Question: am I missing something? this program says net operating cash flow is wrong no matter how I rework it. it also says receivables for year

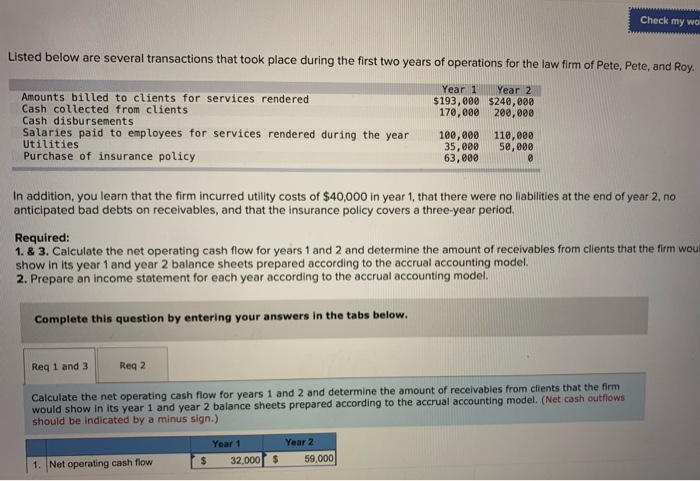

Check my wo Listed below are several transactions that took place during the first two years of operations for the law firm of Pete, Pete, and Roy. Amounts billed to clients for services rendered Cash collected from clients Cash disbursements Salaries paid to employees for services rendered during the year Utilities Purchase of insurance policy Year 1 Year 2 $193,000 $240,000 170,000 200,000 100,000 110,000 35,000 50,000 63,000 In addition, you learn that the firm incurred utility costs of $40,000 in year 1, that there were no liabilities at the end of year 2, no anticipated bad debts on receivables, and that the insurance policy covers a three-year period. Required: 1. & 3. Calculate the net operating cash flow for years 1 and 2 and determine the amount of receivables from clients that the firm woul show in its year 1 and year 2 balance sheets prepared according to the accrual accounting model. 2. Prepare an income statement for each year according to the accrual accounting model. Complete this question by entering your answers in the tabs below. Req 1 and 3 Reg 2 Calculate the net operating cash flow for years 1 and 2 and determine the amount of receivables from clients that the firm would show in its year 1 and year 2 balance sheets prepared according to the accrual accounting model. (Net cash outflows should be indicated by a minus sign.) Year 1 32,000 Year 2 59,000 $ $ 1. Net operating cash flow

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts