Question: Amazon is considering a new multi-year project to test high capacity drones that would make its product deliveries more efficient and save the company

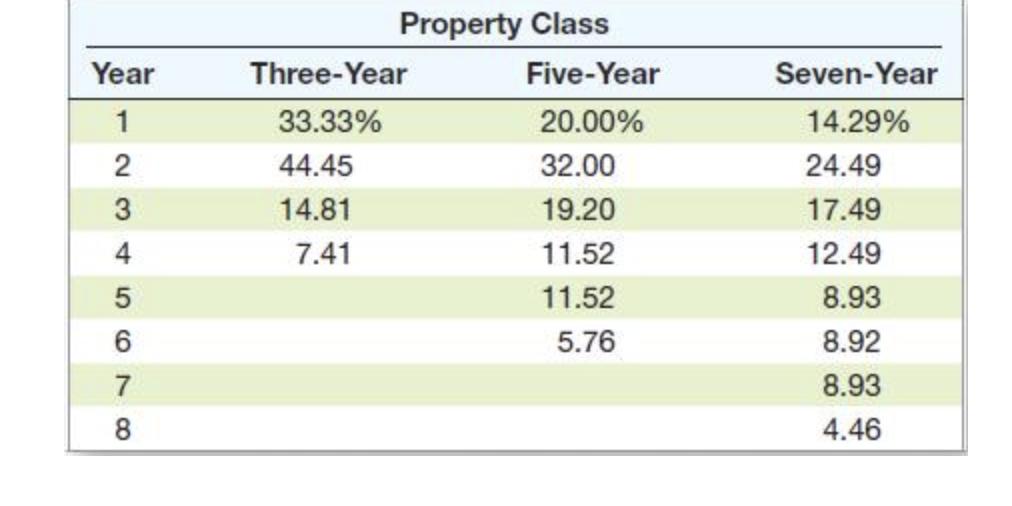

Amazon is considering a new multi-year project to test high capacity drones that would make its product deliveries more efficient and save the company $145,000 each year, in pre-tax money. For this four-year-long project, $385,000 would need to be spent right away to buy the required fleet of drones. The drones will be losing their economic value according to the MACRS schedule for the five-year property class. See Table 10.7. Amazon foresees the need to immediately invest $20,000 in a cash reserve which would then be increased every year by $3,100. At the end of this project, Amazon is hoping to find a different company that would pay $45,000 to buy its used drones. 22 percent tax rate applies to Amazon's annual taxable income as well as any of the company's taxable cash flows. The required return on this investment project is 9 percent per year. The Net Present Value of this project equals (Do not round your intermediate calculations and only round your final answer to 2 decimal places, e.g., 32.16.) NPV Is it worth it to Amazon to buy the drones? O No Yes Year 1 23 2 3 st 4 LO 5 678 6 7 8 Property Class Three-Year 33.33% 44.45 14.81 7.41 Five-Year 20.00% 32.00 19.20 11.52 11.52 5.76 Seven-Year 14.29% 24.49 17.49 12.49 8.93 8.92 8.93 4.46

Step by Step Solution

There are 3 Steps involved in it

Computation of NPV To compute the Net Present Value NPV of the project we need to calculate th... View full answer

Get step-by-step solutions from verified subject matter experts