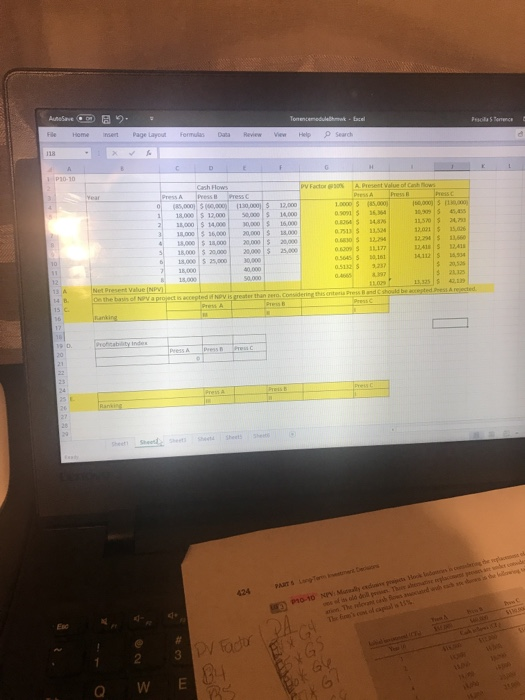

Question: am I on the right track with this assignment? i cant figure out the profitability index. i some detailed instructions. Fle Home insent Page LayoutFormulas

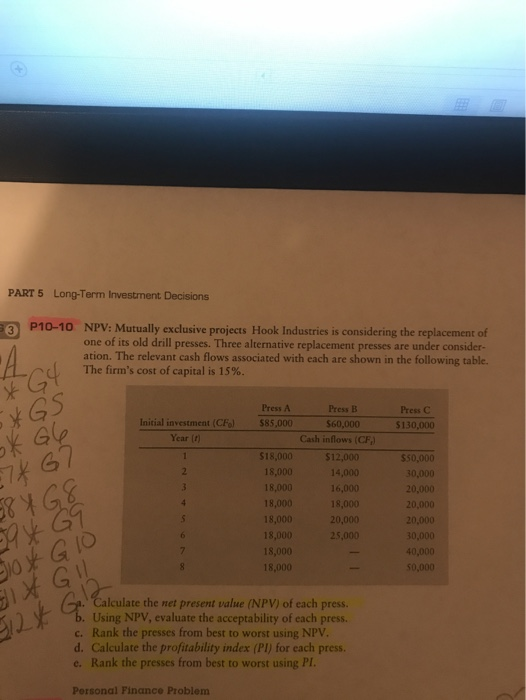

Fle Home insent Page LayoutFormulas DataReview ew Help Search Cash Flows Factor @S0% APresent Value of Canh hv 8,000 5 130,000 12,000 10000 5 9091536364 0.8364 735 13324 0,000) 5 (85,000) 18000 12,0000014000 1,00 1400006000 ,000 $ 18,000 20,000 20000 18,000 $ 20,000 2,000 5 25,000 12,24$ 13,56 18,000 25,00030,000 0.56455 0 16 $ 20,52 Net Present Value INPV 42.1 424 PART 2 O Q WE PART 5 Long-Term Investment Decisions 3 P10-10 NPV: Mutually exclusive projects Hook Industries is considering the replacement of one of its old drill presses. Three alternative replacement presses are under consider ation. The relevant cash flows associated with each are shown in the following table. The firm's cost of capital is 15% Press A Press B $60,000 Press C Initial investmeat (Col Year (t) $85,000 $130,000 Cash inflows (CF $18,000 18,000 18,000 18,000 18,000 18,000 18,000 18,000 $12,000 14,000 16,000 18,000 20,000 25,000 $50,000 30,000 20,000 20,000 50,000 Iculate the net present value (NPV) of each pres. . Using NPV, evaluate the acceptability of each press. c. Rank the presses from best to worst using NPV. d. Calculate the profitability index (PI) for each press. e. Rank the presses from best to worst using PI. Personal Finance

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts