Question: Amaretta Company ( a U . S . - based company ) ordered merchandise from a foreign supplier on November 2 0 at a price

Amaretta Company a USbased company ordered merchandise from a foreign supplier on November at a price of rupees when the spot rate was $ per rupee. Delivery and payment were scheduled for December On November Amaretta acquired a call option on rupees at a strike price of $ paying a premium of $ per rupee. The company designates the option as a fair value hedge of a foreign currency firm commitment. The fair value of the firm commitment is measured by referring to changes in the spot rate. The option's time value is excluded from the assessment of hedge effectiveness, and the change in time value is recognized in net income. The merchandise arrives, and Amaretta makes payment according to schedule. Amaretta sells the merchandise by December when it closes its books.

Required:

a Assuming a spot rate of $ per rupee on December prepare all journal entries to account for the foreign currency option, foreign currency firm commitment, and purchase of inventory.

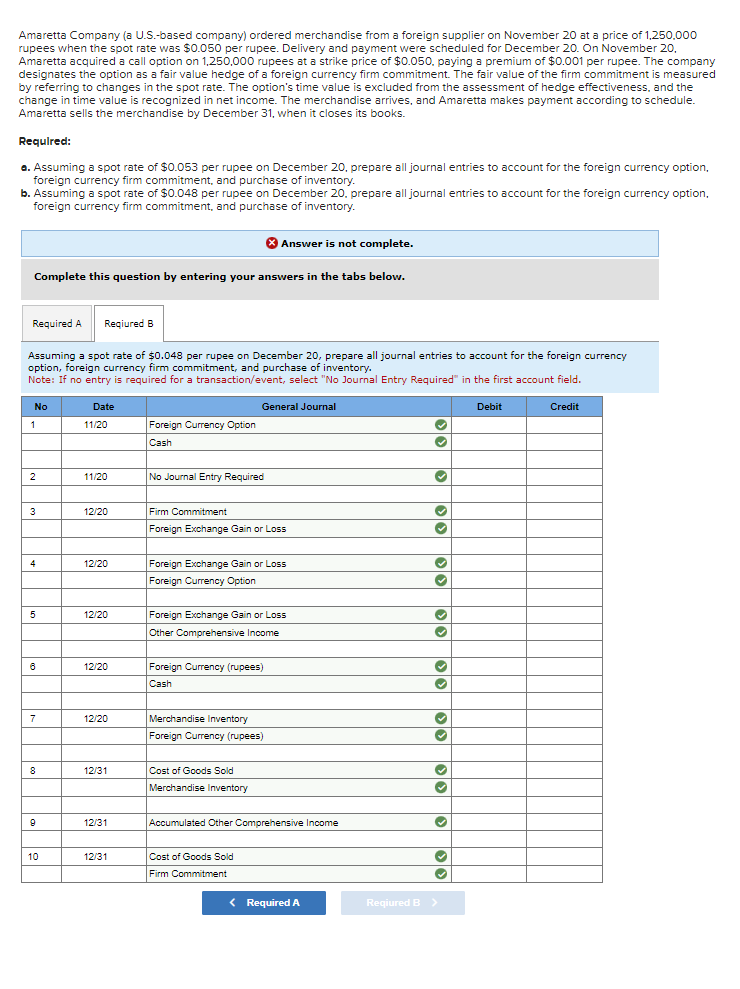

b Assuming a spot rate of $ per rupee on December prepare all journal entries to account for the foreign currency option, foreign currency firm commitment, and purchase of inventory.

Answer is not complete.

Complete this question by entering your answers in the tabs below.

Reqiured B

Assuming a spot rate of $ per rupee on December prepare all journal entries to account for the foreign currency option, foreign currency firm commitment, and purchase of inventory.

Note: If no entry is required for a transactionevent select No Journal Entry Required" in the first account field. Amaretta Company a USbased company ordered merchandise from a foreign supplier on November at a price of rupees when the spot rate was $ per rupee. Delivery and payment were scheduled for December On November Amaretta acquired a call option on rupees at a strike price of $ paying a premium of $ per rupee. The company designates the option as a fair value hedge of a foreign currency firm commitment. The fair value of the firm commitment is measured by referring to changes in the spot rate. The option's time value is excluded from the assessment of hedge effectiveness, and the change in time value is recognized in net income. The merchandise arrives, and Amaretta makes payment according to schedule. Amaretta sells the merchandise by December when it closes its books.

Required:

a Assuming a spot rate of $ per rupee on December prepare all journal entries to account for the foreign currency option, foreign currency firm commitment, and purchase of inventory.

b Assuming a spot rate of $ per rupee on December prepare all journal entries to account for the foreign currency option, foreign currency firm commitment, and purchase of inventory.

Answer is not complete.

Complete this question by entering your answers in the tabs below.

Assuming a spot rate of $ per rupee on December prepare all journal entries to account for the foreign currency option, foreign currency firm commitment, and purchase of inventory.

Note: If no entry is required for a transactionevent select No Journal Entry Required" in the first account field.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock