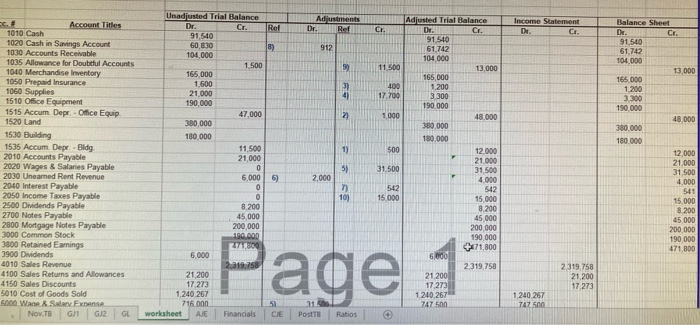

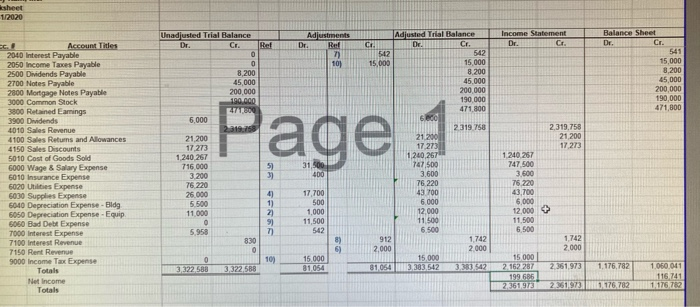

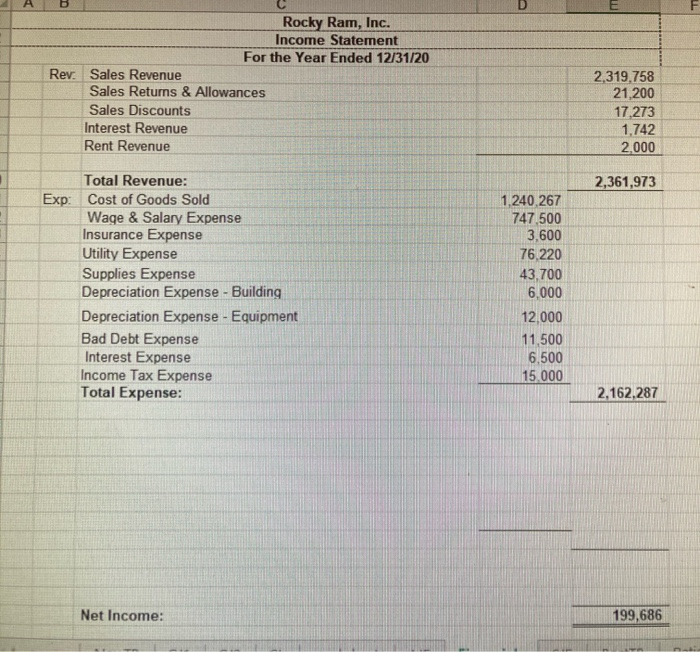

Adjustments Dr. Ref Income Statement Du Cr Cr 912 Balance Sheet Dr. Cr. 91,540 61,742 104.000 13 000 165.000 1.200 3.300 9) 11.500 3) 4) 400 17.700 190.000 2) 1,000 48,000 380,000 180.000 1) 500 Account Titles 1010 Cash 1020 Cash in Savings Account 1030 Accounts Receivable 1035 Allowance for Doubtful Accounts 1040 Merchandise Inventory 1050 Prepaid Insurance 1060 Supplies 1510 Office Equipment 1515 Accum Depr - Office Equip 1520 Land 1530 Building 1535 Accum. Depr - Bldg 2010 Accounts Payable 2020 Wages & Salones Payable 2030 Uneamed Rent Revenue 2040 Interest Payable 2050 Income Taxes Payable 2500 Dividends Payable 2700 Notes Payable 2800 Mortgage Notes Payable 3000 Common Stock 3800 Retained Earnings 3900 Dividends 4010 Sales Revenue 4100 Sales Returns and Allowances 4150 Sales Discounts 5010 Cost of Goods Sold 6000 WAO SA Expense Nov. To GJ1 GJ2 GL Unadjusted Trial Balance Dr. Cr. Ref 91,540 60830 18) 104,000 1,500 165,000 1.600 21.000 190,000 47,000 380,000 180.000 11,500 21,000 0 6,000 6) 0 0 8.200 45,000 200,000 199,000 3471809 6.000 2,319,758 21.200 17,273 1,240 267 716.000 51 worksheet AJE Financials CJE Adjusted Trial Balance Dr. Cr. 91 540 61,742 104.000 13,000 165,000 1.200 3.300 190.000 48.000 380.000 180.000 12.000 21.000 31,500 4.000 542 15.000 8.200 45,000 200.000 190.000 +371,800 6.000 2 319,758 21.200 17273 1240 267 747.500 5) 31.500 2,000 7) 10) 542 15.000 12,000 21.000 31,500 4,000 541 15,000 8.200 45,000 200.000 190.000 471.800 2319,758 21,200 17 273 1,240.267 747 500 31 Posts Ratios sheet 1/2020 Income Statement Dr. Cr Ref Adjustments Dr. Ret 7 10) C. 542 15,000 Balance Sheet Dr. Cr. 541 15,000 8,200 45,000 200,000 190,000 471,000 Account Titles 2040 Interest Payable 2050 Income Taxes Payable 2500 Dividends Payable 2700 Notes Payable 2800 Mortgage Notes Payable 3000 Common Stock 3800 Retained Earnings 3900 Dividends 4010 Sales Revenue 4100 Sales Returns and Allowances 4150 Sales Discounts 5010 Cost of Goods Sold 6000 Wage & Salary Expense 6010 Insurance Expense 6020 Utilities Expense 6030 Supplies Expense 6040 Depreciation Expense - Bldg 6050 Depreciation Expense - Equip 6060 Bad Debt Expense 7000 interest Expense 7100 Interest Revenue 7150 Rent Revenue 9000 Income Tax Expense Totals Net Income Totals Unadjusted Trial Balance Dr. Cr. 0 0 8,200 45,000 200 000 190.000 471,800 6.000 2.31 21,200 17273 1 240 267 716.000 3200 76 220 26.000 5.500 11.000 0 5.958 830 Adjusted Trial Balance Dr. Cr. 542 15 000 8.200 45,000 200.000 190,000 471,800 6 edo 2319.758 21.200 17 273 1,240,267 747 500 3.600 76 220 43.700 6.000 12.000 31,500 400 3) 4 1) 2) 9) 7) 17,700 500 1.000 11,500 542 2.319,758 21,200 17273 1.240.267 747500 3600 76.220 43.700 6.000 12.000 + 11.500 6.500 1742 2.000 15 000 2162287 2 361,973 199.685 2361973 2 361.973 11.500 8) 6) 6.500 912 2,000 15.000 81054383,542 1.742 2.000 10) 15 000 0 3322580 3,322 588 81,054 3.383.542 1.176,782 1.060.041 116,241 1.176,782 1.176 782 D Rocky Ram, Inc. Income Statement For the Year Ended 12/31/20 Rev. Sales Revenue Sales Returns & Allowances Sales Discounts Interest Revenue Rent Revenue 2.319.758 21,200 17,273 1,742 2.000 2,361,973 Total Revenue: Exp: Cost of Goods Sold Wage & Salary Expense Insurance Expense Utility Expense Supplies Expense Depreciation Expense - Building Depreciation Expense - Equipment Bad Debt Expense Interest Expense Income Tax Expense Total Expense: 1.240.267 747,500 3,600 76,220 43,700 6,000 12,000 11,500 6,500 15.000 2,162,287 Net Income: 199,686 2 3 Balance Sheet 12/31/20 5 S ASSETS Current Assets: Total Assets LIABILITIES Nov.TB GJ1 GJ2 GL worksheet AJE Financials CJE PostTB Ra

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts